CAMEF: Causal-Augmented Multi-Modality Event-Driven Financial Forecasting by Integrating Time Series Patterns and Salient Macroeconomic Announcements

Paper and Code

Feb 07, 2025

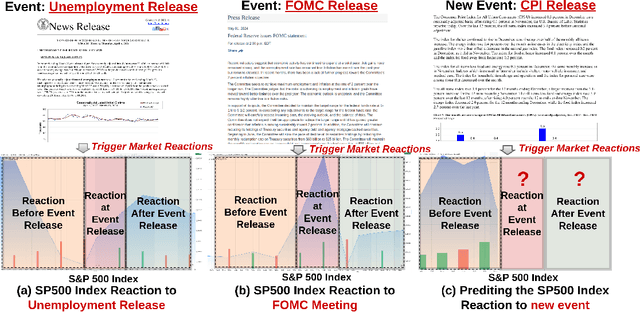

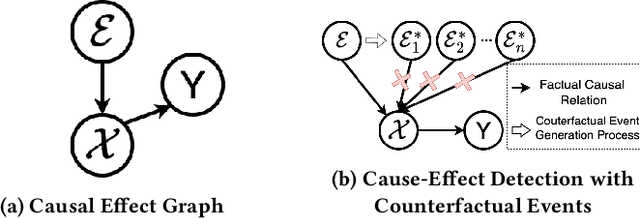

Accurately forecasting the impact of macroeconomic events is critical for investors and policymakers. Salient events like monetary policy decisions and employment reports often trigger market movements by shaping expectations of economic growth and risk, thereby establishing causal relationships between events and market behavior. Existing forecasting methods typically focus either on textual analysis or time-series modeling, but fail to capture the multi-modal nature of financial markets and the causal relationship between events and price movements. To address these gaps, we propose CAMEF (Causal-Augmented Multi-Modality Event-Driven Financial Forecasting), a multi-modality framework that effectively integrates textual and time-series data with a causal learning mechanism and an LLM-based counterfactual event augmentation technique for causal-enhanced financial forecasting. Our contributions include: (1) a multi-modal framework that captures causal relationships between policy texts and historical price data; (2) a new financial dataset with six types of macroeconomic releases from 2008 to April 2024, and high-frequency real trading data for five key U.S. financial assets; and (3) an LLM-based counterfactual event augmentation strategy. We compare CAMEF to state-of-the-art transformer-based time-series and multi-modal baselines, and perform ablation studies to validate the effectiveness of the causal learning mechanism and event types.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge