Paul Doukhan

Deviation inequalities for stochastic approximation by averaging

Feb 17, 2021Abstract:We introduce a class of Markov chains, that contains the model of stochastic approximation by averaging and non-averaging. Using martingale approximation method, we establish various deviation inequalities for separately Lipschitz functions of such a chain, with different moment conditions on some dominating random variables of martingale differences.Finally, we apply these inequalities to the stochastic approximation by averaging.

High dimensional VAR with low rank transition

May 02, 2019

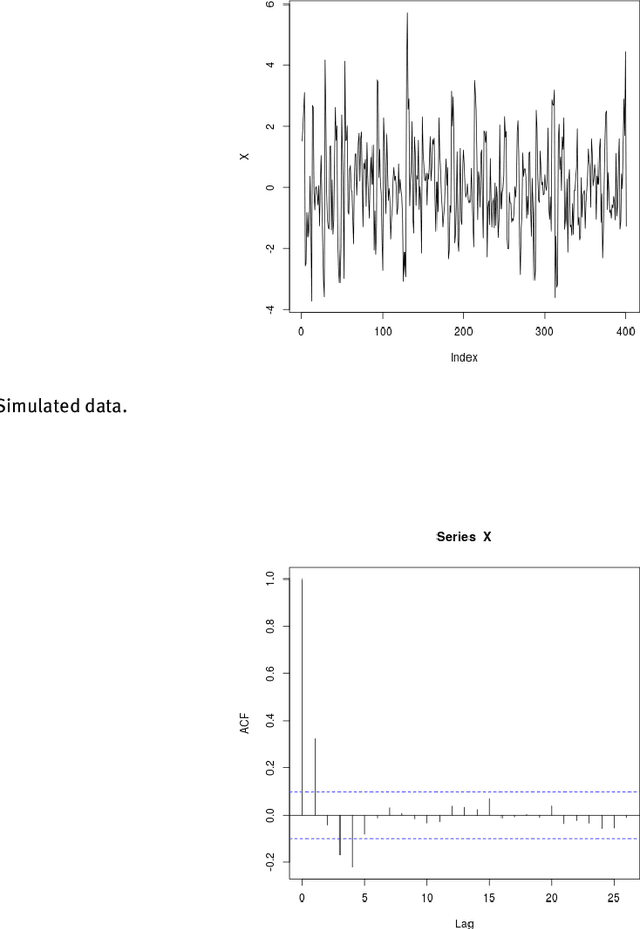

Abstract:We propose a vector auto-regressive (VAR) model with a low-rank constraint on the transition matrix. This new model is well suited to predict high-dimensional series that are highly correlated, or that are driven by a small number of hidden factors. We study estimation, prediction, and rank selection for this model in a very general setting. Our method shows excellent performances on a wide variety of simulated datasets. On macro-economic data from Giannone et al. (2015), our method is competitive with state-of-the-art methods in small dimension, and even improves on them in high dimension.

Exponential inequalities for nonstationary Markov Chains

Aug 27, 2018

Abstract:Exponential inequalities are main tools in machine learning theory. To prove exponential inequalities for non i.i.d random variables allows to extend many learning techniques to these variables. Indeed, much work has been done both on inequalities and learning theory for time series, in the past 15 years. However, for the non independent case, almost all the results concern stationary time series. This excludes many important applications: for example any series with a periodic behaviour is non-stationary. In this paper, we extend the basic tools of Dedecker and Fan (2015) to nonstationary Markov chains. As an application, we provide a Bernstein-type inequality, and we deduce risk bounds for the prediction of periodic autoregressive processes with an unknown period.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge