Jean-François Muzy

Agent market orders representation through a contrastive learning approach

Jun 09, 2023

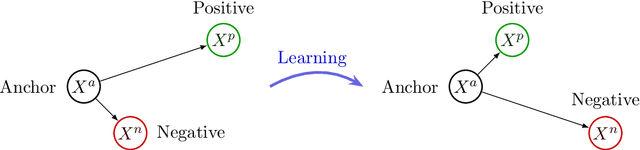

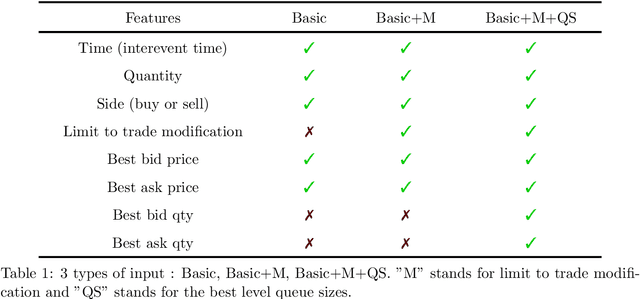

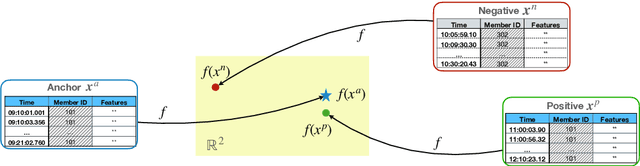

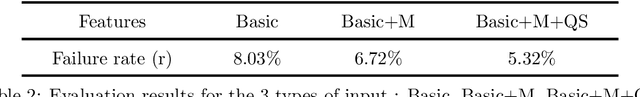

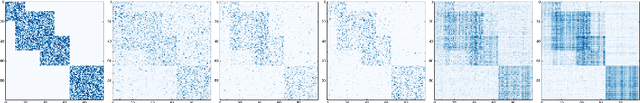

Abstract:Due to the access to the labeled orders on the CAC40 data from Euronext, we are able to analyse agents' behaviours in the market based on their placed orders. In this study, we construct a self-supervised learning model using triplet loss to effectively learn the representation of agent market orders. By acquiring this learned representation, various downstream tasks become feasible. In this work, we utilise the K-means clustering algorithm on the learned representation vectors of agent orders to identify distinct behaviour types within each cluster.

Concentration for matrix martingales in continuous time and microscopic activity of social networks

Oct 27, 2016Abstract:This paper gives new concentration inequalities for the spectral norm of a wide class of matrix martingales in continuous time. These results extend previously established Freedman and Bernstein inequalities for series of random matrices to the class of continuous time processes. Our analysis relies on a new supermartingale property of the trace exponential proved within the framework of stochastic calculus. We provide also several examples that illustrate the fact that our results allow us to recover easily several formerly obtained sharp bounds for discrete time matrix martingales.

Mean-field inference of Hawkes point processes

Nov 04, 2015

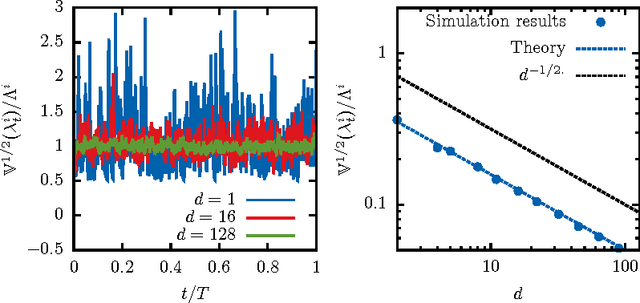

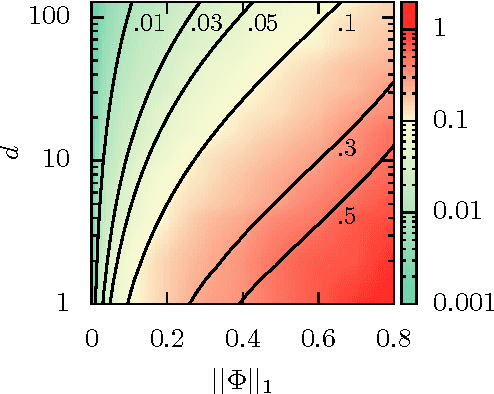

Abstract:We propose a fast and efficient estimation method that is able to accurately recover the parameters of a d-dimensional Hawkes point-process from a set of observations. We exploit a mean-field approximation that is valid when the fluctuations of the stochastic intensity are small. We show that this is notably the case in situations when interactions are sufficiently weak, when the dimension of the system is high or when the fluctuations are self-averaging due to the large number of past events they involve. In such a regime the estimation of a Hawkes process can be mapped on a least-squares problem for which we provide an analytic solution. Though this estimator is biased, we show that its precision can be comparable to the one of the Maximum Likelihood Estimator while its computation speed is shown to be improved considerably. We give a theoretical control on the accuracy of our new approach and illustrate its efficiency using synthetic datasets, in order to assess the statistical estimation error of the parameters.

A generalization error bound for sparse and low-rank multivariate Hawkes processes

Jan 04, 2015

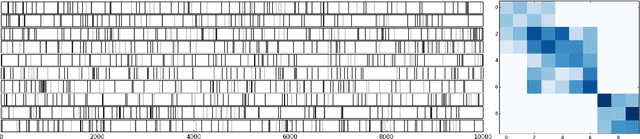

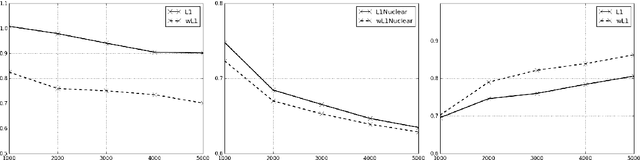

Abstract:We consider the problem of unveiling the implicit network structure of user interactions in a social network, based only on high-frequency timestamps. Our inference is based on the minimization of the least-squares loss associated with a multivariate Hawkes model, penalized by $\ell_1$ and trace norms. We provide a first theoretical analysis of the generalization error for this problem, that includes sparsity and low-rank inducing priors. This result involves a new data-driven concentration inequality for matrix martingales in continuous time with observable variance, which is a result of independent interest. A consequence of our analysis is the construction of sharply tuned $\ell_1$ and trace-norm penalizations, that leads to a data-driven scaling of the variability of information available for each users. Numerical experiments illustrate the strong improvements achieved by the use of such data-driven penalizations.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge