Ceena Modarres

Global Explanations of Neural Networks: Mapping the Landscape of Predictions

Feb 06, 2019

Abstract:A barrier to the wider adoption of neural networks is their lack of interpretability. While local explanation methods exist for one prediction, most global attributions still reduce neural network decisions to a single set of features. In response, we present an approach for generating global attributions called GAM, which explains the landscape of neural network predictions across subpopulations. GAM augments global explanations with the proportion of samples that each attribution best explains and specifies which samples are described by each attribution. Global explanations also have tunable granularity to detect more or fewer subpopulations. We demonstrate that GAM's global explanations 1) yield the known feature importances of simulated data, 2) match feature weights of interpretable statistical models on real data, and 3) are intuitive to practitioners through user studies. With more transparent predictions, GAM can help ensure neural network decisions are generated for the right reasons.

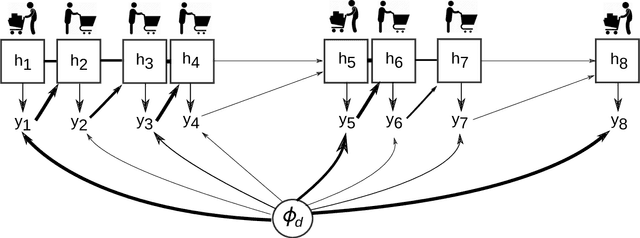

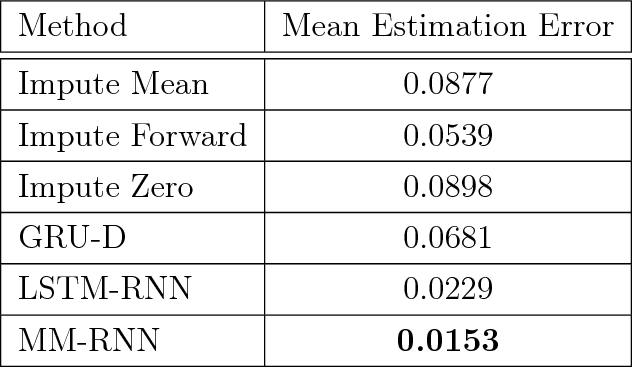

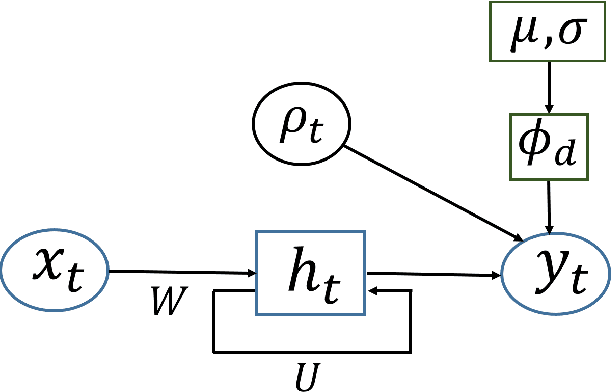

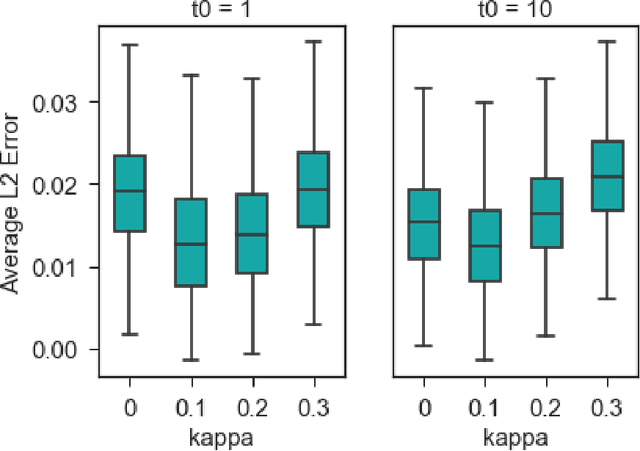

Mixed Membership Recurrent Neural Networks

Dec 23, 2018

Abstract:Models for sequential data such as the recurrent neural network (RNN) often implicitly model a sequence as having a fixed time interval between observations and do not account for group-level effects when multiple sequences are observed. We propose a model for grouped sequential data based on the RNN that accounts for varying time intervals between observations in a sequence by learning a group-level base parameter to which each sequence can revert. Our approach is motivated by the mixed membership framework, and we show how it can be used for dynamic topic modeling in which the distribution on topics (not the topics themselves) are evolving in time. We demonstrate our approach on a dataset of 3.4 million online grocery shopping orders made by 206K customers.

Towards Explainable Deep Learning for Credit Lending: A Case Study

Nov 30, 2018

Abstract:Deep learning adoption in the financial services industry has been limited due to a lack of model interpretability. However, several techniques have been proposed to explain predictions made by a neural network. We provide an initial investigation into these techniques for the assessment of credit risk with neural networks.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge