Yongli Zhu

On-Device Training of PV Power Forecasting Models in a Smart Meter for Grid Edge Intelligence

Jul 09, 2025Abstract:In this paper, an edge-side model training study is conducted on a resource-limited smart meter. The motivation of grid-edge intelligence and the concept of on-device training are introduced. Then, the technical preparation steps for on-device training are described. A case study on the task of photovoltaic power forecasting is presented, where two representative machine learning models are investigated: a gradient boosting tree model and a recurrent neural network model. To adapt to the resource-limited situation in the smart meter, "mixed"- and "reduced"-precision training schemes are also devised. Experiment results demonstrate the feasibility of economically achieving grid-edge intelligence via the existing advanced metering infrastructures.

Diffusion-assisted Model Predictive Control Optimization for Power System Real-Time Operation

May 15, 2025Abstract:This paper presents a modified model predictive control (MPC) framework for real-time power system operation. The framework incorporates a diffusion model tailored for time series generation to enhance the accuracy of the load forecasting module used in the system operation. In the absence of explicit state transition law, a model-identification procedure is leveraged to derive the system dynamics, thereby eliminating a barrier when applying MPC to a renewables-dominated power system. Case study results on an industry park system and the IEEE 30-bus system demonstrate that using the diffusion model to augment the training dataset significantly improves load-forecasting accuracy, and the inferred system dynamics are applicable to the real-time grid operation with solar and wind.

Offline Reinforcement Learning for Microgrid Voltage Regulation

May 15, 2025Abstract:This paper presents a study on using different offline reinforcement learning algorithms for microgrid voltage regulation with solar power penetration. When environment interaction is unviable due to technical or safety reasons, the proposed approach can still obtain an applicable model through offline-style training on a previously collected dataset, lowering the negative impact of lacking online environment interactions. Experiment results on the IEEE 33-bus system demonstrate the feasibility and effectiveness of the proposed approach on different offline datasets, including the one with merely low-quality experience.

Deep Reinforcement Learning for Power Grid Multi-Stage Cascading Failure Mitigation

May 13, 2025Abstract:Cascading failures in power grids can lead to grid collapse, causing severe disruptions to social operations and economic activities. In certain cases, multi-stage cascading failures can occur. However, existing cascading-failure-mitigation strategies are usually single-stage-based, overlooking the complexity of the multi-stage scenario. This paper treats the multi-stage cascading failure problem as a reinforcement learning task and develops a simulation environment. The reinforcement learning agent is then trained via the deterministic policy gradient algorithm to achieve continuous actions. Finally, the effectiveness of the proposed approach is validated on the IEEE 14-bus and IEEE 118-bus systems.

Generative Modeling and Data Augmentation for Power System Production Simulation

Dec 10, 2024Abstract:As a key component of power system production simulation, load forecasting is critical for the stable operation of power systems. Machine learning methods prevail in this field. However, the limited training data can be a challenge. This paper proposes a generative model-assisted approach for load forecasting under small sample scenarios, consisting of two steps: expanding the dataset using a diffusion-based generative model and then training various machine learning regressors on the augmented dataset to identify the best performer. The expanded dataset significantly reduces forecasting errors compared to the original dataset, and the diffusion model outperforms the generative adversarial model by achieving about 200 times smaller errors and better alignment in latent data distributions.

Embedded Machine Learning for Solar PV Power Regulation in a Remote Microgrid

Dec 02, 2024Abstract:This paper presents a machine-learning study for solar inverter power regulation in a remote microgrid. Machine learning models for active and reactive power control are respectively trained using an ensemble learning method. Then, unlike conventional schemes that make inferences on a central server in the far-end control center, the proposed scheme deploys the trained models on an embedded edge-computing device near the inverter to reduce the communication delay. Experiments on a real embedded device achieve matched results as on the desktop PC, with about 0.1ms time cost for each inference input.

MAHTM: A Multi-Agent Framework for Hierarchical Transactive Microgrids

Mar 15, 2023

Abstract:Integrating variable renewable energy into the grid has posed challenges to system operators in achieving optimal trade-offs among energy availability, cost affordability, and pollution controllability. This paper proposes a multi-agent reinforcement learning framework for managing energy transactions in microgrids. The framework addresses the challenges above: it seeks to optimize the usage of available resources by minimizing the carbon footprint while benefiting all stakeholders. The proposed architecture consists of three layers of agents, each pursuing different objectives. The first layer, comprised of prosumers and consumers, minimizes the total energy cost. The other two layers control the energy price to decrease the carbon impact while balancing the consumption and production of both renewable and conventional energy. This framework also takes into account fluctuations in energy demand and supply.

End-to-End Topology-Aware Machine Learning for Power System Reliability Assessment

May 30, 2022

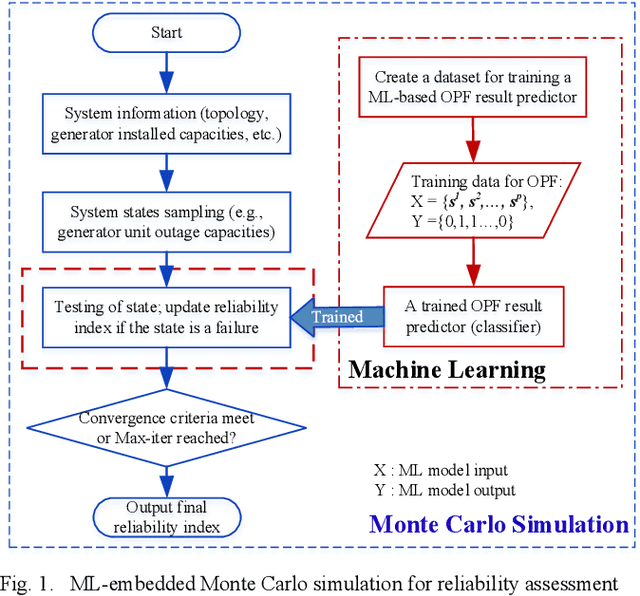

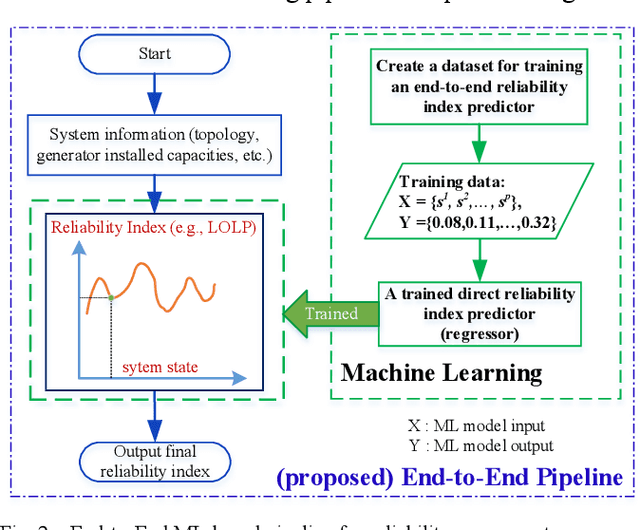

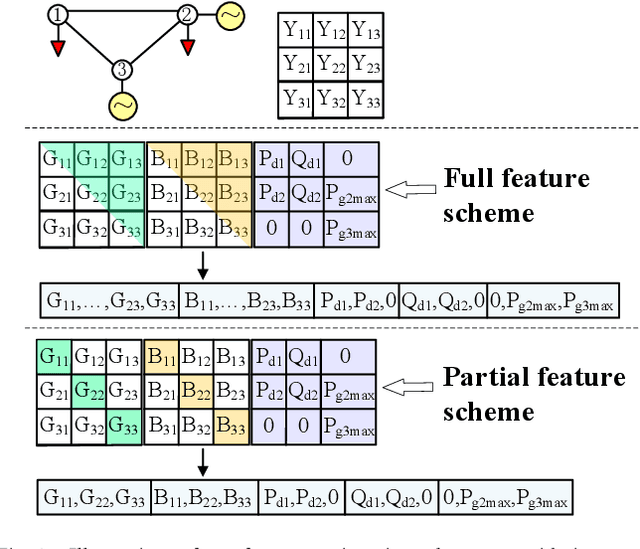

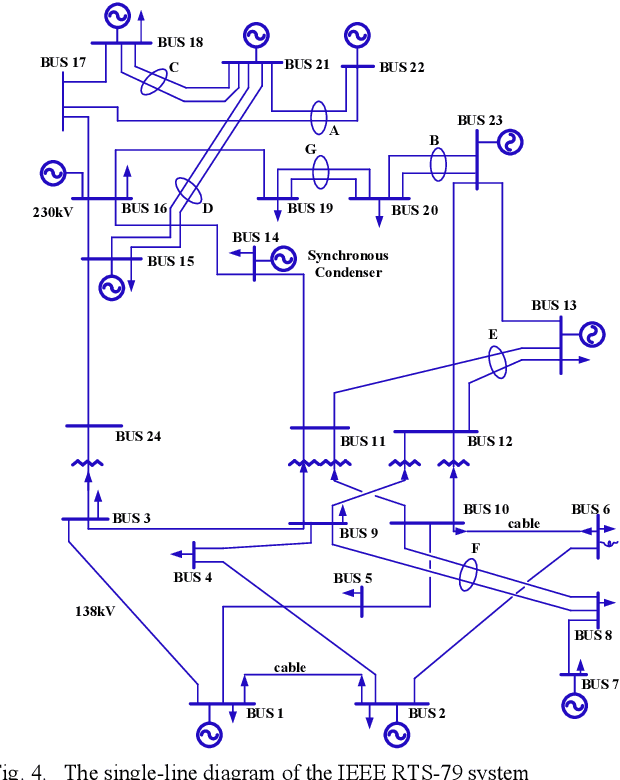

Abstract:Conventional power system reliability suffers from the long run time of Monte Carlo simulation and the dimension-curse of analytic enumeration methods. This paper proposes a preliminary investigation on end-to-end machine learning for directly predicting the reliability index, e.g., the Loss of Load Probability (LOLP). By encoding the system admittance matrix into the input feature, the proposed machine learning pipeline can consider the impact of specific topology changes due to regular maintenances of transmission lines. Two models (Support Vector Machine and Boosting Trees) are trained and compared. Details regarding the training data creation and preprocessing are also discussed. Finally, experiments are conducted on the IEEE RTS-79 system. Results demonstrate the applicability of the proposed end-to-end machine learning pipeline in reliability assessment.

Power Grid Cascading Failure Mitigation by Reinforcement Learning

Aug 23, 2021

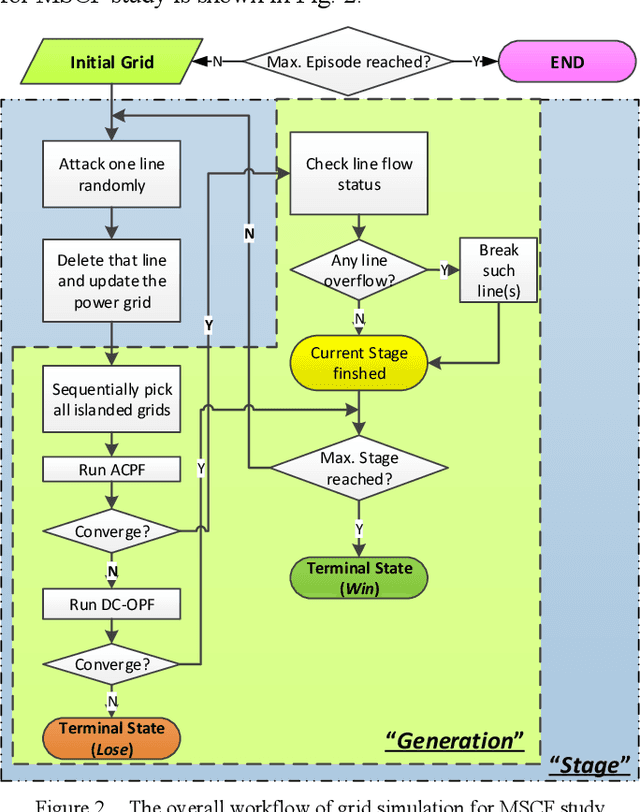

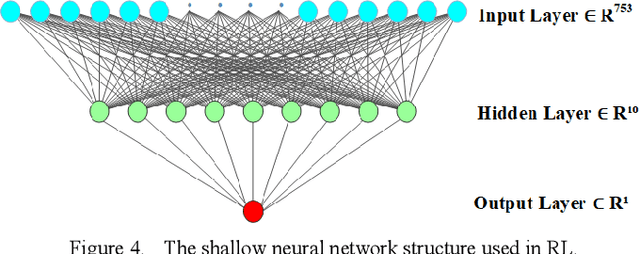

Abstract:This paper proposes a cascading failure mitigation strategy based on Reinforcement Learning (RL). The motivation of the Multi-Stage Cascading Failure (MSCF) problem and its connection with the challenge of climate change are introduced. The bottom-level corrective control of the MCSF problem is formulated based on DCOPF (Direct Current Optimal Power Flow). Then, to mitigate the MSCF issue by a high-level RL-based strategy, physics-informed reward, action, and state are devised. Besides, both shallow and deep neural network architectures are tested. Experiments on the IEEE 118-bus system by the proposed mitigation strategy demonstrate a promising performance in reducing system collapses.

Mitigating Multi-Stage Cascading Failure by Reinforcement Learning

Aug 19, 2019

Abstract:This paper proposes a cascading failure mitigation strategy based on Reinforcement Learning (RL) method. Firstly, the principles of RL are introduced. Then, the Multi-Stage Cascading Failure (MSCF) problem is presented and its challenges are investigated. The problem is then tackled by the RL based on DC-OPF (Optimal Power Flow). Designs of the key elements of the RL framework (rewards, states, etc.) are also discussed in detail. Experiments on the IEEE 118-bus system by both shallow and deep neural networks demonstrate promising results in terms of reduced system collapse rates.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge