Divyanshu Daiya

COLLAGE: Collaborative Human-Agent Interaction Generation using Hierarchical Latent Diffusion and Language Models

Sep 30, 2024Abstract:We propose a novel framework COLLAGE for generating collaborative agent-object-agent interactions by leveraging large language models (LLMs) and hierarchical motion-specific vector-quantized variational autoencoders (VQ-VAEs). Our model addresses the lack of rich datasets in this domain by incorporating the knowledge and reasoning abilities of LLMs to guide a generative diffusion model. The hierarchical VQ-VAE architecture captures different motion-specific characteristics at multiple levels of abstraction, avoiding redundant concepts and enabling efficient multi-resolution representation. We introduce a diffusion model that operates in the latent space and incorporates LLM-generated motion planning cues to guide the denoising process, resulting in prompt-specific motion generation with greater control and diversity. Experimental results on the CORE-4D, and InterHuman datasets demonstrate the effectiveness of our approach in generating realistic and diverse collaborative human-object-human interactions, outperforming state-of-the-art methods. Our work opens up new possibilities for modeling complex interactions in various domains, such as robotics, graphics and computer vision.

DiffSTOCK: Probabilistic relational Stock Market Predictions using Diffusion Models

Mar 21, 2024Abstract:In this work, we propose an approach to generalize denoising diffusion probabilistic models for stock market predictions and portfolio management. Present works have demonstrated the efficacy of modeling interstock relations for market time-series forecasting and utilized Graph-based learning models for value prediction and portfolio management. Though convincing, these deterministic approaches still fall short of handling uncertainties i.e., due to the low signal-to-noise ratio of the financial data, it is quite challenging to learn effective deterministic models. Since the probabilistic methods have shown to effectively emulate higher uncertainties for time-series predictions. To this end, we showcase effective utilisation of Denoising Diffusion Probabilistic Models (DDPM), to develop an architecture for providing better market predictions conditioned on the historical financial indicators and inter-stock relations. Additionally, we also provide a novel deterministic architecture MaTCHS which uses Masked Relational Transformer(MRT) to exploit inter-stock relations along with historical stock features. We demonstrate that our model achieves SOTA performance for movement predication and Portfolio management.

Using Statistical and Semantic Models for Multi-Document Summarization

May 17, 2018

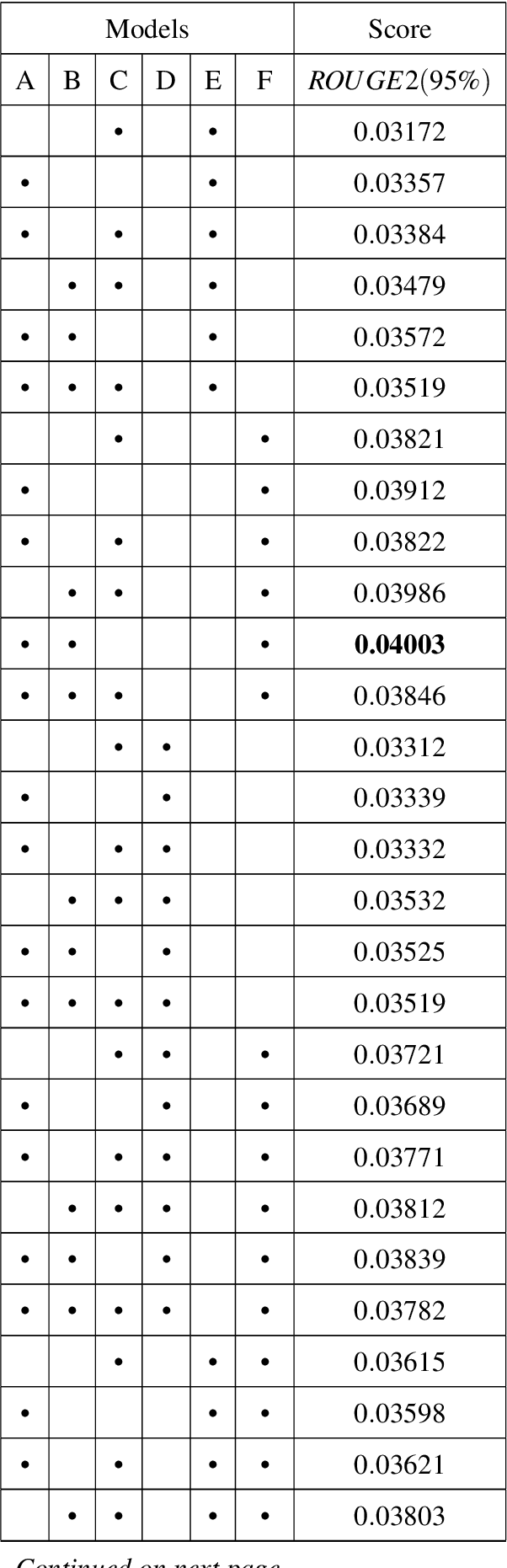

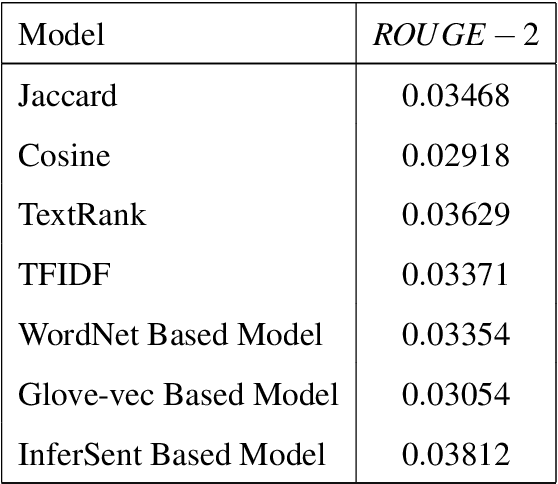

Abstract:We report a series of experiments with different semantic models on top of various statistical models for extractive text summarization. Though statistical models may better capture word co-occurrences and distribution around the text, they fail to detect the context and the sense of sentences /words as a whole. Semantic models help us gain better insight into the context of sentences. We show that how tuning weights between different models can help us achieve significant results on various benchmarks. Learning pre-trained vectors used in semantic models further, on given corpus, can give addition spike in performance. Using weighing techniques in between different statistical models too further refines our result. For Statistical models, we have used TF/IDF, TextRAnk, Jaccard/Cosine Similarities. For Semantic Models, we have used WordNet-based Model and proposed two models based on Glove Vectors and Facebook's InferSent. We tested our approach on DUC 2004 dataset, generating 100-word summaries. We have discussed the system, algorithms, analysis and also proposed and tested possible improvements. ROUGE scores were used to compare to other summarizers.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge