Nicola Uras

On Technical Trading and Social Media Indicators in Cryptocurrencies' Price Classification Through Deep Learning

Feb 17, 2021

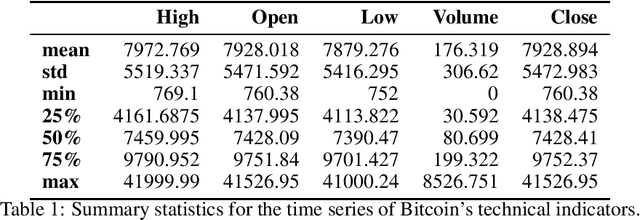

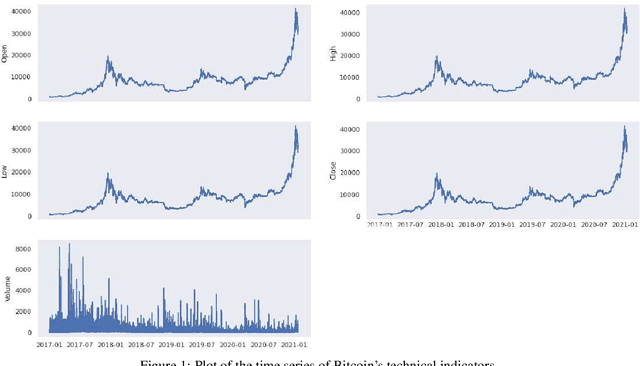

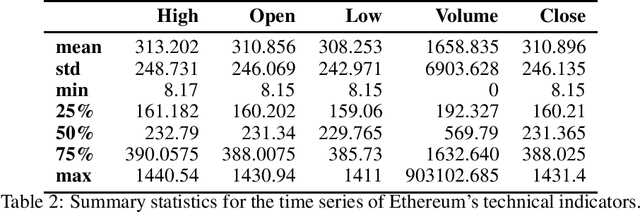

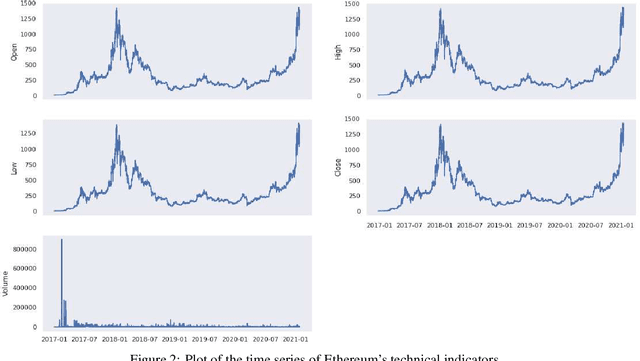

Abstract:This work aims to analyse the predictability of price movements of cryptocurrencies on both hourly and daily data observed from January 2017 to January 2021, using deep learning algorithms. For our experiments, we used three sets of features: technical, trading and social media indicators, considering a restricted model of only technical indicators and an unrestricted model with technical, trading and social media indicators. We verified whether the consideration of trading and social media indicators, along with the classic technical variables (such as price's returns), leads to a significative improvement in the prediction of cryptocurrencies price's changes. We conducted the study on the two highest cryptocurrencies in volume and value (at the time of the study): Bitcoin and Ethereum. We implemented four different machine learning algorithms typically used in time-series classification problems: Multi Layers Perceptron (MLP), Convolutional Neural Network (CNN), Long Short Term Memory (LSTM) neural network and Attention Long Short Term Memory (ALSTM). We devised the experiments using the advanced bootstrap technique to consider the variance problem on test samples, which allowed us to evaluate a more reliable estimate of the model's performance. Furthermore, the Grid Search technique was used to find the best hyperparameters values for each implemented algorithm. The study shows that, based on the hourly frequency results, the unrestricted model outperforms the restricted one. The addition of the trading indicators to the classic technical indicators improves the accuracy of Bitcoin and Ethereum price's changes prediction, with an increase of accuracy from a range of 51-55% for the restricted model, to 67-84% for the unrestricted model.

Forecasting Bitcoin closing price series using linear regression and neural networks models

Jan 04, 2020

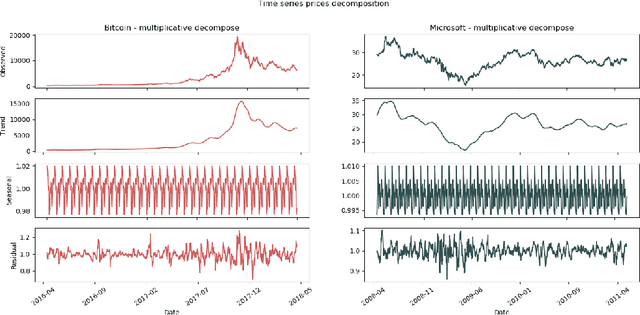

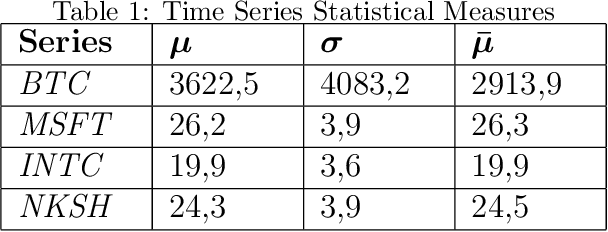

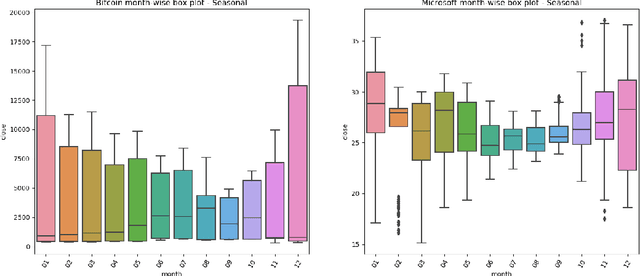

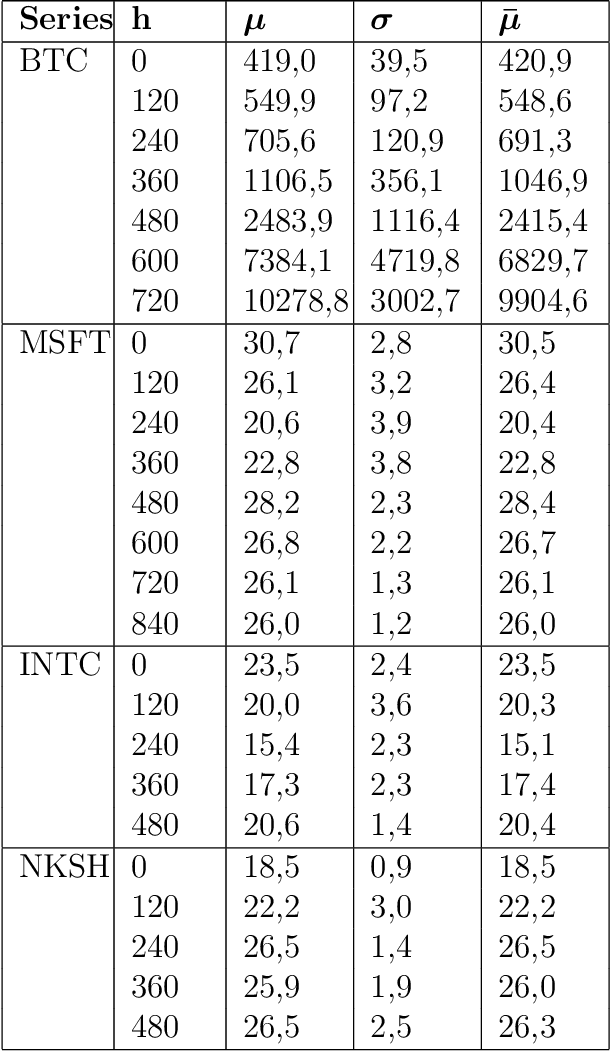

Abstract:This paper studies how to forecast daily closing price series of Bitcoin, using data on prices and volumes of prior days. Bitcoin price behaviour is still largely unexplored, presenting new opportunities. We compared our results with two modern works on Bitcoin prices forecasting and with a well-known recent paper that uses Intel, National Bank shares and Microsoft daily NASDAQ closing prices spanning a 3-year interval. We followed different approaches in parallel, implementing both statistical techniques and machine learning algorithms. The SLR model for univariate series forecast uses only closing prices, whereas the MLR model for multivariate series uses both price and volume data. We applied the ADF -Test to these series, which resulted to be indistinguishable from a random walk. We also used two artificial neural networks: MLP and LSTM. We then partitioned the dataset into shorter sequences, representing different price regimes, obtaining best result using more than one previous price, thus confirming our regime hypothesis. All the models were evaluated in terms of MAPE and relativeRMSE. They performed well, and were overall better than those obtained in the benchmarks. Based on the results, it was possible to demonstrate the efficacy of the proposed methodology and its contribution to the state-of-the-art.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge