Shikhar Jain

Performance evaluation of deep neural networks for forecasting time-series with multiple structural breaks and high volatility

Nov 14, 2019

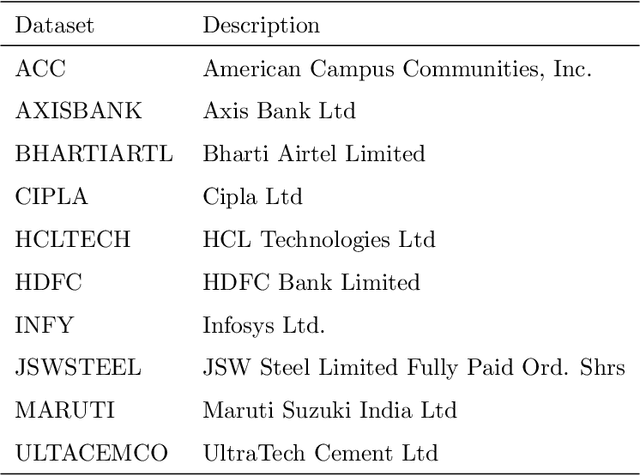

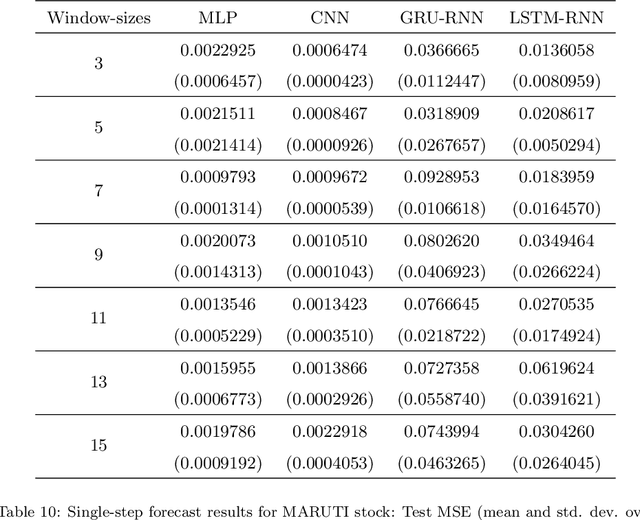

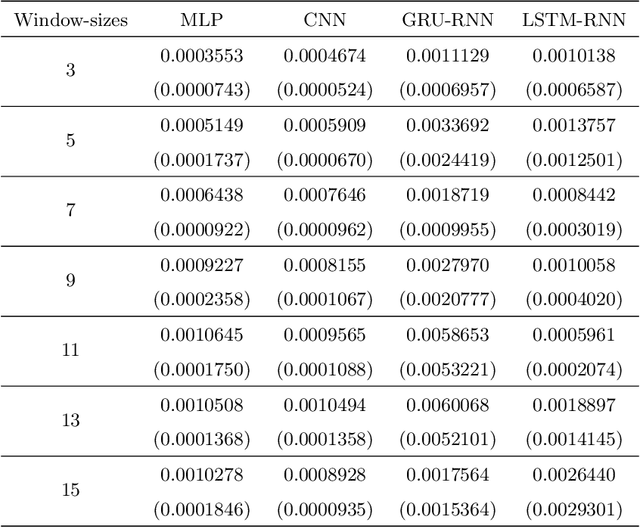

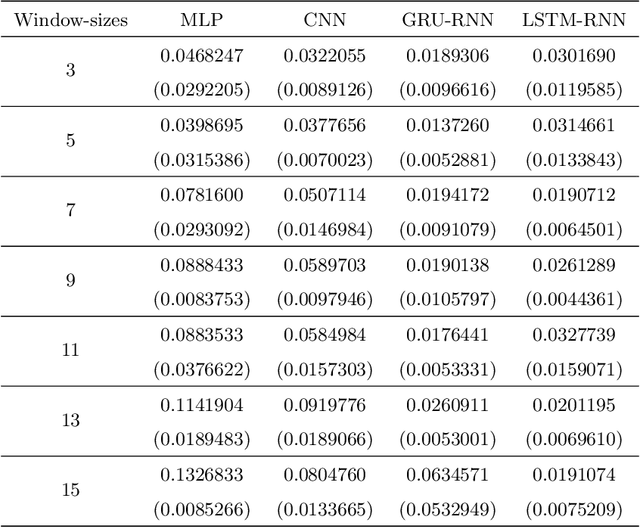

Abstract:The problem of automatic forecasting of time-series data has been a long-standing challenge for the machine learning and forecasting community. The problem is relatively simple when the series is stationary. However, the majority of the real-world time-series problems have non-stationary characteristics making the understanding of the trend and seasonality very complex. Further, it is assumed that the future response is dependent on the past data and, therefore, can be modeled using a function approximator. Our interest in this paper is to study the applicability of the popular deep neural networks (DNN) comprehensively as function approximators for non-stationary time-series forecasting. We employ the following DNN models: Multi-layer Perceptron (MLP), Convolutional Neural Network (CNN), and RNN with Long-Short Term Memory (LSTM-RNN) and RNN with Gated-Recurrent Unit (GRU-RNN). These powerful DNN methods have been evaluated over popular Indian financial stocks data comprising of five stocks from National Stock Exchange Nifty-50 (NSE-Nifty50), and five stocks from Bombay Stock Exchange 30 (BSE-30). Further, the performance evaluation of these DNNs in terms of their predictive power has been done using two fashions: (1) single-step forecasting, (2) multi-step forecasting. Our extensive simulation experiments on these ten datasets report that the performance of these DNNs for single-step forecasting is pretty convincing as the predictions are found to follow the truely observed values closely. However, we also find that all these DNN models perform miserably in the case of multi-step time-series forecasting, based on the datasets used by us. Consequently, we observe that none of these DNN models are reliable for multi-step time-series forecasting.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge