David Zarruk-Valencia

Proactive Detractor Detection Framework Based on Message-Wise Sentiment Analysis Over Customer Support Interactions

Nov 08, 2022

Abstract:In this work, we propose a framework relying solely on chat-based customer support (CS) interactions for predicting the recommendation decision of individual users. For our case study, we analyzed a total number of 16.4k users and 48.7k customer support conversations within the financial vertical of a large e-commerce company in Latin America. Consequently, our main contributions and objectives are to use Natural Language Processing (NLP) to assess and predict the recommendation behavior where, in addition to using static sentiment analysis, we exploit the predictive power of each user's sentiment dynamics. Our results show that, with respective feature interpretability, it is possible to predict the likelihood of a user to recommend a product or service, based solely on the message-wise sentiment evolution of their CS conversations in a fully automated way.

Feature-Level Fusion of Super-App and Telecommunication Alternative Data Sources for Credit Card Fraud Detection

Nov 05, 2021

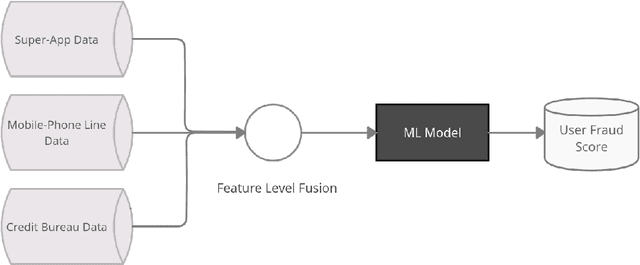

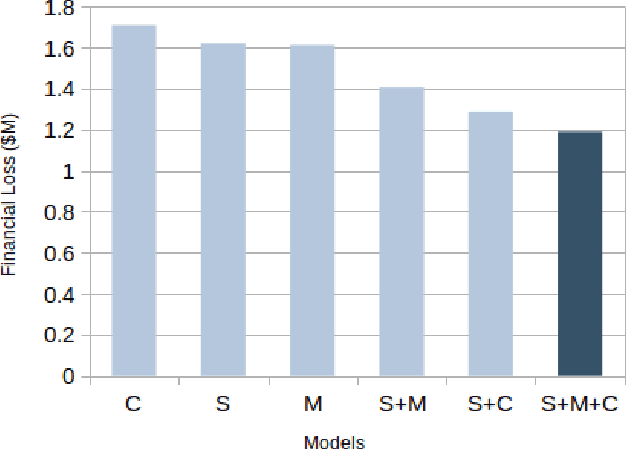

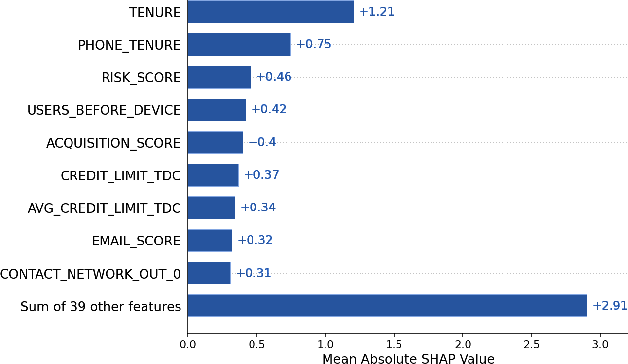

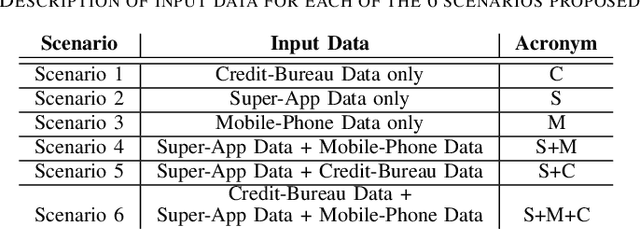

Abstract:Identity theft is a major problem for credit lenders when there's not enough data to corroborate a customer's identity. Among super-apps large digital platforms that encompass many different services this problem is even more relevant; losing a client in one branch can often mean losing them in other services. In this paper, we review the effectiveness of a feature-level fusion of super-app customer information, mobile phone line data, and traditional credit risk variables for the early detection of identity theft credit card fraud. Through the proposed framework, we achieved better performance when using a model whose input is a fusion of alternative data and traditional credit bureau data, achieving a ROC AUC score of 0.81. We evaluate our approach over approximately 90,000 users from a credit lender's digital platform database. The evaluation was performed using not only traditional ML metrics but the financial costs as well.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge