Guo-Qiang Lo

Efficient option pricing with unary-based photonic computing chip and generative adversarial learning

Aug 08, 2023

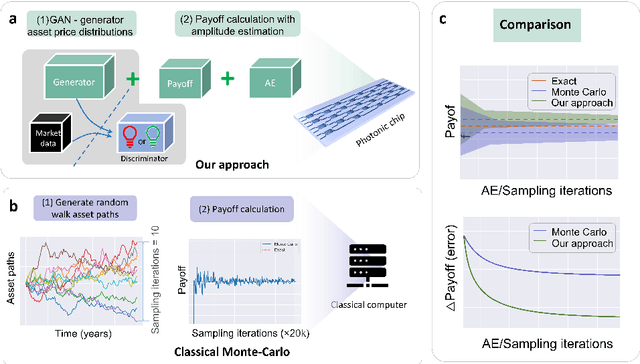

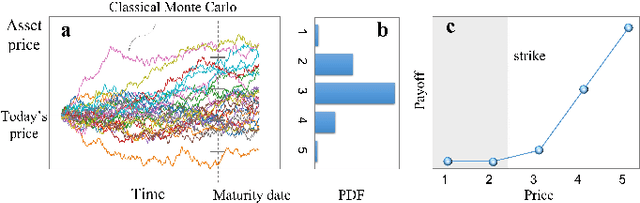

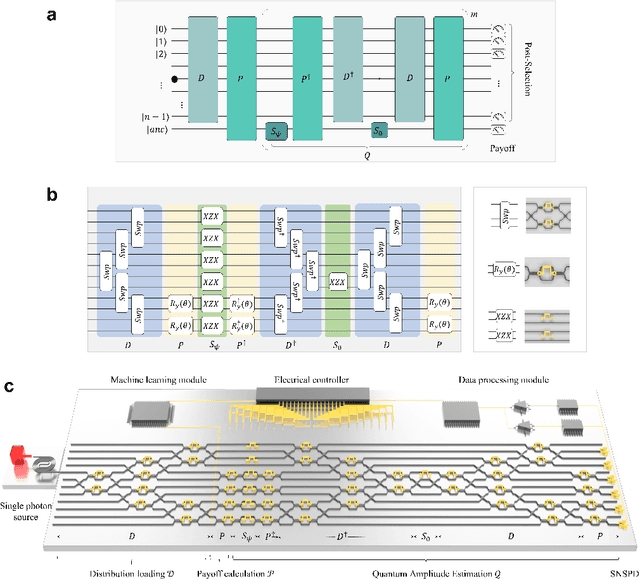

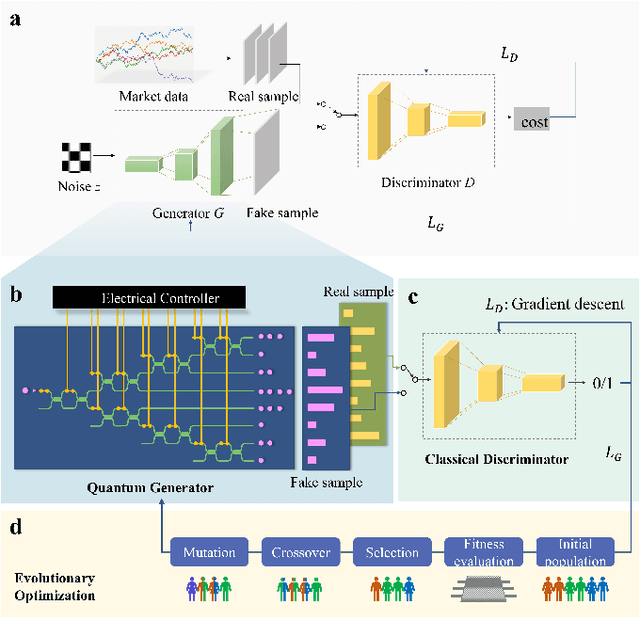

Abstract:In the modern financial industry system, the structure of products has become more and more complex, and the bottleneck constraint of classical computing power has already restricted the development of the financial industry. Here, we present a photonic chip that implements the unary approach to European option pricing, in combination with the quantum amplitude estimation algorithm, to achieve a quadratic speedup compared to classical Monte Carlo methods. The circuit consists of three modules: a module loading the distribution of asset prices, a module computing the expected payoff, and a module performing the quantum amplitude estimation algorithm to introduce speed-ups. In the distribution module, a generative adversarial network is embedded for efficient learning and loading of asset distributions, which precisely capture the market trends. This work is a step forward in the development of specialized photonic processors for applications in finance, with the potential to improve the efficiency and quality of financial services.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge