Naman Shukla

Time series forecasting with high stakes: A field study of the air cargo industry

Jul 29, 2024

Abstract:Time series forecasting in the air cargo industry presents unique challenges due to volatile market dynamics and the significant impact of accurate forecasts on generated revenue. This paper explores a comprehensive approach to demand forecasting at the origin-destination (O\&D) level, focusing on the development and implementation of machine learning models in decision-making for the air cargo industry. We leverage a mixture of experts framework, combining statistical and advanced deep learning models to provide reliable forecasts for cargo demand over a six-month horizon. The results demonstrate that our approach outperforms industry benchmarks, offering actionable insights for cargo capacity allocation and strategic decision-making in the air cargo industry. While this work is applied in the airline industry, the methodology is broadly applicable to any field where forecast-based decision-making in a volatile environment is crucial.

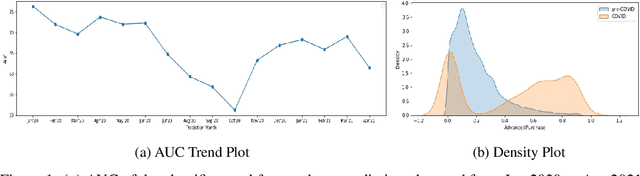

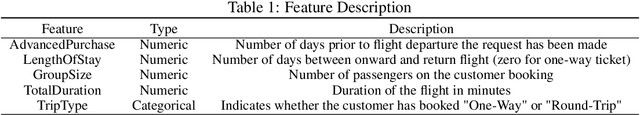

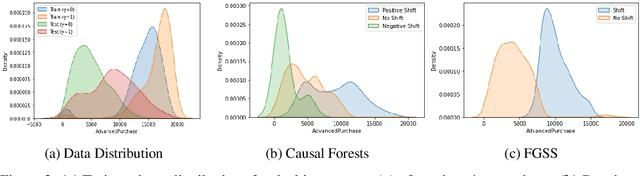

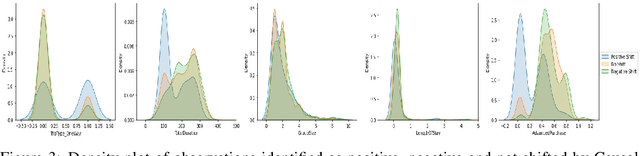

Distribution Shift in Airline Customer Behavior during COVID-19

Dec 23, 2021

Abstract:Traditional AI approaches in customized (personalized) contextual pricing applications assume that the data distribution at the time of online pricing is similar to that observed during training. However, this assumption may be violated in practice because of the dynamic nature of customer buying patterns, particularly due to unanticipated system shocks such as COVID-19. We study the changes in customer behavior for a major airline during the COVID-19 pandemic by framing it as a covariate shift and concept drift detection problem. We identify which customers changed their travel and purchase behavior and the attributes affecting that change using (i) Fast Generalized Subset Scanning and (ii) Causal Forests. In our experiments with simulated and real-world data, we present how these two techniques can be used through qualitative analysis.

Negotiating Networks in Oligopoly Markets for Price-Sensitive Products

Oct 25, 2021

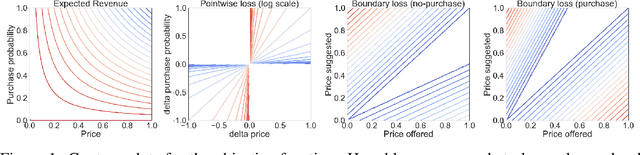

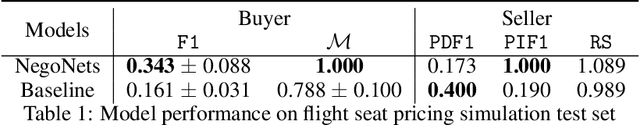

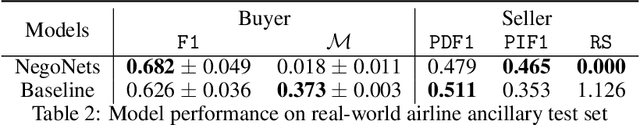

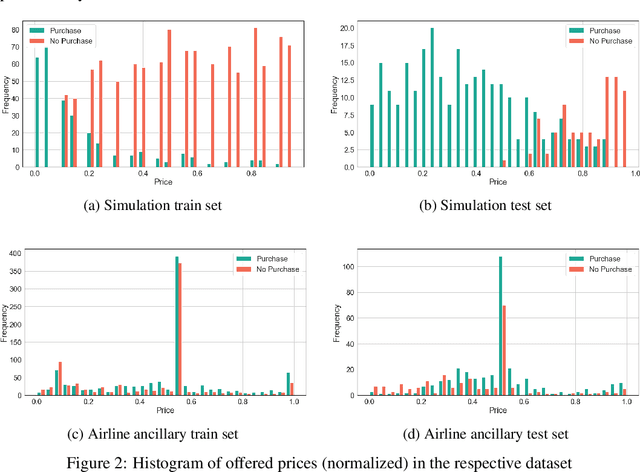

Abstract:We present a novel framework to learn functions that estimate decisions of sellers and buyers simultaneously in an oligopoly market for a price-sensitive product. In this setting, the aim of the seller network is to come up with a price for a given context such that the expected revenue is maximized by considering the buyer's satisfaction as well. On the other hand, the aim of the buyer network is to assign probability of purchase to the offered price to mimic the real world buyers' responses while also showing price sensitivity through its action. In other words, rejecting the unnecessarily high priced products. Similar to generative adversarial networks, this framework corresponds to a minimax two-player game. In our experiments with simulated and real-world transaction data, we compared our framework with the baseline model and demonstrated its potential through proposed evaluation metrics.

Monotonic Trends in Deep Neural Networks

Sep 25, 2019

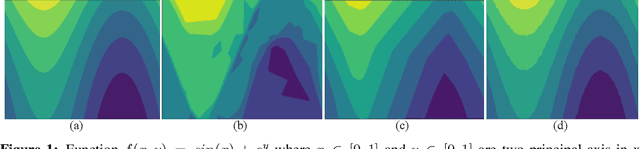

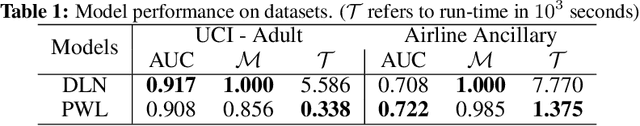

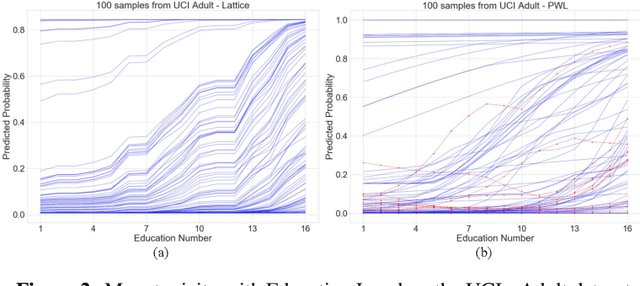

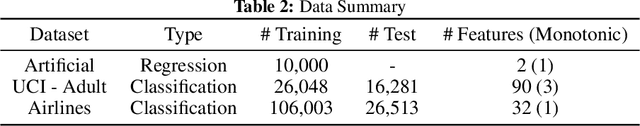

Abstract:Comparison between the previous method and proposed method TBU.

Adaptive Model Selection Framework: An Application to Airline Pricing

May 21, 2019

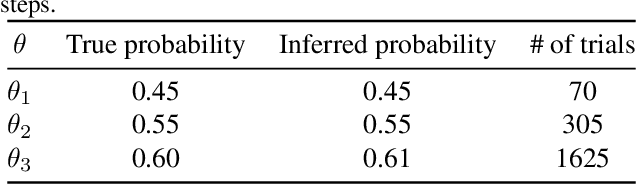

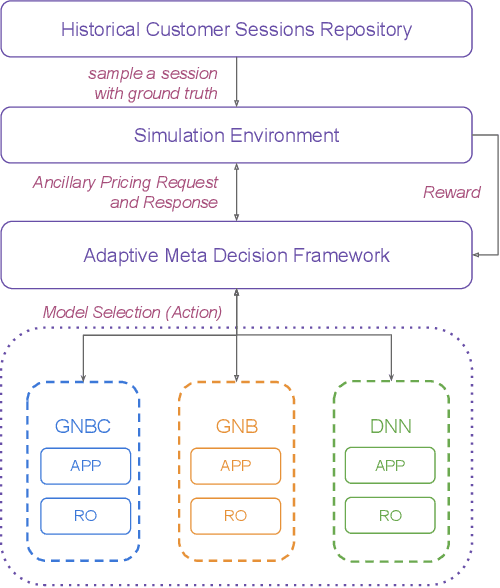

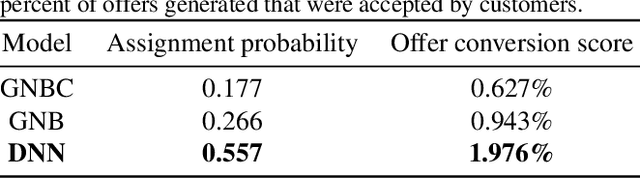

Abstract:Multiple machine learning and prediction models are often used for the same prediction or recommendation task. In our recent work, where we develop and deploy airline ancillary pricing models in an online setting, we found that among multiple pricing models developed, no one model clearly dominates other models for all incoming customer requests. Thus, as algorithm designers, we face an exploration - exploitation dilemma. In this work, we introduce an adaptive meta-decision framework that uses Thompson sampling, a popular multi-armed bandit solution method, to route customer requests to various pricing models based on their online performance. We show that this adaptive approach outperform a uniformly random selection policy by improving the expected revenue per offer by 43% and conversion score by 58% in an offline simulation.

Dynamic Pricing for Airline Ancillaries with Customer Context

Feb 06, 2019

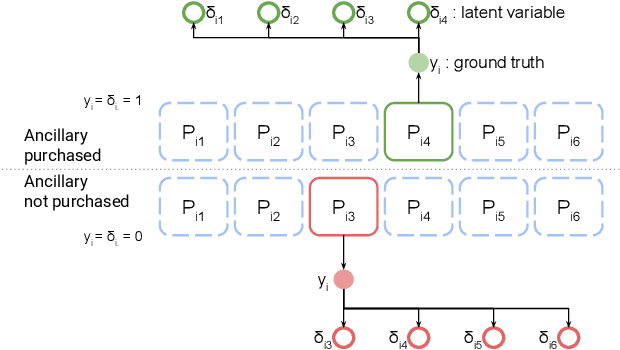

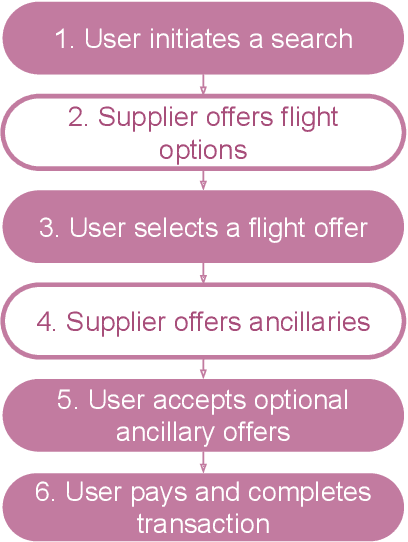

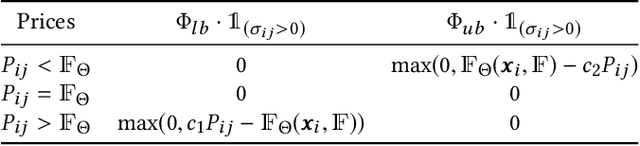

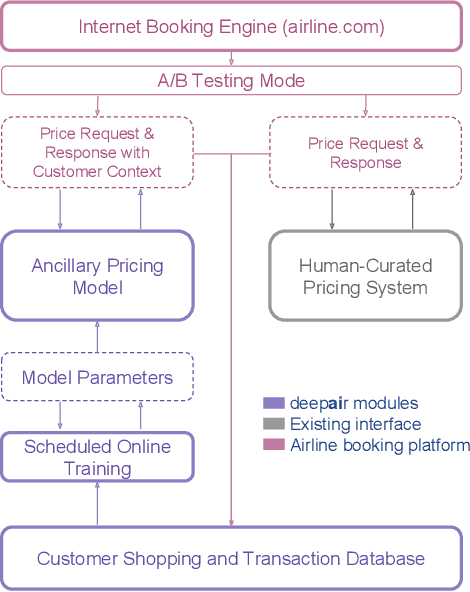

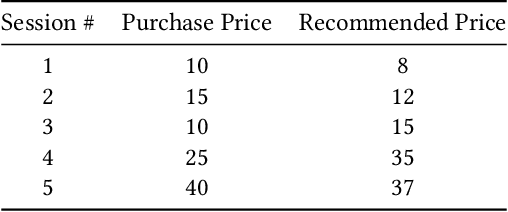

Abstract:Ancillaries have become a major source of revenue and profitability in the travel industry. Yet, conventional pricing strategies are based on business rules that are poorly optimized and do not respond to changing market conditions. This paper describes the dynamic pricing model developed by Deepair solutions, an AI technology provider for travel suppliers. We present a pricing model that provides dynamic pricing recommendations specific to each customer interaction and optimizes expected revenue per customer. The unique nature of personalized pricing provides the opportunity to search over the market space to find the optimal price-point of each ancillary for each customer, without violating customer privacy. In this paper, we present and compare three approaches for dynamic pricing of ancillaries, with increasing levels of sophistication: (1) a two-stage forecasting and optimization model using a logistic mapping function; (2) a two-stage model that uses a deep neural network for forecasting, coupled with a revenue maximization technique using discrete exhaustive search; (3) a single-stage end-to-end deep neural network that recommends the optimal price. We describe the performance of these models based on both offline and online evaluations. We also measure the real-world business impact of these approaches by deploying them in an A/B test on an airline's internet booking website. We show that traditional machine learning techniques outperform human rule-based approaches in an online setting by improving conversion by 36% and revenue per offer by 10%. We also provide results for our offline experiments which show that deep learning algorithms outperform traditional machine learning techniques for this problem. Our end-to-end deep learning model is currently being deployed by the airline in their booking system.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge