Sajjad Zarifzadeh

Low-Cost High-Power Membership Inference by Boosting Relativity

Dec 06, 2023

Abstract:We present a robust membership inference attack (RMIA) that amplifies the distinction between population data and the training data on any target model, by effectively leveraging both reference models and reference data in our likelihood ratio test. Our algorithm exhibits superior test power (true-positive rate) when compared to prior methods, even at extremely low false-positive error rates (as low as 0). Also, under computation constraints, where only a limited number of reference models (as few as 1) are available, our method performs exceptionally well, unlike some prior attacks that approach random guessing in such scenarios. Our method lays the groundwork for cost-effective and practical yet powerful and robust privacy risk analysis of machine learning algorithms.

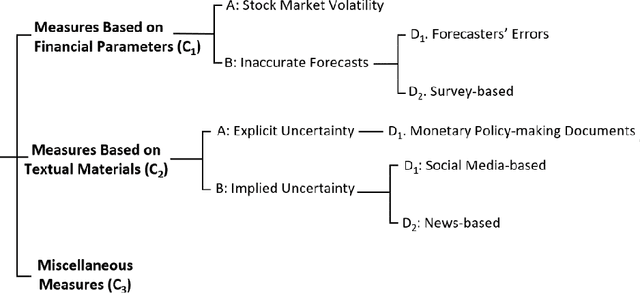

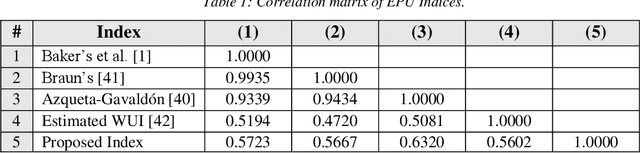

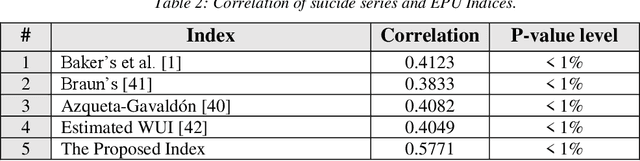

Economic Policy Uncertainty: A Review on Applications and Measurement Methods with Focus on Text Mining Methods

Aug 20, 2023Abstract:Economic Policy Uncertainty (EPU) represents the uncertainty realized by the investors during economic policy alterations. EPU is a critical indicator in economic studies to predict future investments, the unemployment rate, and recessions. EPU values can be estimated based on financial parameters directly or implied uncertainty indirectly using the text mining methods. Although EPU is a well-studied topic within the economy, the methods utilized to measure it are understudied. In this article, we define the EPU briefly and review the methods used to measure the EPU, and survey the areas influenced by the changes in EPU level. We divide the EPU measurement methods into three major groups with respect to their input data. Examples of each group of methods are enlisted, and the pros and cons of the groups are discussed. Among the EPU measures, text mining-based ones are dominantly studied. These methods measure the realized uncertainty by taking into account the uncertainty represented in the news and publicly available sources of financial information. Finally, we survey the research areas that rely on measuring the EPU index with the hope that studying the impacts of uncertainty would attract further attention of researchers from various research fields. In addition, we propose a list of future research approaches focusing on measuring EPU using textual material.

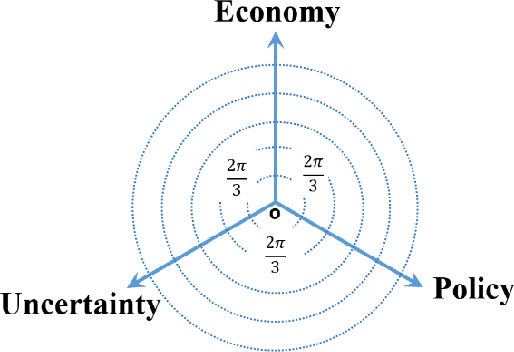

Measuring Economic Policy Uncertainty Using an Unsupervised Word Embedding-based Method

May 10, 2021

Abstract:Economic Policy Uncertainty (EPU) is a critical indicator in economic studies, while it can be used to forecast a recession. Under higher levels of uncertainty, firms' owners cut their investment, which leads to a longer post-recession recovery. EPU index is computed by counting news articles containing pre-defined keywords related to policy-making and economy and convey uncertainty. Unfortunately, this method is sensitive to the original keyword set, its richness, and the news coverage. Thus, reproducing its results for different countries is challenging. In this paper, we propose an unsupervised text mining method that uses word-embedding representation space to select relevant keywords. This method is not strictly sensitive to the semantic similarity threshold applied to the word embedding vectors and does not require a pre-defined dictionary. Our experiments using a massive repository of Persian news show that the EPU series computed by the proposed method precisely follows major events affecting Iran's economy and is compatible with the World Uncertainty Index (WUI) of Iran.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge