Xiaoshan Huang

Automatic deductive coding in discourse analysis: an application of large language models in learning analytics

Oct 02, 2024

Abstract:Deductive coding is a common discourse analysis method widely used by learning science and learning analytics researchers for understanding teaching and learning interactions. It often requires researchers to manually label all discourses to be analyzed according to a theoretically guided coding scheme, which is time-consuming and labor-intensive. The emergence of large language models such as GPT has opened a new avenue for automatic deductive coding to overcome the limitations of traditional deductive coding. To evaluate the usefulness of large language models in automatic deductive coding, we employed three different classification methods driven by different artificial intelligence technologies, including the traditional text classification method with text feature engineering, BERT-like pretrained language model and GPT-like pretrained large language model (LLM). We applied these methods to two different datasets and explored the potential of GPT and prompt engineering in automatic deductive coding. By analyzing and comparing the accuracy and Kappa values of these three classification methods, we found that GPT with prompt engineering outperformed the other two methods on both datasets with limited number of training samples. By providing detailed prompt structures, the reported work demonstrated how large language models can be used in the implementation of automatic deductive coding.

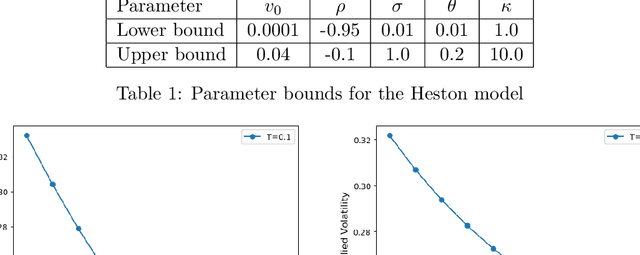

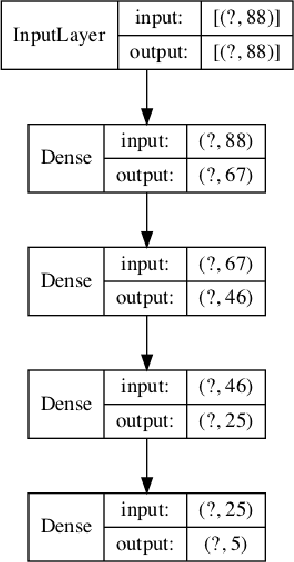

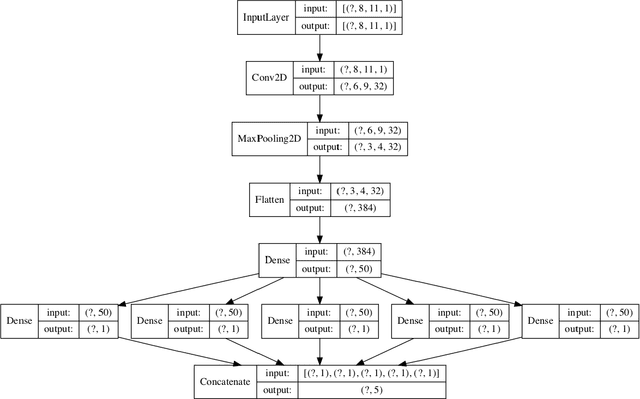

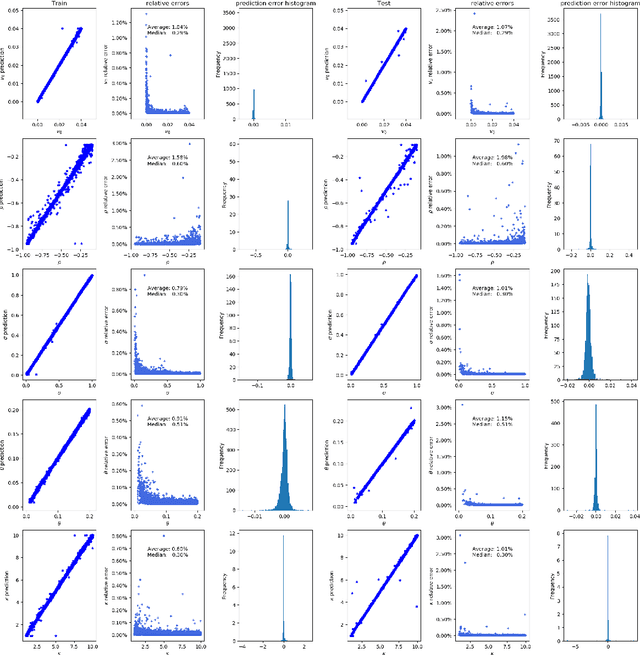

Interpretability in deep learning for finance: a case study for the Heston model

Apr 19, 2021

Abstract:Deep learning is a powerful tool whose applications in quantitative finance are growing every day. Yet, artificial neural networks behave as black boxes and this hinders validation and accountability processes. Being able to interpret the inner functioning and the input-output relationship of these networks has become key for the acceptance of such tools. In this paper we focus on the calibration process of a stochastic volatility model, a subject recently tackled by deep learning algorithms. We analyze the Heston model in particular, as this model's properties are well known, resulting in an ideal benchmark case. We investigate the capability of local strategies and global strategies coming from cooperative game theory to explain the trained neural networks, and we find that global strategies such as Shapley values can be effectively used in practice. Our analysis also highlights that Shapley values may help choose the network architecture, as we find that fully-connected neural networks perform better than convolutional neural networks in predicting and interpreting the Heston model prices to parameters relationship.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge