Carlos Sebastián

Enhancing reliability in prediction intervals using point forecasters: Heteroscedastic Quantile Regression and Width-Adaptive Conformal Inference

Jun 21, 2024Abstract:Building prediction intervals for time series forecasting problems presents a complex challenge, particularly when relying solely on point predictors, a common scenario for practitioners in the industry. While research has primarily focused on achieving increasingly efficient valid intervals, we argue that, when evaluating a set of intervals, traditional measures alone are insufficient. There are additional crucial characteristics: the intervals must vary in length, with this variation directly linked to the difficulty of the prediction, and the coverage of the interval must remain independent of the difficulty of the prediction for practical utility. We propose the Heteroscedastic Quantile Regression (HQR) model and the Width-Adaptive Conformal Inference (WACI) method, providing theoretical coverage guarantees, to overcome those issues, respectively. The methodologies are evaluated in the context of Electricity Price Forecasting and Wind Power Forecasting, representing complex scenarios in time series forecasting. The results demonstrate that HQR and WACI not only improve or achieve typical measures of validity and efficiency but also successfully fulfil the commonly ignored mentioned characteristics.

An adaptive standardisation model for Day-Ahead electricity price forecasting

Nov 05, 2023

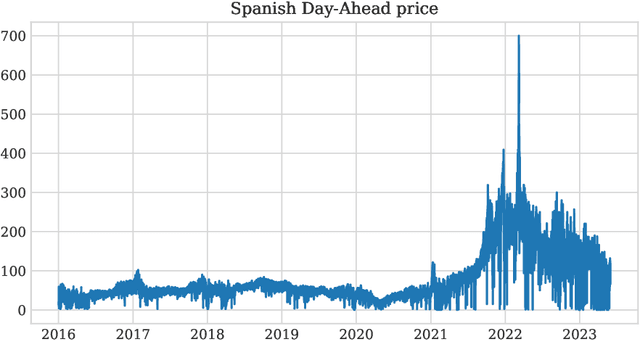

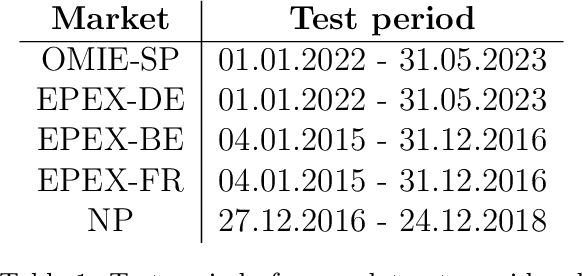

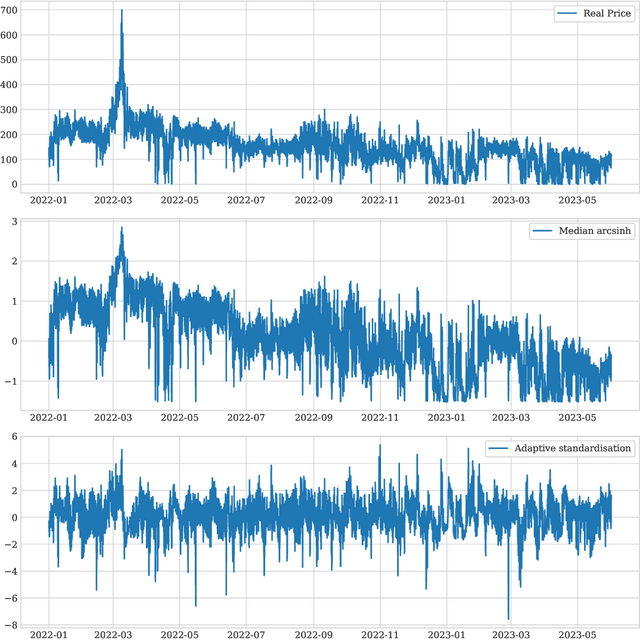

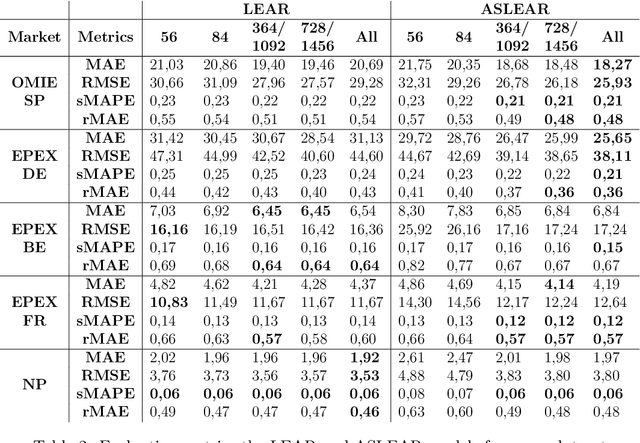

Abstract:The study of Day-Ahead prices in the electricity market is one of the most popular problems in time series forecasting. Previous research has focused on employing increasingly complex learning algorithms to capture the sophisticated dynamics of the market. However, there is a threshold where increased complexity fails to yield substantial improvements. In this work, we propose an alternative approach by introducing an adaptive standardisation to mitigate the effects of dataset shifts that commonly occur in the market. By doing so, learning algorithms can prioritize uncovering the true relationship between the target variable and the explanatory variables. We investigate four distinct markets, including two novel datasets, previously unexplored in the literature. These datasets provide a more realistic representation of the current market context, that conventional datasets do not show. The results demonstrate a significant improvement across all four markets, using learning algorithms that are less complex yet widely accepted in the literature. This significant advancement unveils opens up new lines of research in this field, highlighting the potential of adaptive transformations in enhancing the performance of forecasting models.

A feature selection method based on Shapley values robust to concept shift in regression

Apr 28, 2023Abstract:Feature selection is one of the most relevant processes in any methodology for creating a statistical learning model. Generally, existing algorithms establish some criterion to select the most influential variables, discarding those that do not contribute any relevant information to the model. This methodology makes sense in a classical static situation where the joint distribution of the data does not vary over time. However, when dealing with real data, it is common to encounter the problem of the dataset shift and, specifically, changes in the relationships between variables (concept shift). In this case, the influence of a variable cannot be the only indicator of its quality as a regressor of the model, since the relationship learned in the traning phase may not correspond to the current situation. Thus, we propose a new feature selection methodology for regression problems that takes this fact into account, using Shapley values to study the effect that each variable has on the predictions. Five examples are analysed: four correspond to typical situations where the method matches the state of the art and one example related to electricity price forecasting where a concept shift phenomenon has occurred in the Iberian market. In this case the proposed algorithm improves the results significantly.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge