Roy Wedge

Prediction Factory: automated development and collaborative evaluation of predictive models

Nov 29, 2018

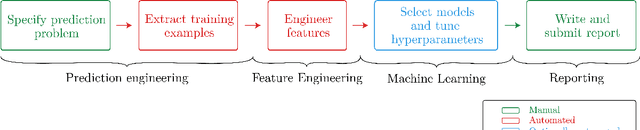

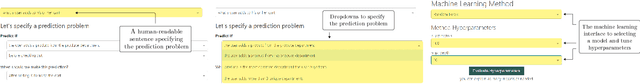

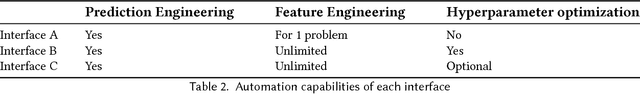

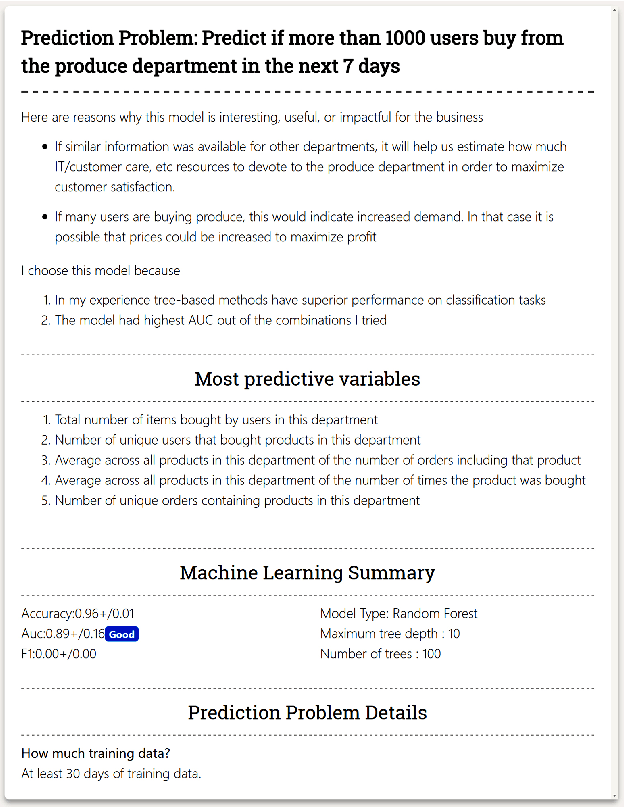

Abstract:In this paper, we present a data science automation system called Prediction Factory. The system uses several key automation algorithms to enable data scientists to rapidly develop predictive models and share them with domain experts. To assess the system's impact, we implemented 3 different interfaces for creating predictive modeling projects: baseline automation, full automation, and optional automation. With a dataset of online grocery shopper behaviors, we divided data scientists among the interfaces to specify prediction problems, learn and evaluate models, and write a report for domain experts to judge whether or not to fund to continue working on. In total, 22 data scientists created 94 reports that were judged 296 times by 26 experts. In a head-to-head trial, reports generated utilizing full data science automation interface reports were funded 57.5% of the time, while the ones that used baseline automation were only funded 42.5% of the time. An intermediate interface which supports optional automation generated reports were funded 58.6% more often compared to the baseline. Full automation and optional automation reports were funded about equally when put head-to-head. These results demonstrate that Prediction Factory has implemented a critical amount of automation to augment the role of data scientists and improve business outcomes.

Solving the "false positives" problem in fraud prediction

Oct 20, 2017

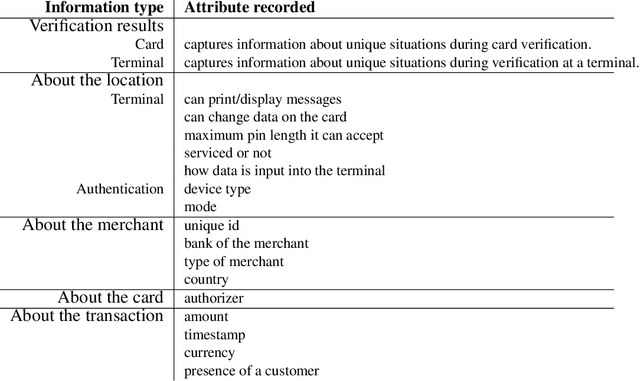

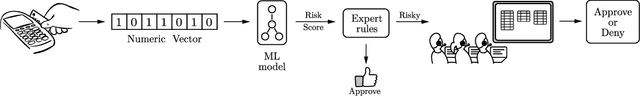

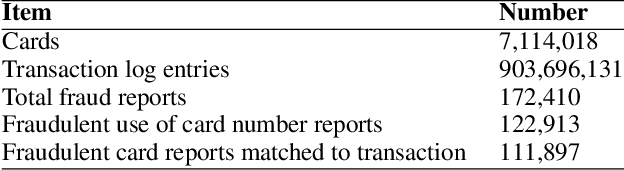

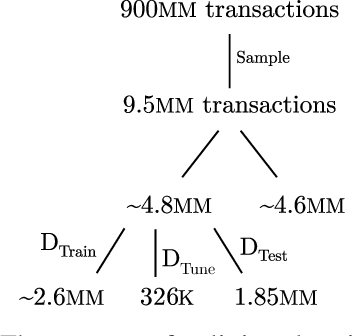

Abstract:In this paper, we present an automated feature engineering based approach to dramatically reduce false positives in fraud prediction. False positives plague the fraud prediction industry. It is estimated that only 1 in 5 declared as fraud are actually fraud and roughly 1 in every 6 customers have had a valid transaction declined in the past year. To address this problem, we use the Deep Feature Synthesis algorithm to automatically derive behavioral features based on the historical data of the card associated with a transaction. We generate 237 features (>100 behavioral patterns) for each transaction, and use a random forest to learn a classifier. We tested our machine learning model on data from a large multinational bank and compared it to their existing solution. On an unseen data of 1.852 million transactions, we were able to reduce the false positives by 54% and provide a savings of 190K euros. We also assess how to deploy this solution, and whether it necessitates streaming computation for real time scoring. We found that our solution can maintain similar benefits even when historical features are computed once every 7 days.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge