Multi-Domain Transformer-Based Counterfactual Augmentation for Earnings Call Analysis

Paper and Code

Dec 03, 2021

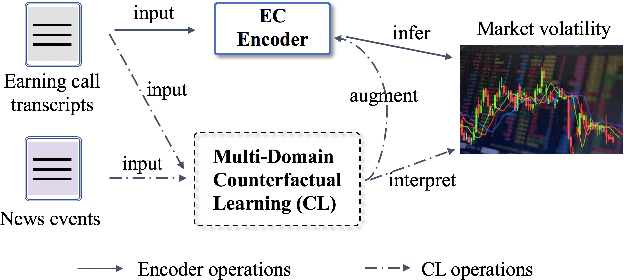

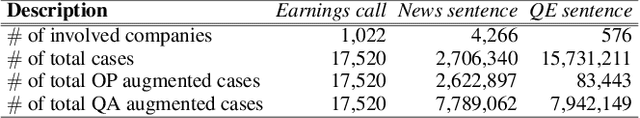

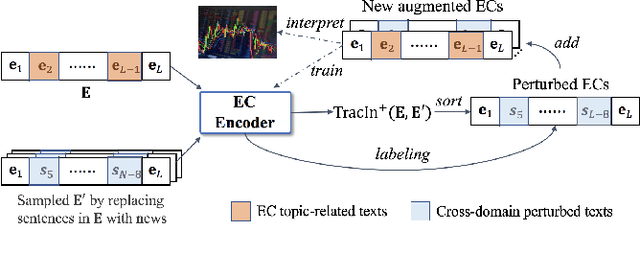

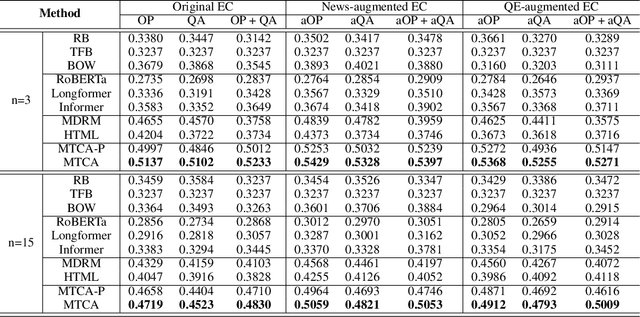

Earnings call (EC), as a periodic teleconference of a publicly-traded company, has been extensively studied as an essential market indicator because of its high analytical value in corporate fundamentals. The recent emergence of deep learning techniques has shown great promise in creating automated pipelines to benefit the EC-supported financial applications. However, these methods presume all included contents to be informative without refining valuable semantics from long-text transcript and suffer from EC scarcity issue. Meanwhile, these black-box methods possess inherent difficulties in providing human-understandable explanations. To this end, in this paper, we propose a Multi-Domain Transformer-Based Counterfactual Augmentation, named MTCA, to address the above problems. Specifically, we first propose a transformer-based EC encoder to attentively quantify the task-inspired significance of critical EC content for market inference. Then, a multi-domain counterfactual learning framework is developed to evaluate the gradient-based variations after we perturb limited EC informative texts with plentiful cross-domain documents, enabling MTCA to perform unsupervised data augmentation. As a bonus, we discover a way to use non-training data as instance-based explanations for which we show the result with case studies. Extensive experiments on the real-world financial datasets demonstrate the effectiveness of interpretable MTCA for improving the volatility evaluation ability of the state-of-the-art by 14.2\% in accuracy.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge