Bankruptcy Prediction via Mixing Intra-Risk and Spillover-Risk

Paper and Code

Feb 12, 2022

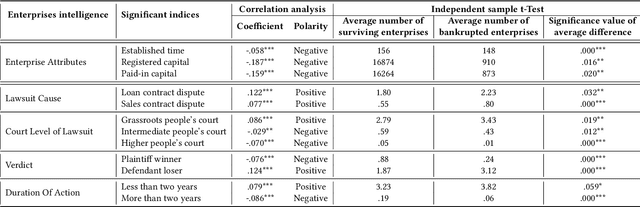

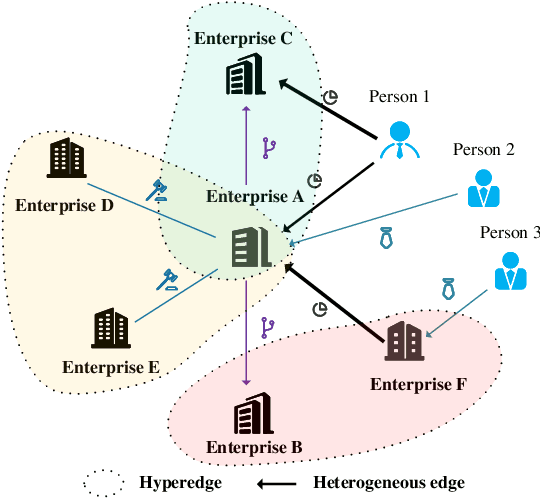

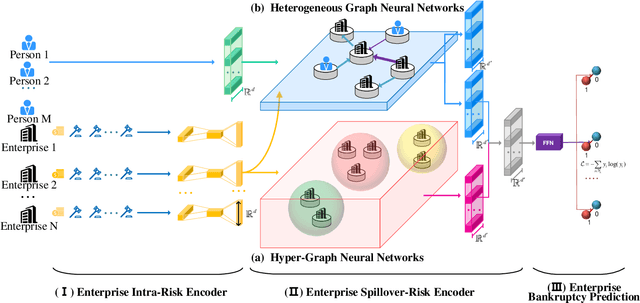

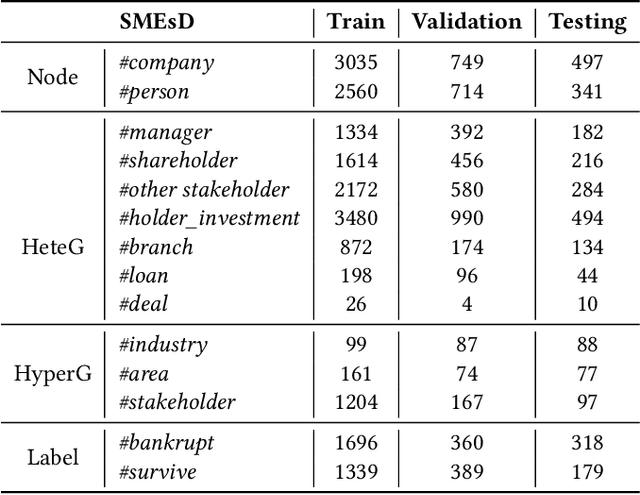

Bankruptcy risk prediction for Small and Medium-sized Enterprises (SMEs) is a crucial step for financial institutions to make the loan decision and identify region economics's early warning. However, previous studies in both finance and AI research fields only consider either the intra-risk or the spillover-risk, ignoring their interactions and their combinatorial effect for simplicity. This paper for the first time considers both risks simultaneously and their joint effect in bankruptcy prediction. Specifically, we first propose an enterprise intra-risk encoder with LSTM based on enterprise risk statistical significance indicators from its basic business information and litigation information for its intra-risk learning. Afterward, we propose an enterprise spillover-risk encoder based on enterprise relational information from the enterprise knowledge graph for its spillover-risk embedding. In particular, the spillover-risk encoder is equipped with both the newly proposed Hyper-Graph Neural Networks (Hyper-GNNs) and Heterogeneous Graph Neural Networks (Heter-GNNs), which is able to model spillover risk from two different aspects, i.e. common risk factors based on hyperedges and direct diffusion risk from the neighbors, respectively. With the two kinds of encoders, a unified framework is designed to simultaneously capture intra-risk and spillover-risk for bankruptcy prediction. To evaluate our model, we collect multi-sources SMEs real-world data and build a novel benchmark dataset SMEsD. We provide open access to the dataset, which is expected to promote the financial risk analysis research further. Experiments on SMEsD against nine SOTA baselines demonstrate the effectiveness of the proposed model for bankruptcy prediction.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge