Zaffar Zaffar

Credit Card Fraud Detection with Subspace Learning-based One-Class Classification

Sep 26, 2023

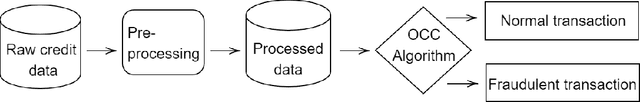

Abstract:In an increasingly digitalized commerce landscape, the proliferation of credit card fraud and the evolution of sophisticated fraudulent techniques have led to substantial financial losses. Automating credit card fraud detection is a viable way to accelerate detection, reducing response times and minimizing potential financial losses. However, addressing this challenge is complicated by the highly imbalanced nature of the datasets, where genuine transactions vastly outnumber fraudulent ones. Furthermore, the high number of dimensions within the feature set gives rise to the ``curse of dimensionality". In this paper, we investigate subspace learning-based approaches centered on One-Class Classification (OCC) algorithms, which excel in handling imbalanced data distributions and possess the capability to anticipate and counter the transactions carried out by yet-to-be-invented fraud techniques. The study highlights the potential of subspace learning-based OCC algorithms by investigating the limitations of current fraud detection strategies and the specific challenges of credit card fraud detection. These algorithms integrate subspace learning into the data description; hence, the models transform the data into a lower-dimensional subspace optimized for OCC. Through rigorous experimentation and analysis, the study validated that the proposed approach helps tackle the curse of dimensionality and the imbalanced nature of credit card data for automatic fraud detection to mitigate financial losses caused by fraudulent activities.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge