Pratyush Muthukumar

Generative Adversarial Imitation Learning for Empathy-based AI

May 27, 2021

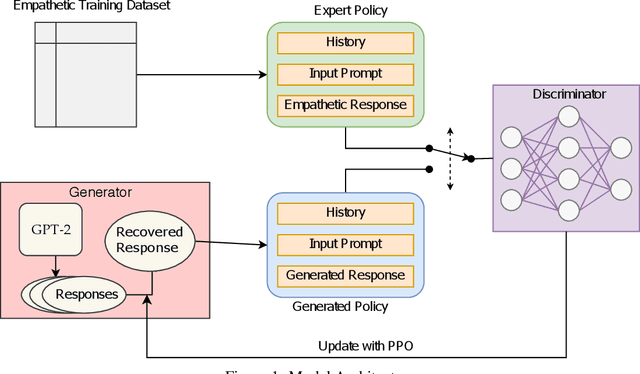

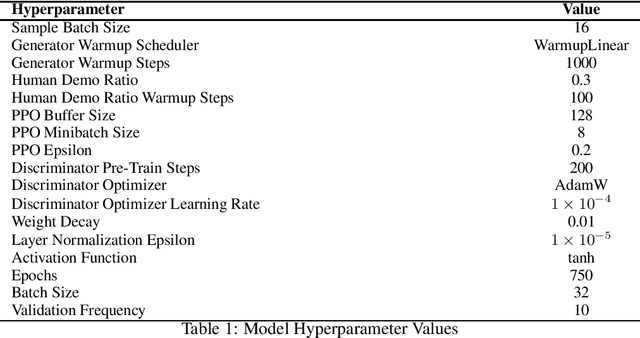

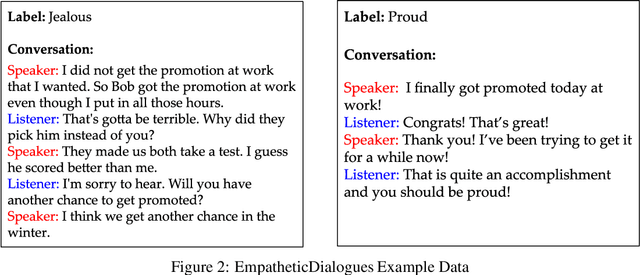

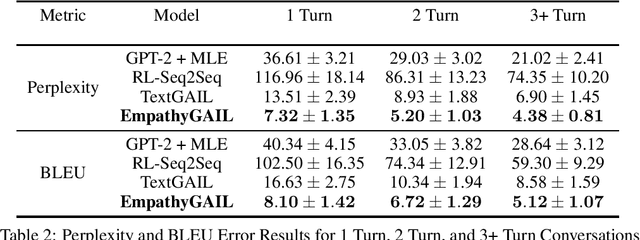

Abstract:Generative adversarial imitation learning (GAIL) is a model-free algorithm that has been shown to provide strong results in imitating complex behaviors in high-dimensional environments. In this paper, we utilize the GAIL model for text generation to develop empathy-based context-aware conversational AI. Our model uses an expert trajectory of empathetic prompt-response dialogues which can accurately exhibit the correct empathetic emotion when generating a response. The Generator of the GAIL model uses the GPT-2 sequential pre-trained language model trained on 117 million parameters from 40 GB of internet data. We propose a novel application of an approach used in transfer learning to fine tune the GPT-2 model in order to generate concise, user-specific empathetic responses validated against the Discriminator. Our novel GAIL model utilizes a sentiment analysis history-based reinforcement learning approach to empathetically respond to human interactions in a personalized manner. We find that our model's response scores on various human-generated prompts collected from the Facebook Empathetic Dialogues dataset outperform baseline counterparts. Moreover, our model improves upon various history-based conversational AI models developed recently, as our model's performance over a sustained conversation of 3 or more interactions outperform similar conversational AI models.

A Stochastic Time Series Model for Predicting Financial Trends using NLP

Feb 02, 2021

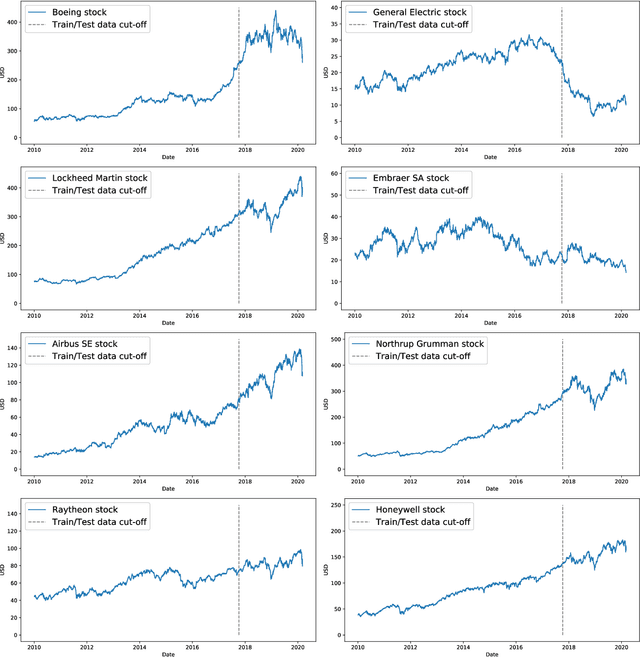

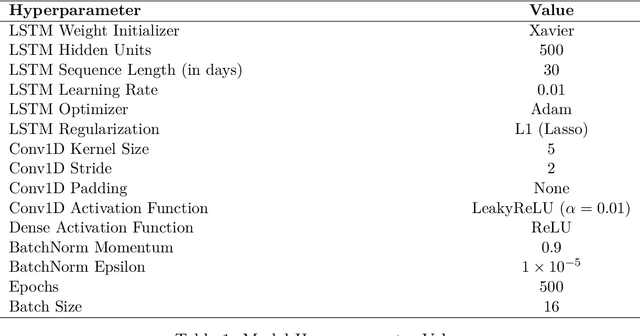

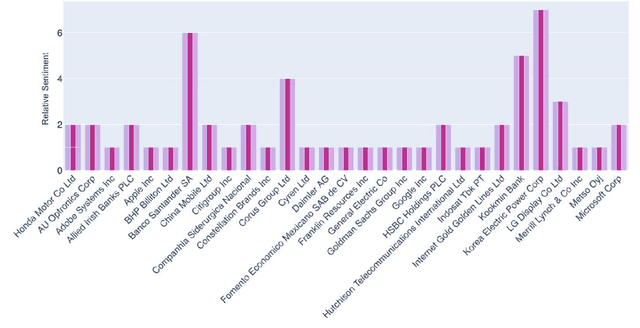

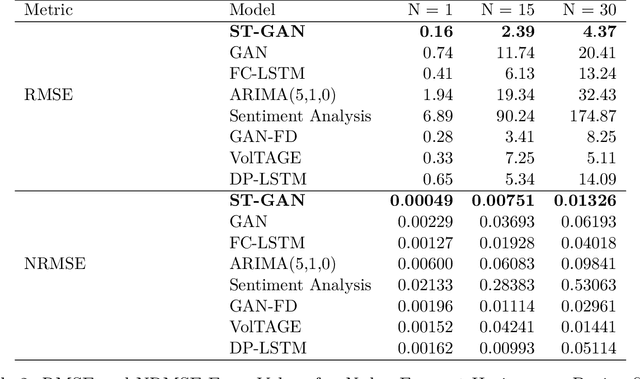

Abstract:Stock price forecasting is a highly complex and vitally important field of research. Recent advancements in deep neural network technology allow researchers to develop highly accurate models to predict financial trends. We propose a novel deep learning model called ST-GAN, or Stochastic Time-series Generative Adversarial Network, that analyzes both financial news texts and financial numerical data to predict stock trends. We utilize cutting-edge technology like the Generative Adversarial Network (GAN) to learn the correlations among textual and numerical data over time. We develop a new method of training a time-series GAN directly using the learned representations of Naive Bayes' sentiment analysis on financial text data alongside technical indicators from numerical data. Our experimental results show significant improvement over various existing models and prior research on deep neural networks for stock price forecasting.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge