Minseok Song

MAP4TS: A Multi-Aspect Prompting Framework for Time-Series Forecasting with Large Language Models

Oct 27, 2025

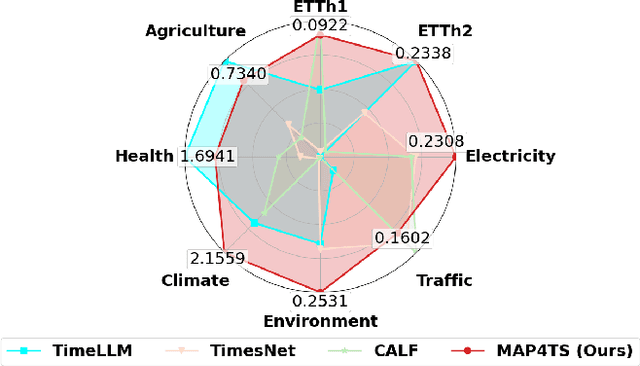

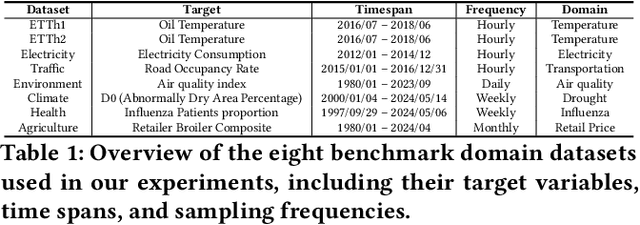

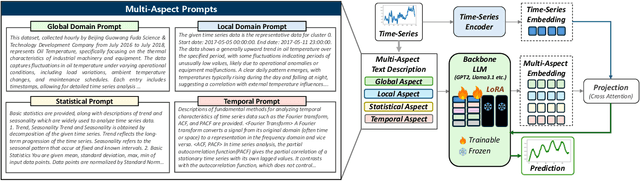

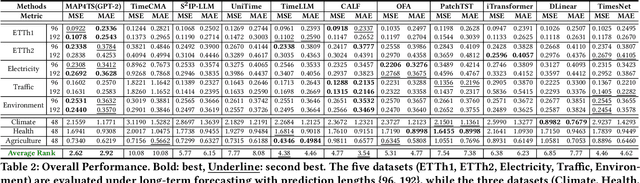

Abstract:Recent advances have investigated the use of pretrained large language models (LLMs) for time-series forecasting by aligning numerical inputs with LLM embedding spaces. However, existing multimodal approaches often overlook the distinct statistical properties and temporal dependencies that are fundamental to time-series data. To bridge this gap, we propose MAP4TS, a novel Multi-Aspect Prompting Framework that explicitly incorporates classical time-series analysis into the prompt design. Our framework introduces four specialized prompt components: a Global Domain Prompt that conveys dataset-level context, a Local Domain Prompt that encodes recent trends and series-specific behaviors, and a pair of Statistical and Temporal Prompts that embed handcrafted insights derived from autocorrelation (ACF), partial autocorrelation (PACF), and Fourier analysis. Multi-Aspect Prompts are combined with raw time-series embeddings and passed through a cross-modality alignment module to produce unified representations, which are then processed by an LLM and projected for final forecasting. Extensive experiments across eight diverse datasets show that MAP4TS consistently outperforms state-of-the-art LLM-based methods. Our ablation studies further reveal that prompt-aware designs significantly enhance performance stability and that GPT-2 backbones, when paired with structured prompts, outperform larger models like LLaMA in long-term forecasting tasks.

A Survey of Large Language Models in Finance

Feb 04, 2024Abstract:Large Language Models (LLMs) have shown remarkable capabilities across a wide variety of Natural Language Processing (NLP) tasks and have attracted attention from multiple domains, including financial services. Despite the extensive research into general-domain LLMs, and their immense potential in finance, Financial LLM (FinLLM) research remains limited. This survey provides a comprehensive overview of FinLLMs, including their history, techniques, performance, and opportunities and challenges. Firstly, we present a chronological overview of general-domain Pre-trained Language Models (PLMs) through to current FinLLMs, including the GPT-series, selected open-source LLMs, and financial LMs. Secondly, we compare five techniques used across financial PLMs and FinLLMs, including training methods, training data, and fine-tuning methods. Thirdly, we summarize the performance evaluations of six benchmark tasks and datasets. In addition, we provide eight advanced financial NLP tasks and datasets for developing more sophisticated FinLLMs. Finally, we discuss the opportunities and the challenges facing FinLLMs, such as hallucination, privacy, and efficiency. To support AI research in finance, we compile a collection of accessible datasets and evaluation benchmarks on GitHub.

Prediction-based Resource Allocation using Bayesian Neural Networks and Minimum Cost and Maximum Flow Algorithm

Oct 11, 2019

Abstract:Predictive business process monitoring aims at providing predictions about running instances by analyzing logs of completed cases in a business process. Recently, a lot of research focuses on increasing productivity and efficiency in a business process by forecasting potential problems during its executions. However, most of the studies lack suggesting concrete actions to improve the process. They leave it up to the subjective judgment of a user. In this paper, we propose a novel method to connect the results from predictive business process monitoring to actual business process improvements. More in detail, we optimize the resource allocation in a non-clairvoyant online environment, where we have limited information required for scheduling, by exploiting the predictions. The proposed method integrates the offline prediction model construction that predicts the processing time and the next activity of an ongoing instance using Bayesian Neural Networks (BNNs) with the online resource allocation that is extended from the minimum cost and maximum flow algorithm. To validate the proposed method, we performed experiments using an artificial event log and a real-life event log from a global financial organization.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge