Diogo Seca

A Review on Oracle Issues in Machine Learning

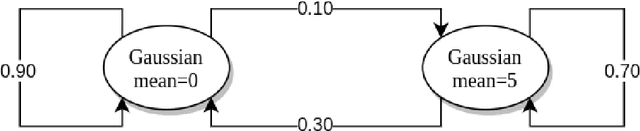

May 04, 2021Abstract:Machine learning contrasts with traditional software development in that the oracle is the data, and the data is not always a correct representation of the problem that machine learning tries to model. We present a survey of the oracle issues found in machine learning and state-of-the-art solutions for dealing with these issues. These include lines of research for differential testing, metamorphic testing, and test coverage. We also review some recent improvements to robustness during modeling that reduce the impact of oracle issues, as well as tools and frameworks for assisting in testing and discovering issues specific to the dataset.

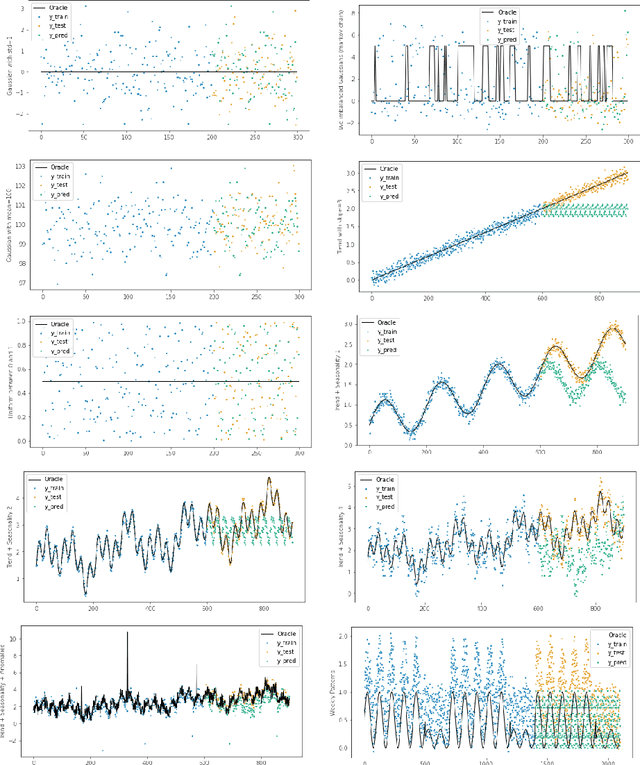

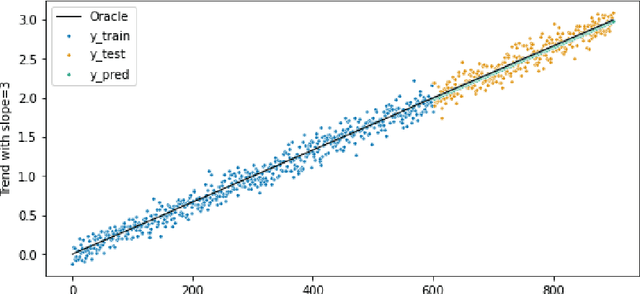

TimeGym: Debugging for Time Series Modeling in Python

May 04, 2021

Abstract:We introduce the TimeGym Forecasting Debugging Toolkit, a Python library for testing and debugging time series forecasting pipelines. TimeGym simplifies the testing forecasting pipeline by providing generic tests for forecasting pipelines fresh out of the box. These tests are based on common modeling challenges of time series. Our library enables forecasters to apply a Test-Driven Development approach to forecast modeling, using specified oracles to generate artificial data with noise.

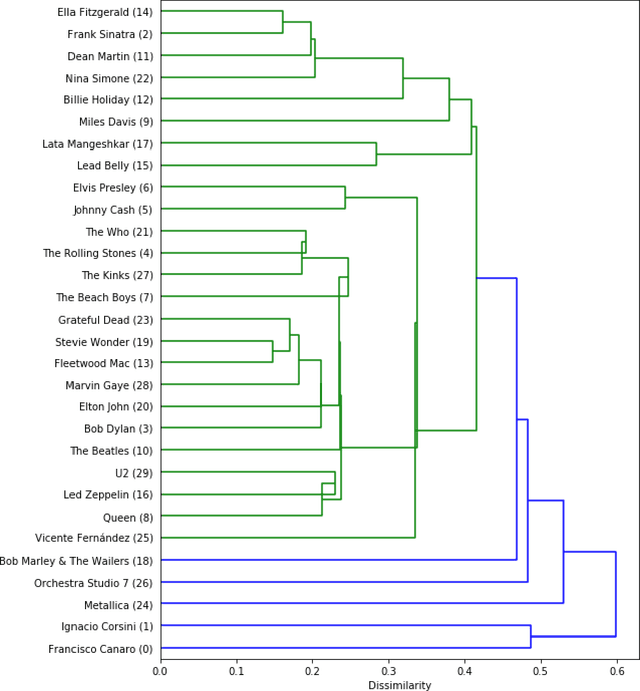

Hierarchical Qualitative Clustering: clustering mixed datasets with critical qualitative information

Jul 06, 2020

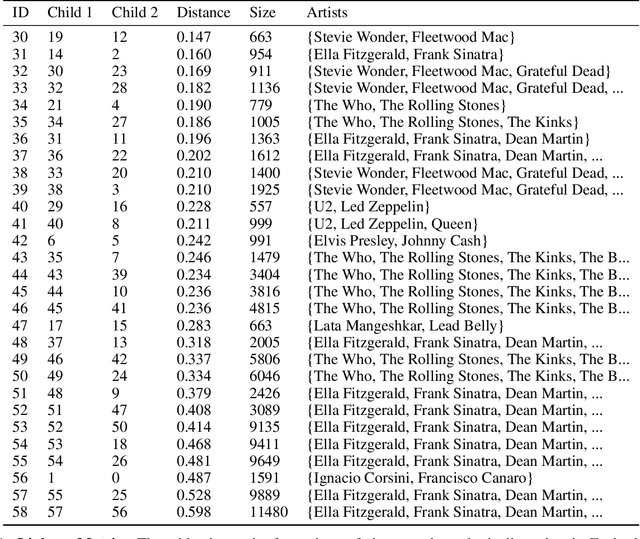

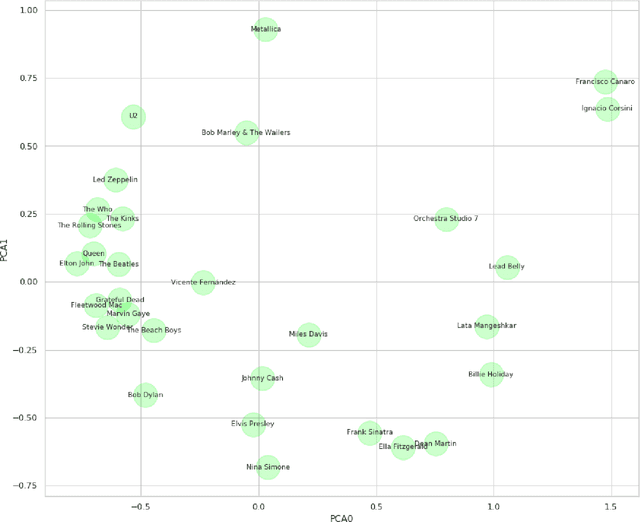

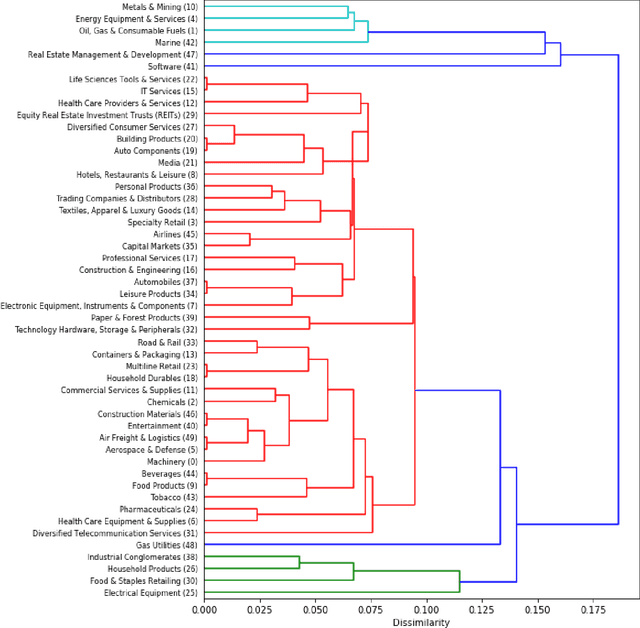

Abstract:Clustering can be used to extract insights from data or to verify some of the assumptions held by the domain experts, namely data segmentation. In the literature, few methods can be applied in clustering qualitative values using the context associated with other variables present in the data, without losing interpretability. Moreover, the metrics for calculating dissimilarity between qualitative values often scale poorly for high dimensional mixed datasets. In this study, we propose a novel method for clustering qualitative values, based on Hierarchical Clustering (HQC), and using Maximum Mean Discrepancy. HQC maintains the original interpretability of the qualitative information present in the dataset. We apply HQC to two datasets. Using a mixed dataset provided by Spotify, we showcase how our method can be used for clustering music artists based on the quantitative features of thousands of songs. In addition, using financial features of companies, we cluster company industries, and discuss the implications in investment portfolios diversification.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge