Zhijiang Yang

Explainable Enterprise Credit Rating via Deep Feature Crossing Network

May 22, 2021

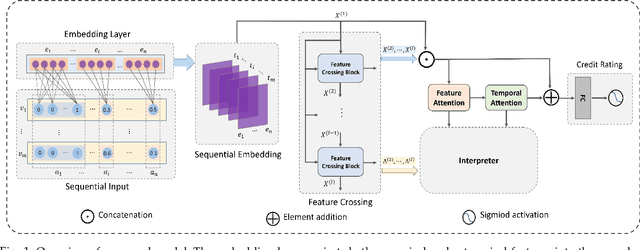

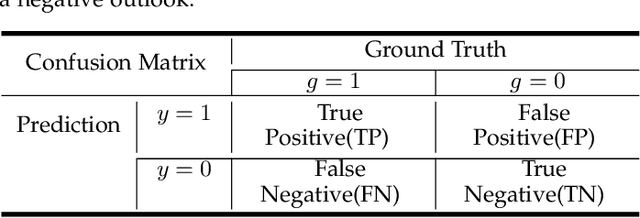

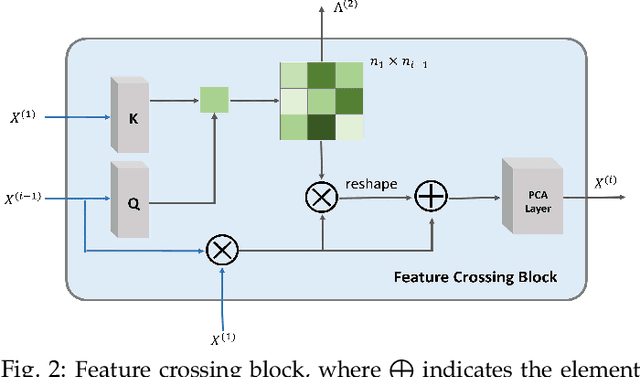

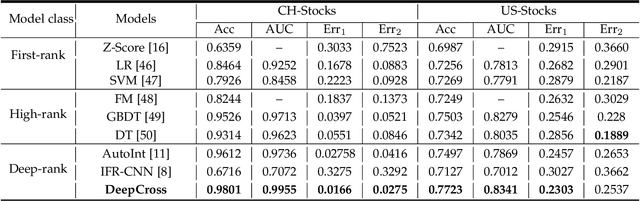

Abstract:Due to the powerful learning ability on high-rank and non-linear features, deep neural networks (DNNs) are being applied to data mining and machine learning in various fields, and exhibit higher discrimination performance than conventional methods. However, the applications based on DNNs are rare in enterprise credit rating tasks because most of DNNs employ the "end-to-end" learning paradigm, which outputs the high-rank representations of objects and predictive results without any explanations. Thus, users in the financial industry cannot understand how these high-rank representations are generated, what do they mean and what relations exist with the raw inputs. Then users cannot determine whether the predictions provided by DNNs are reliable, and not trust the predictions providing by such "black box" models. Therefore, in this paper, we propose a novel network to explicitly model the enterprise credit rating problem using DNNs and attention mechanisms. The proposed model realizes explainable enterprise credit ratings. Experimental results obtained on real-world enterprise datasets verify that the proposed approach achieves higher performance than conventional methods, and provides insights into individual rating results and the reliability of model training.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge