Nga Pham

FAIREDU: A Multiple Regression-Based Method for Enhancing Fairness in Machine Learning Models for Educational Applications

Oct 08, 2024Abstract:Fairness in artificial intelligence and machine learning (AI/ML) models is becoming critically important, especially as decisions made by these systems impact diverse groups. In education, a vital sector for all countries, the widespread application of AI/ML systems raises specific concerns regarding fairness. Current research predominantly focuses on fairness for individual sensitive features, which limits the comprehensiveness of fairness assessments. This paper introduces FAIREDU, a novel and effective method designed to improve fairness across multiple sensitive features. Through extensive experiments, we evaluate FAIREDU effectiveness in enhancing fairness without compromising model performance. The results demonstrate that FAIREDU addresses intersectionality across features such as gender, race, age, and other sensitive features, outperforming state-of-the-art methods with minimal effect on model accuracy. The paper also explores potential future research directions to enhance further the method robustness and applicability to various machine-learning models and datasets.

Predicting Performances of Mutual Funds using Deep Learning and Ensemble Techniques

Sep 18, 2022

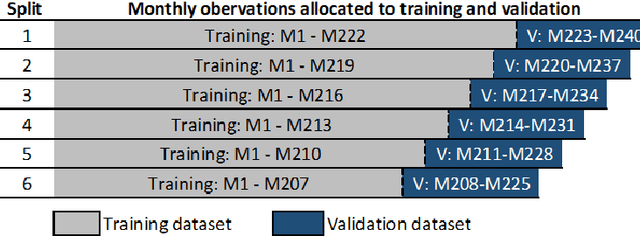

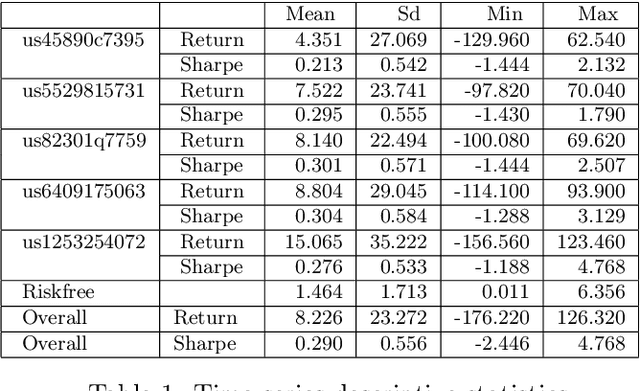

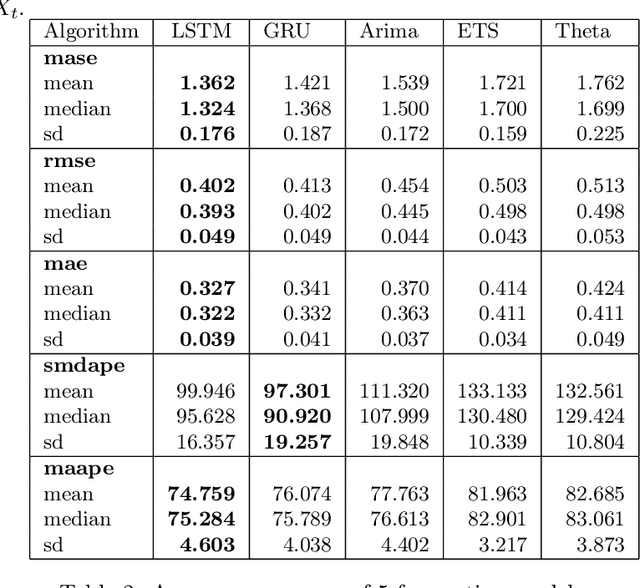

Abstract:Predicting fund performance is beneficial to both investors and fund managers, and yet is a challenging task. In this paper, we have tested whether deep learning models can predict fund performance more accurately than traditional statistical techniques. Fund performance is typically evaluated by the Sharpe ratio, which represents the risk-adjusted performance to ensure meaningful comparability across funds. We calculated the annualised Sharpe ratios based on the monthly returns time series data for more than 600 open-end mutual funds investing in listed large-cap equities in the United States. We find that long short-term memory (LSTM) and gated recurrent units (GRUs) deep learning methods, both trained with modern Bayesian optimization, provide higher accuracy in forecasting funds' Sharpe ratios than traditional statistical ones. An ensemble method, which combines forecasts from LSTM and GRUs, achieves the best performance of all models. There is evidence to say that deep learning and ensembling offer promising solutions in addressing the challenge of fund performance forecasting.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge