David Rushing Dewhurst

The incel lexicon: Deciphering the emergent cryptolect of a global misogynistic community

May 25, 2021

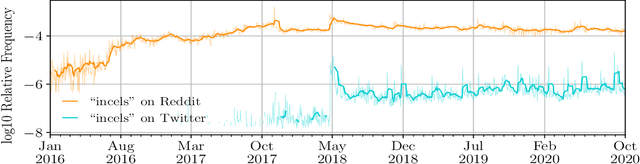

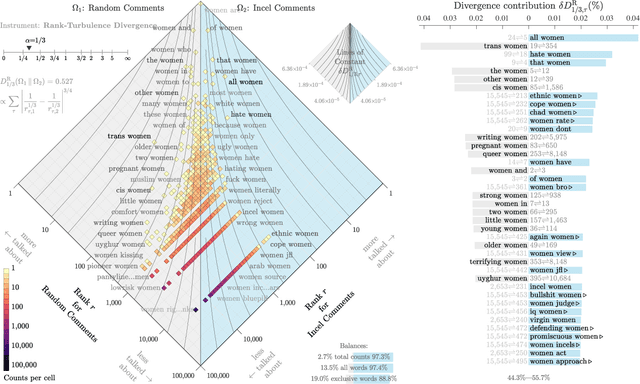

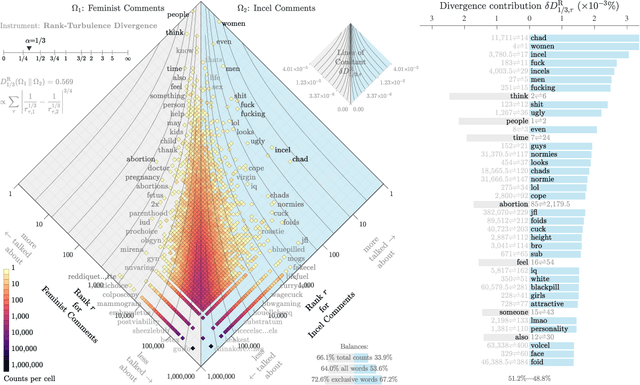

Abstract:Evolving out of a gender-neutral framing of an involuntary celibate identity, the concept of `incels' has come to refer to an online community of men who bear antipathy towards themselves, women, and society-at-large for their perceived inability to find and maintain sexual relationships. By exploring incel language use on Reddit, a global online message board, we contextualize the incel community's online expressions of misogyny and real-world acts of violence perpetrated against women. After assembling around three million comments from incel-themed Reddit channels, we analyze the temporal dynamics of a data driven rank ordering of the glossary of phrases belonging to an emergent incel lexicon. Our study reveals the generation and normalization of an extensive coded misogynist vocabulary in service of the group's identity.

Evolving ab initio trading strategies in heterogeneous environments

Dec 19, 2019

Abstract:Securities markets are quintessential complex adaptive systems in which heterogeneous agents compete in an attempt to maximize returns. Species of trading agents are also subject to evolutionary pressure as entire classes of strategies become obsolete and new classes emerge. Using an agent-based model of interacting heterogeneous agents as a flexible environment that can endogenously model many diverse market conditions, we subject deep neural networks to evolutionary pressure to create dominant trading agents. After analyzing the performance of these agents and noting the emergence of anomalous superdiffusion through the evolutionary process, we construct a method to turn high-fitness agents into trading algorithms. We backtest these trading algorithms on real high-frequency foreign exchange data, demonstrating that elite trading algorithms are consistently profitable in a variety of market conditions---even though these algorithms had never before been exposed to real financial data. These results provide evidence to suggest that developing \textit{ab initio} trading strategies by repeated simulation and evolution in a mechanistic market model may be a practical alternative to explicitly training models with past observed market data.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge