Xiaohua Zhou

On the Performance of Lossless Reciprocal MiLAC Architectures in Multi-User Networks

Jan 05, 2026Abstract:Microwave linear analog computer (MiLAC)-aided beamforming, which processes the transmitted symbols fully in the analog domain, has recently emerged as a promising alternative to fully digital and hybrid beamforming architectures for multiple-input multiple-output (MIMO) systems. While prior studies have shown that lossless and reciprocal MiLAC can achieve the same capacity as digital beamforming in a single-user MIMO network, its performance in multi-user scenarios remains unknown. To answer this question, in this work, we establish a downlink multi-user multiple-input single-output (MU-MISO) network with a MiLAC-aided transmitter, and investigate its sum-rate performance. Based on the microwave network theory, we first prove that lossless and reciprocal MiLAC cannot achieve the same performance as digital beamforming in a general MU-MISO network. Then, we formulate a sum-rate maximization problem and develop an efficient optimization framework to jointly optimize the power allocation and the scattering matrix for MiLAC. Numerical results validate our theoretical analysis and demonstrate that MiLAC is a promising architecture for future extremely large-scale MIMO systems.

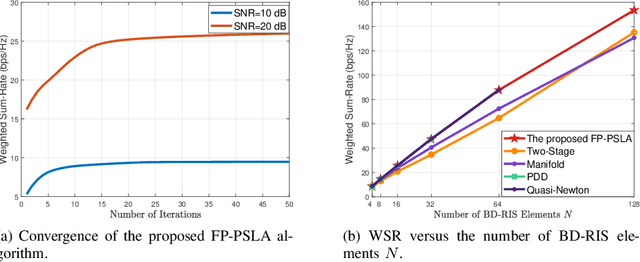

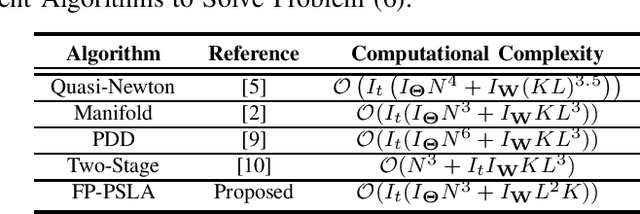

Joint Active and Passive Beamforming Optimization for Beyond Diagonal RIS-aided Multi-User Communications

Jan 17, 2025

Abstract:Benefiting from its capability to generalize existing reconfigurable intelligent surface (RIS) architectures and provide additional design flexibility via interactions between RIS elements, beyond-diagonal RIS (BD-RIS) has attracted considerable research interests recently. However, due to the symmetric and unitary passive beamforming constraint imposed on BD-RIS, existing joint active and passive beamforming optimization algorithms for BD-RIS either exhibit high computational complexity to achieve near optimal solutions or rely on heuristic algorithms with substantial performance loss. In this paper, we address this issue by proposing an efficient optimization framework for BD-RIS assisted multi-user multi-antenna communication networks. Specifically, we solve the weighted sum rate maximization problem by introducing a novel beamforming optimization algorithm that alternately optimizes active and passive beamforming matrices using iterative closed-form solutions. Numerical results demonstrate that our algorithm significantly reduces computational complexity while ensuring a sub-optimal solution.

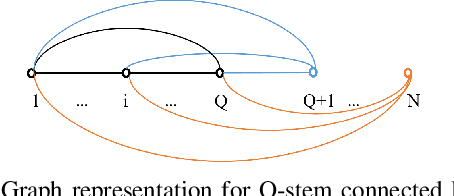

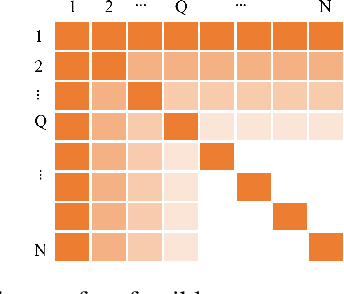

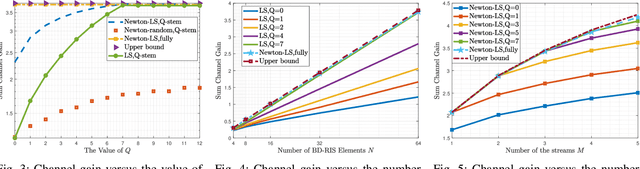

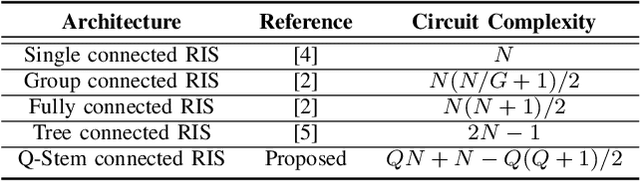

A Novel Q-stem Connected Architecture for Beyond-Diagonal Reconfigurable Intelligent Surfaces

Nov 27, 2024

Abstract:Beyond-diagonal reconfigurable intelligent surface (BD-RIS) has garnered significant research interest recently due to its ability to generalize existing reconfigurable intelligent surface (RIS) architectures and provide enhanced performance through flexible inter-connection among RIS elements. However, current BD-RIS designs often face challenges related to high circuit complexity and computational complexity, and there is limited study on the trade-off between system performance and circuit complexity. To address these issues, in this work, we propose a novel BD-RIS architecture named Q-stem connected RIS that integrates the characteristics of existing single connected, tree connected, and fully connected BD-RIS, facilitating an effective trade-off between system performance and circuit complexity. Additionally, we propose two algorithms to design the RIS scattering matrix for a Q-stem connected RIS aided multi-user broadcast channels, namely, a low-complexity least squares (LS) algorithm and a suboptimal LS-based quasi-Newton algorithm. Simulations show that the proposed architecture is capable of attaining the sum channel gain achieved by fully connected RIS while reducing the circuit complexity. Moreover, the proposed LS-based quasi-Newton algorithm significantly outperforms the baselines, while the LS algorithm provides comparable performance with a substantial reduction in computational complexity.

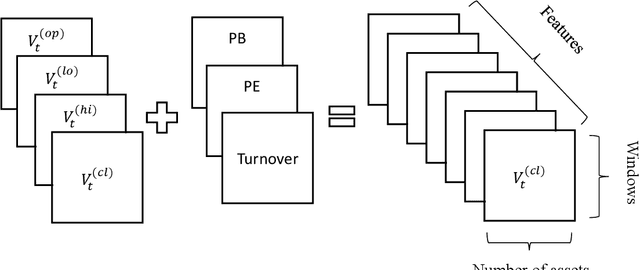

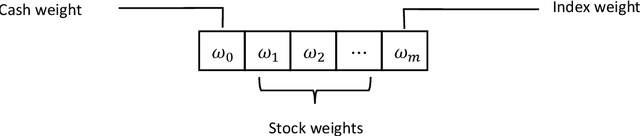

Deep reinforcement learning for portfolio management based on the empirical study of chinese stock market

Jan 10, 2021

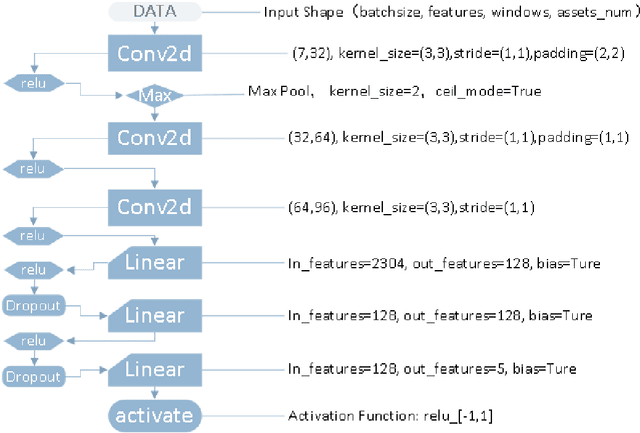

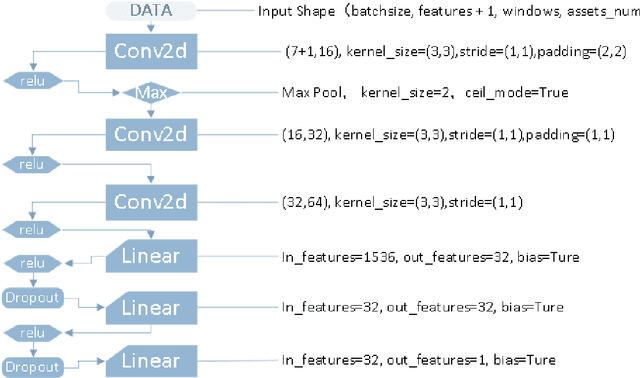

Abstract:The objective of this paper is to verify that current cutting-edge artificial intelligence technology, deep reinforcement learning, can be applied to portfolio management. We improve on the existing Deep Reinforcement Learning Portfolio model and make many innovations. Unlike many previous studies on discrete trading signals in portfolio management, we make the agent to short in a continuous action space, design an arbitrage mechanism based on Arbitrage Pricing Theory,and redesign the activation function for acquiring action vectors, in addition, we redesign neural networks for reinforcement learning with reference to deep neural networks that process image data. In experiments, we use our model in several randomly selected portfolios which include CSI300 that represents the market's rate of return and the randomly selected constituents of CSI500. The experimental results show that no matter what stocks we select in our portfolios, we can almost get a higher return than the market itself. That is to say, we can defeat market by using deep reinforcement learning.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge