Yu Ono

HiPerformer: Hierarchically Permutation-Equivariant Transformer for Time Series Forecasting

May 14, 2023

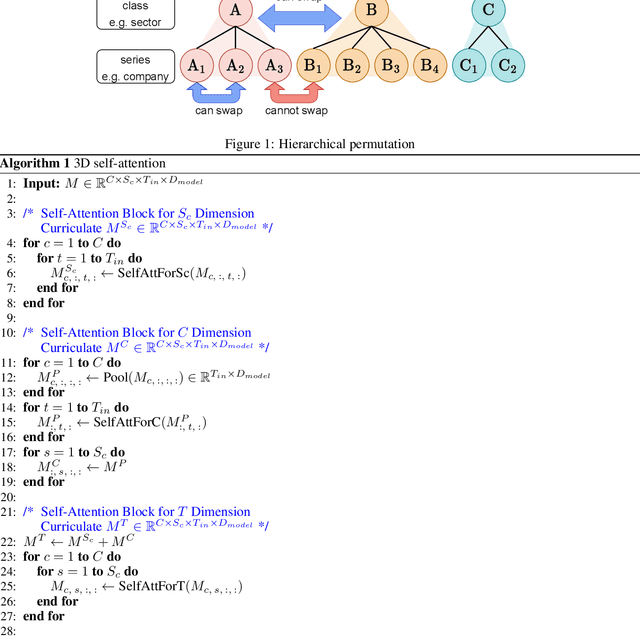

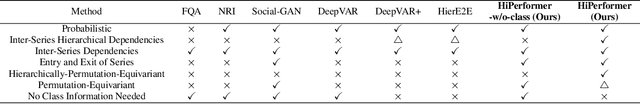

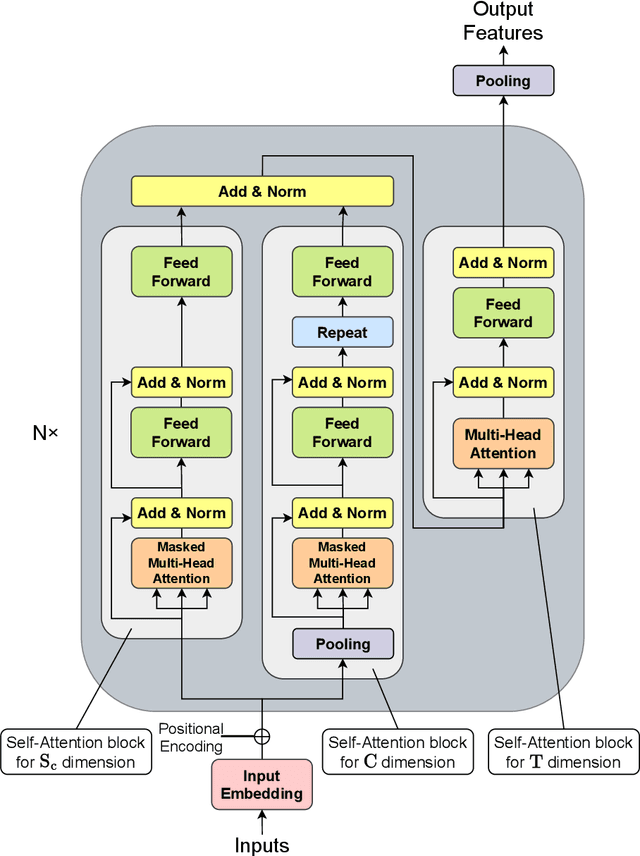

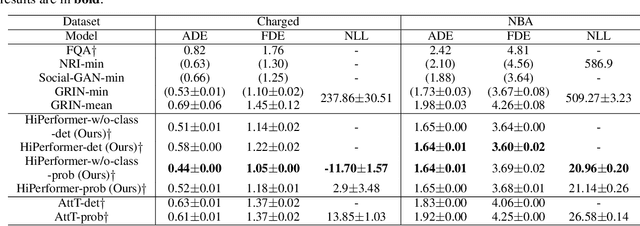

Abstract:It is imperative to discern the relationships between multiple time series for accurate forecasting. In particular, for stock prices, components are often divided into groups with the same characteristics, and a model that extracts relationships consistent with this group structure should be effective. Thus, we propose the concept of hierarchical permutation-equivariance, focusing on index swapping of components within and among groups, to design a model that considers this group structure. When the prediction model has hierarchical permutation-equivariance, the prediction is consistent with the group relationships of the components. Therefore, we propose a hierarchically permutation-equivariant model that considers both the relationship among components in the same group and the relationship among groups. The experiments conducted on real-world data demonstrate that the proposed method outperforms existing state-of-the-art methods.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge