Jajati Keshari Sahoo

Smart Parking Space Detection under Hazy conditions using Convolutional Neural Networks: A Novel Approach

Jan 15, 2022

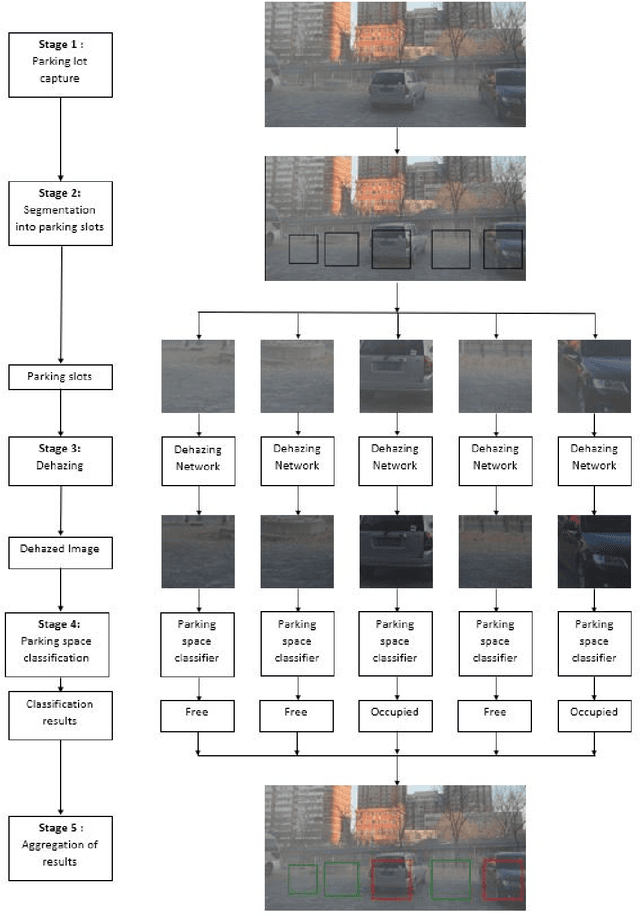

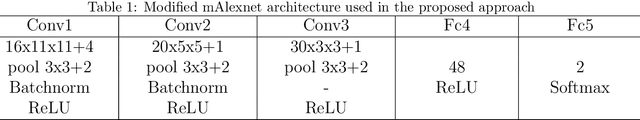

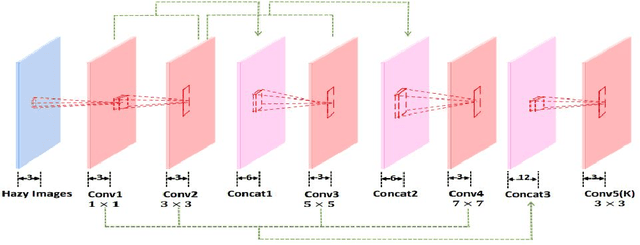

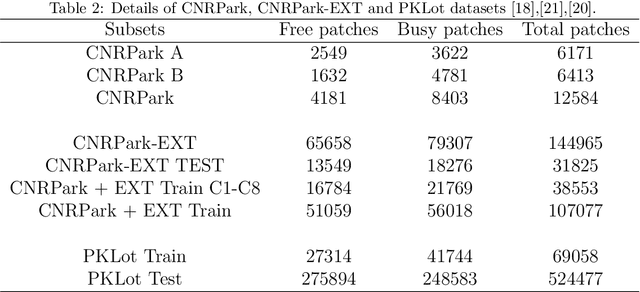

Abstract:Limited urban parking space combined with urbanization has necessitated the development of smart parking systems that can communicate the availability of parking slots to the end users. Towards this, various deep learning based solutions using convolutional neural networks have been proposed for parking space occupation detection. Though these approaches are robust to partial obstructions and lighting conditions, their performance is found to degrade in the presence of haze conditions. Looking in this direction, this paper investigates the use of dehazing networks that improves the performance of parking space occupancy classifier under hazy conditions. Additionally, training procedures are proposed for dehazing networks to maximize the performance of the system on both hazy and non-hazy conditions. The proposed system is deployable as part of existing smart parking systems where limited number of cameras are used to monitor hundreds of parking spaces. To validate our approach, we have developed a custom hazy parking system dataset from real-world task-driven test set of RESIDE-\b{eta} dataset. The proposed approach is tested against existing state-of-the-art parking space detectors on CNRPark-EXT and hazy parking system datasets. Experimental results indicate that there is a significant accuracy improvement of the proposed approach on the hazy parking system dataset.

Forecasting directional movements of stock prices for intraday trading using LSTM and random forests

Apr 21, 2020

Abstract:We employ both random forests and LSTM networks (more precisely CuDNNLSTM) as training methodologies to analyze their effectiveness in forecasting out-of-sample directional movements of constituent stocks of the S&P 500 from January 1993 till December 2018 for intraday trading. We introduce a multi-feature setting consisting not only of the returns with respect to the closing prices, but also with respect to the opening prices and intraday returns. As trading strategy, we use Krauss et al. (2017) and Fischer & Krauss (2018) as benchmark and, on each trading day, buy the 10 stocks with the highest probability and sell short the 10 stocks with the lowest probability to outperform the market in terms of intraday returns -- all with equal monetary weight. Our empirical results show that the multi-feature setting provides a daily return, prior to transaction costs, of 0.64% using LSTM networks, and 0.54% using random forests. Hence we outperform the single-feature setting in Fischer & Krauss (2018) and Krauss et al. (2017) consisting only of the daily returns with respect to the closing prices, having corresponding daily returns of 0.41% and of 0.39% with respect to LSTM and random forests, respectively.

Convolutional Feature Extraction and Neural Arithmetic Logic Units for Stock Prediction

May 18, 2019

Abstract:Stock prediction is a topic undergoing intense study for many years. Finance experts and mathematicians have been working on a way to predict the future stock price so as to decide to buy the stock or sell it to make profit. Stock experts or economists, usually analyze on the previous stock values using technical indicators, sentiment analysis etc to predict the future stock price. In recent years, many researches have extensively used machine learning for predicting the stock behaviour. In this paper we propose data driven deep learning approach to predict the future stock value with the previous price with the feature extraction property of convolutional neural network and to use Neural Arithmetic Logic Units with it.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge