Savina Kim

Fair Models in Credit: Intersectional Discrimination and the Amplification of Inequity

Aug 01, 2023

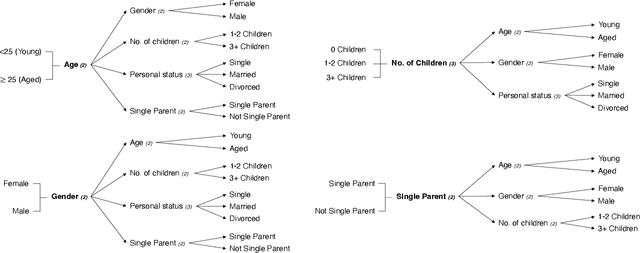

Abstract:The increasing usage of new data sources and machine learning (ML) technology in credit modeling raises concerns with regards to potentially unfair decision-making that rely on protected characteristics (e.g., race, sex, age) or other socio-economic and demographic data. The authors demonstrate the impact of such algorithmic bias in the microfinance context. Difficulties in assessing credit are disproportionately experienced among vulnerable groups, however, very little is known about inequities in credit allocation between groups defined, not only by single, but by multiple and intersecting social categories. Drawing from the intersectionality paradigm, the study examines intersectional horizontal inequities in credit access by gender, age, marital status, single parent status and number of children. This paper utilizes data from the Spanish microfinance market as its context to demonstrate how pluralistic realities and intersectional identities can shape patterns of credit allocation when using automated decision-making systems. With ML technology being oblivious to societal good or bad, we find that a more thorough examination of intersectionality can enhance the algorithmic fairness lens to more authentically empower action for equitable outcomes and present a fairer path forward. We demonstrate that while on a high-level, fairness may exist superficially, unfairness can exacerbate at lower levels given combinatorial effects; in other words, the core fairness problem may be more complicated than current literature demonstrates. We find that in addition to legally protected characteristics, sensitive attributes such as single parent status and number of children can result in imbalanced harm. We discuss the implications of these findings for the financial services industry.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge