Beatrice Guez

Can ChatGPT Compute Trustworthy Sentiment Scores from Bloomberg Market Wraps?

Jan 09, 2024

Abstract:We used a dataset of daily Bloomberg Financial Market Summaries from 2010 to 2023, reposted on large financial media, to determine how global news headlines may affect stock market movements using ChatGPT and a two-stage prompt approach. We document a statistically significant positive correlation between the sentiment score and future equity market returns over short to medium term, which reverts to a negative correlation over longer horizons. Validation of this correlation pattern across multiple equity markets indicates its robustness across equity regions and resilience to non-linearity, evidenced by comparison of Pearson and Spearman correlations. Finally, we provide an estimate of the optimal horizon that strikes a balance between reactivity to new information and correlation.

BCMA-ES II: revisiting Bayesian CMA-ES

Apr 09, 2019

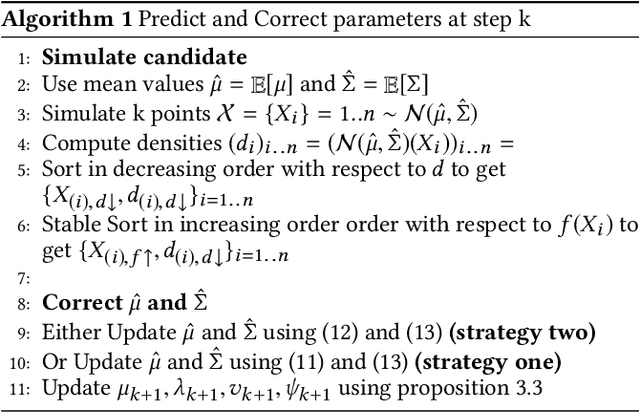

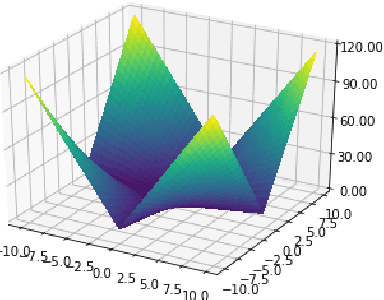

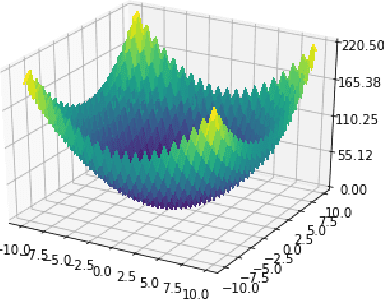

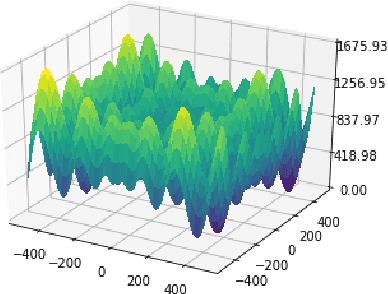

Abstract:This paper revisits the Bayesian CMA-ES and provides updates for normal Wishart. It emphasizes the difference between a normal and normal inverse Wishart prior. After some computation, we prove that the only difference relies surprisingly in the expected covariance. We prove that the expected covariance should be lower in the normal Wishart prior model because of the convexity of the inverse. We present a mixture model that generalizes both normal Wishart and normal inverse Wishart model. We finally present various numerical experiments to compare both methods as well as the generalized method.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge