Rohan Sen

Probabilistic energy forecasting through quantile regression in reproducing kernel Hilbert spaces

Aug 08, 2024Abstract:Accurate energy demand forecasting is crucial for sustainable and resilient energy development. To meet the Net Zero Representative Concentration Pathways (RCP) $4.5$ scenario in the DACH countries, increased renewable energy production, energy storage, and reduced commercial building consumption are needed. This scenario's success depends on hydroelectric capacity and climatic factors. Informed decisions require quantifying uncertainty in forecasts. This study explores a non-parametric method based on \emph{reproducing kernel Hilbert spaces (RKHS)}, known as kernel quantile regression, for energy prediction. Our experiments demonstrate its reliability and sharpness, and we benchmark it against state-of-the-art methods in load and price forecasting for the DACH region. We offer our implementation in conjunction with additional scripts to ensure the reproducibility of our research.

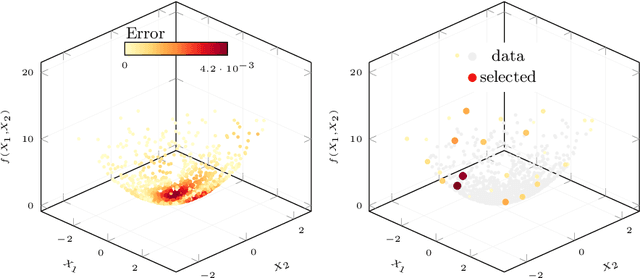

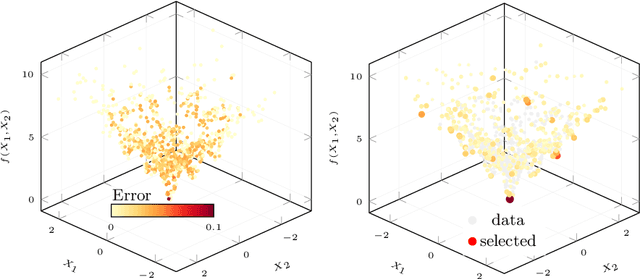

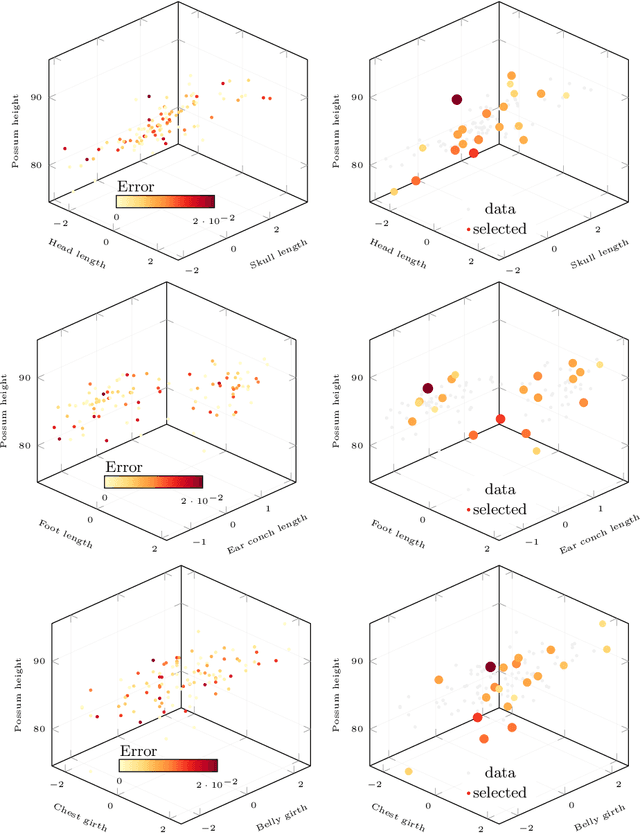

Observation-specific explanations through scattered data approximation

Apr 12, 2024

Abstract:This work introduces the definition of observation-specific explanations to assign a score to each data point proportional to its importance in the definition of the prediction process. Such explanations involve the identification of the most influential observations for the black-box model of interest. The proposed method involves estimating these explanations by constructing a surrogate model through scattered data approximation utilizing the orthogonal matching pursuit algorithm. The proposed approach is validated on both simulated and real-world datasets.

Fast Empirical Scenarios

Jul 08, 2023Abstract:We seek to extract a small number of representative scenarios from large and high-dimensional panel data that are consistent with sample moments. Among two novel algorithms, the first identifies scenarios that have not been observed before, and comes with a scenario-based representation of covariance matrices. The second proposal picks important data points from states of the world that have already realized, and are consistent with higher-order sample moment information. Both algorithms are efficient to compute, and lend themselves to consistent scenario-based modeling and high-dimensional numerical integration. Extensive numerical benchmarking studies and an application in portfolio optimization favor the proposed algorithms.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge