Eric Sodomka

Matching Algorithms for Blood Donation

Aug 13, 2021

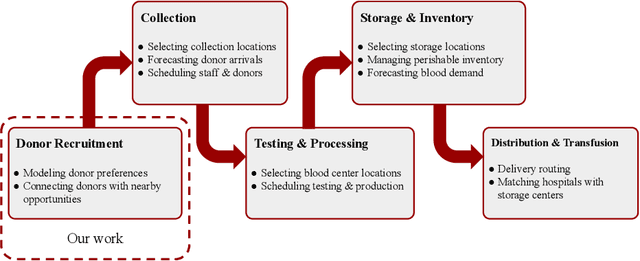

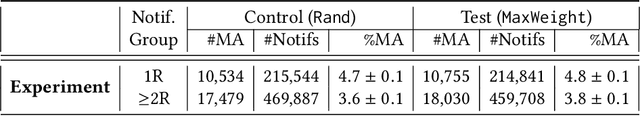

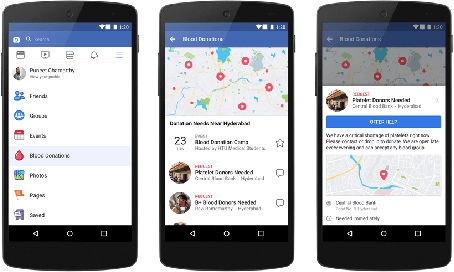

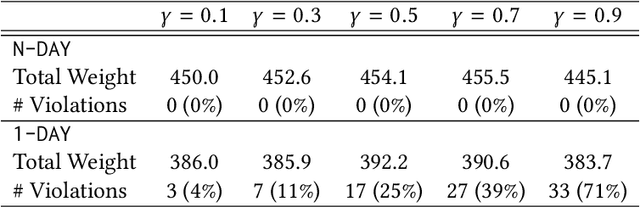

Abstract:Global demand for donated blood far exceeds supply, and unmet need is greatest in low- and middle-income countries; experts suggest that large-scale coordination is necessary to alleviate demand. Using the Facebook Blood Donation tool, we conduct the first large-scale algorithmic matching of blood donors with donation opportunities. While measuring actual donation rates remains a challenge, we measure donor action (e.g., making a donation appointment) as a proxy for actual donation. We develop automated policies for matching donors with donation opportunities, based on an online matching model. We provide theoretical guarantees for these policies, both regarding the number of expected donations and the equitable treatment of blood recipients. In simulations, a simple matching strategy increases the number of donations by 5-10%; a pilot experiment with real donors shows a 5% relative increase in donor action rate (from 3.7% to 3.9%). When scaled to the global Blood Donation tool user base, this corresponds to an increase of around one hundred thousand users taking action toward donation. Further, observing donor action on a social network can shed light onto donor behavior and response to incentives. Our initial findings align with several observations made in the medical and social science literature regarding donor behavior.

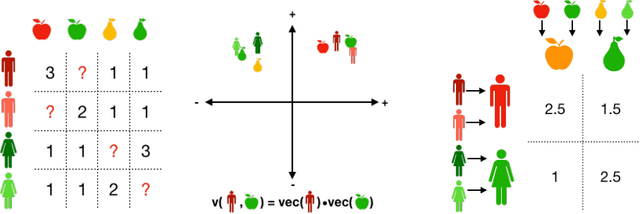

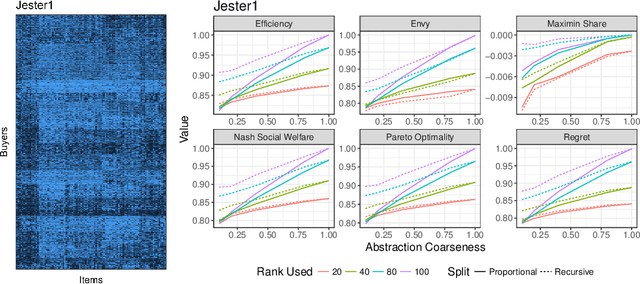

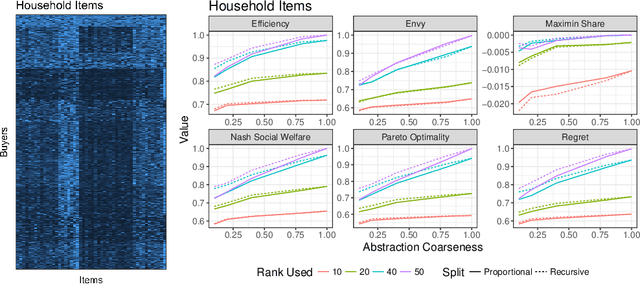

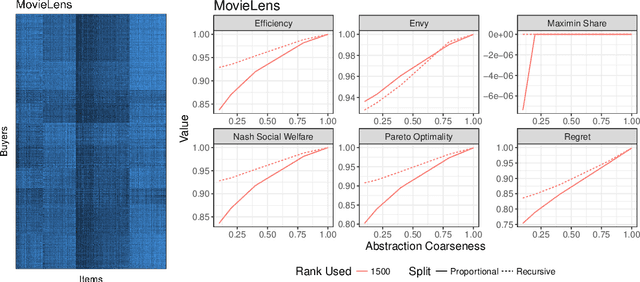

Computing large market equilibria using abstractions

Jan 18, 2019

Abstract:Computing market equilibria is an important practical problem for market design (e.g. fair division, item allocation). However, computing equilibria requires large amounts of information (e.g. all valuations for all buyers for all items) and compute power. We consider ameliorating these issues by applying a method used for solving complex games: constructing a coarsened abstraction of a given market, solving for the equilibrium in the abstraction, and lifting the prices and allocations back to the original market. We show how to bound important quantities such as regret, envy, Nash social welfare, Pareto optimality, and maximin share when the abstracted prices and allocations are used in place of the real equilibrium. We then study two abstraction methods of interest for practitioners: 1) filling in unknown valuations using techniques from matrix completion, 2) reducing the problem size by aggregating groups of buyers/items into smaller numbers of representative buyers/items and solving for equilibrium in this coarsened market. We find that in real data allocations/prices that are relatively close to equilibria can be computed from even very coarse abstractions.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge