An adaptive standardisation model for Day-Ahead electricity price forecasting

Paper and Code

Nov 05, 2023

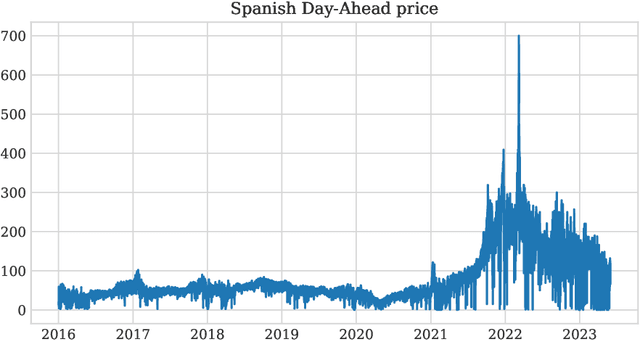

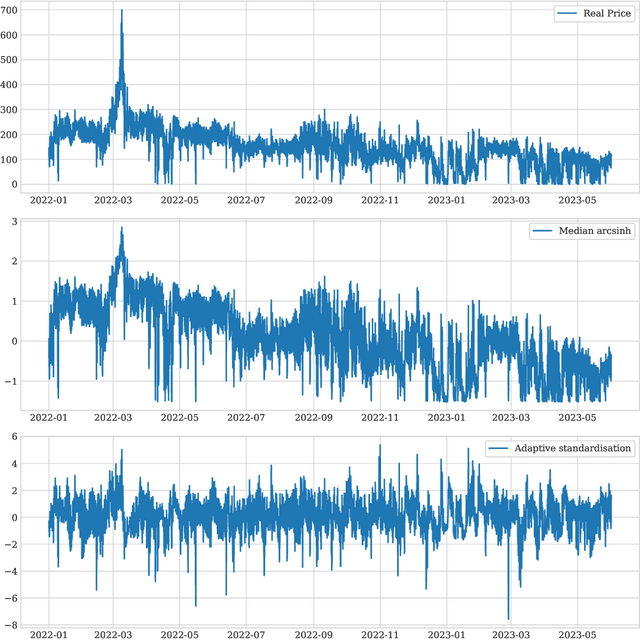

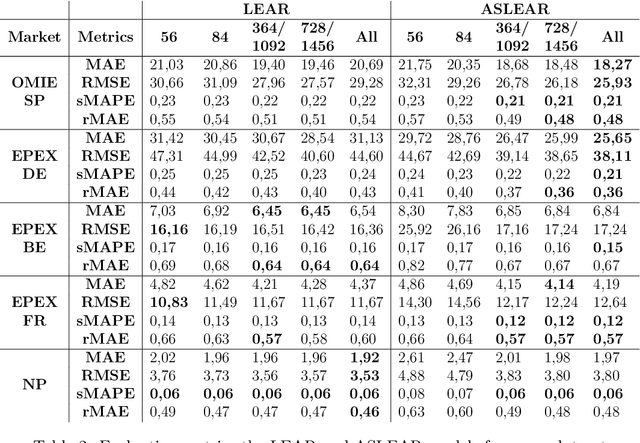

The study of Day-Ahead prices in the electricity market is one of the most popular problems in time series forecasting. Previous research has focused on employing increasingly complex learning algorithms to capture the sophisticated dynamics of the market. However, there is a threshold where increased complexity fails to yield substantial improvements. In this work, we propose an alternative approach by introducing an adaptive standardisation to mitigate the effects of dataset shifts that commonly occur in the market. By doing so, learning algorithms can prioritize uncovering the true relationship between the target variable and the explanatory variables. We investigate four distinct markets, including two novel datasets, previously unexplored in the literature. These datasets provide a more realistic representation of the current market context, that conventional datasets do not show. The results demonstrate a significant improvement across all four markets, using learning algorithms that are less complex yet widely accepted in the literature. This significant advancement unveils opens up new lines of research in this field, highlighting the potential of adaptive transformations in enhancing the performance of forecasting models.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge