Yung-wen Liu

Predictive Modeling with Delayed Information: a Case Study in E-commerce Transaction Fraud Control

Nov 14, 2018

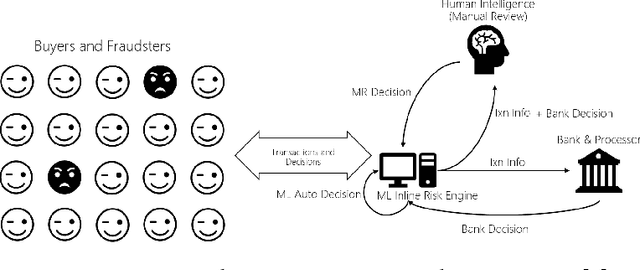

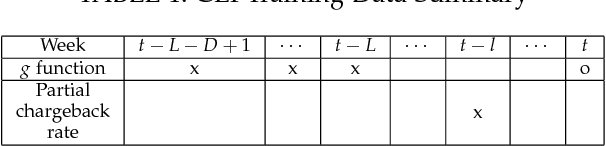

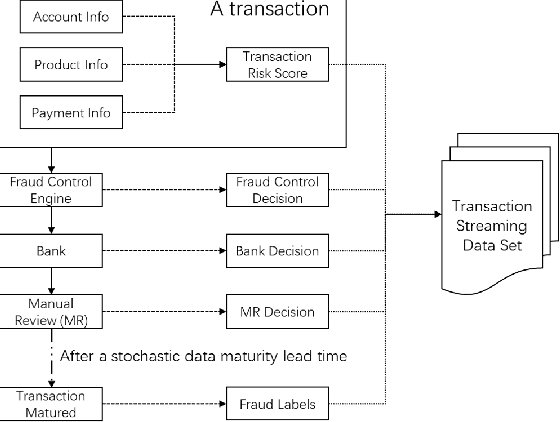

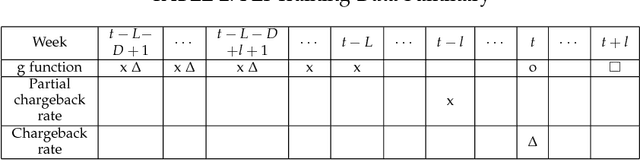

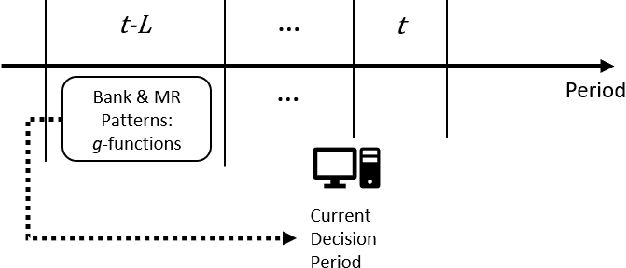

Abstract:In Business Intelligence, accurate predictive modeling is the key for providing adaptive decisions. We studied predictive modeling problems in this research which was motivated by real-world cases that Microsoft data scientists encountered while dealing with e-commerce transaction fraud control decisions using transaction streaming data in an uncertain probabilistic decision environment. The values of most online transactions related features can return instantly, while the true fraud labels only return after a stochastic delay. Using partially mature data directly for predictive modeling in an uncertain probabilistic decision environment would lead to significant inaccuracy on risk decision-making. To improve accurate estimation of the probabilistic prediction environment, which leads to more accurate predictive modeling, two frameworks, Current Environment Inference (CEI) and Future Environment Inference (FEI), are proposed. These frameworks generated decision environment related features using long-term fully mature and short-term partially mature data, and the values of those features were estimated using varies of learning methods, including linear regression, random forest, gradient boosted tree, artificial neural network, and recurrent neural network. Performance tests were conducted using some e-commerce transaction data from Microsoft. Testing results suggested that proposed frameworks significantly improved the accuracy of decision environment estimation.

Discriminative Data-driven Self-adaptive Fraud Control Decision System with Incomplete Information

Oct 03, 2018

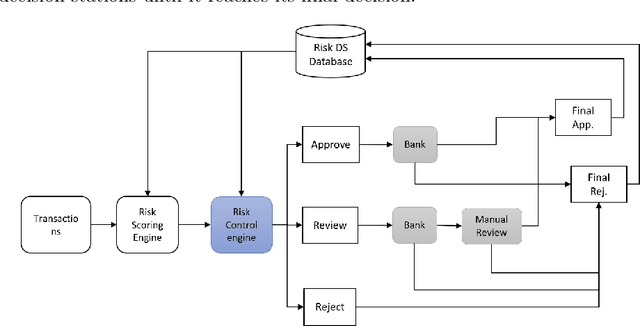

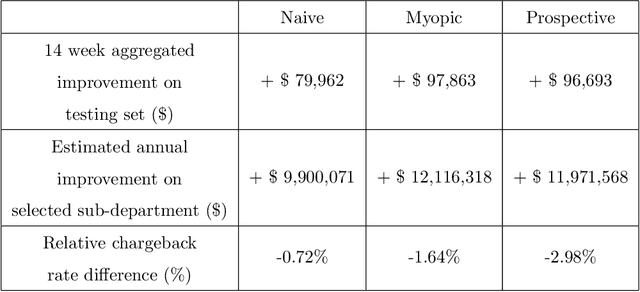

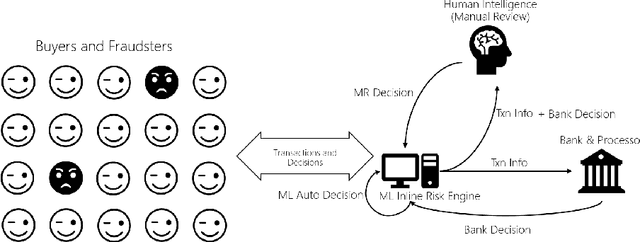

Abstract:While E-commerce has been growing explosively and online shopping has become popular and even dominant in the present era, online transaction fraud control has drawn considerable attention in business practice and academic research. Conventional fraud control considers mainly the interactions of two major involved decision parties, i.e. merchants and fraudsters, to make fraud classification decision without paying much attention to dynamic looping effect arose from the decisions made by other profit-related parties. This paper proposes a novel fraud control framework that can quantify interactive effects of decisions made by different parties and can adjust fraud control strategies using data analytics, artificial intelligence, and dynamic optimization techniques. Three control models, Naive, Myopic and Prospective Controls, were developed based on the availability of data attributes and levels of label maturity. The proposed models are purely data-driven and self-adaptive in a real-time manner. The field test on Microsoft real online transaction data suggested that new systems could sizably improve the company's profit.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge