Explaining Adverse Actions in Credit Decisions Using Shapley Decomposition

Paper and Code

Apr 26, 2022

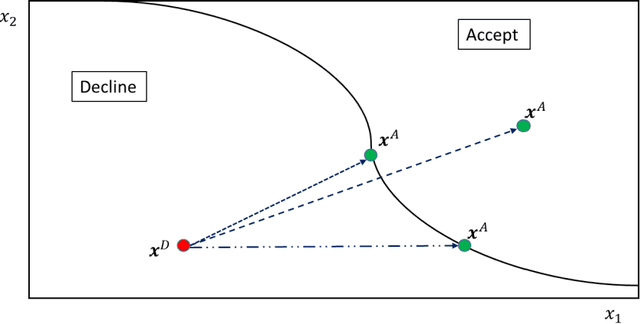

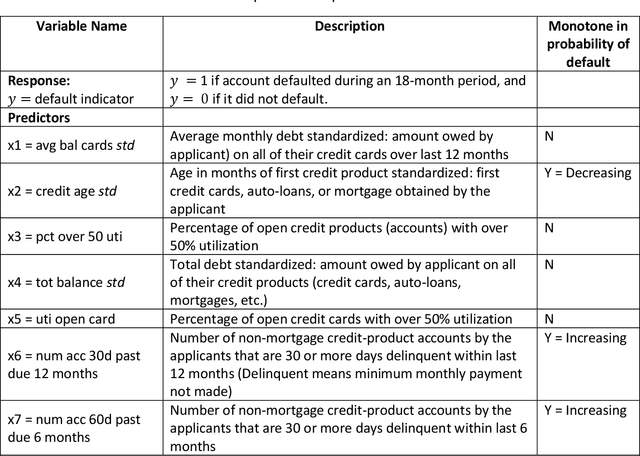

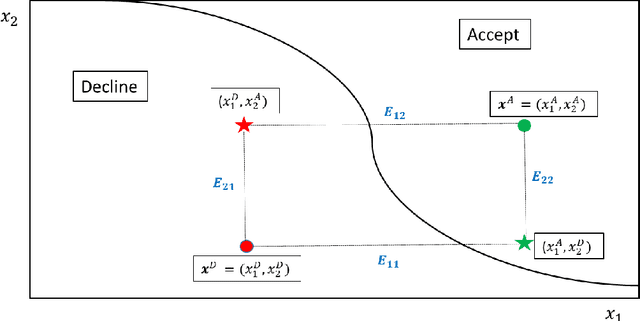

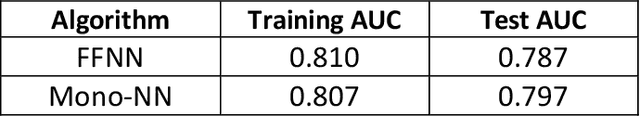

When a financial institution declines an application for credit, an adverse action (AA) is said to occur. The applicant is then entitled to an explanation for the negative decision. This paper focuses on credit decisions based on a predictive model for probability of default and proposes a methodology for AA explanation. The problem involves identifying the important predictors responsible for the negative decision and is straightforward when the underlying model is additive. However, it becomes non-trivial even for linear models with interactions. We consider models with low-order interactions and develop a simple and intuitive approach based on first principles. We then show how the methodology generalizes to the well-known Shapely decomposition and the recently proposed concept of Baseline Shapley (B-Shap). Unlike other Shapley techniques in the literature for local interpretability of machine learning results, B-Shap is computationally tractable since it involves just function evaluations. An illustrative case study is used to demonstrate the usefulness of the method. The paper also discusses situations with highly correlated predictors and desirable properties of fitted models in the credit-lending context, such as monotonicity and continuity.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge