Anahita Namvar

Discretization-based ensemble model for robust learning in IoT

Jul 18, 2023

Abstract:IoT device identification is the process of recognizing and verifying connected IoT devices to the network. This is an essential process for ensuring that only authorized devices can access the network, and it is necessary for network management and maintenance. In recent years, machine learning models have been used widely for automating the process of identifying devices in the network. However, these models are vulnerable to adversarial attacks that can compromise their accuracy and effectiveness. To better secure device identification models, discretization techniques enable reduction in the sensitivity of machine learning models to adversarial attacks contributing to the stability and reliability of the model. On the other hand, Ensemble methods combine multiple heterogeneous models to reduce the impact of remaining noise or errors in the model. Therefore, in this paper, we integrate discretization techniques and ensemble methods and examine it on model robustness against adversarial attacks. In other words, we propose a discretization-based ensemble stacking technique to improve the security of our ML models. We evaluate the performance of different ML-based IoT device identification models against white box and black box attacks using a real-world dataset comprised of network traffic from 28 IoT devices. We demonstrate that the proposed method enables robustness to the models for IoT device identification.

Credit risk prediction in an imbalanced social lending environment

Apr 28, 2018

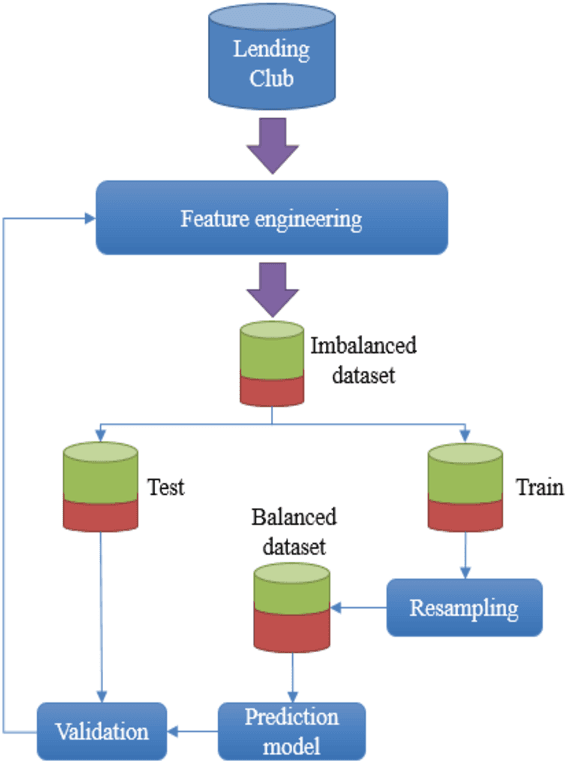

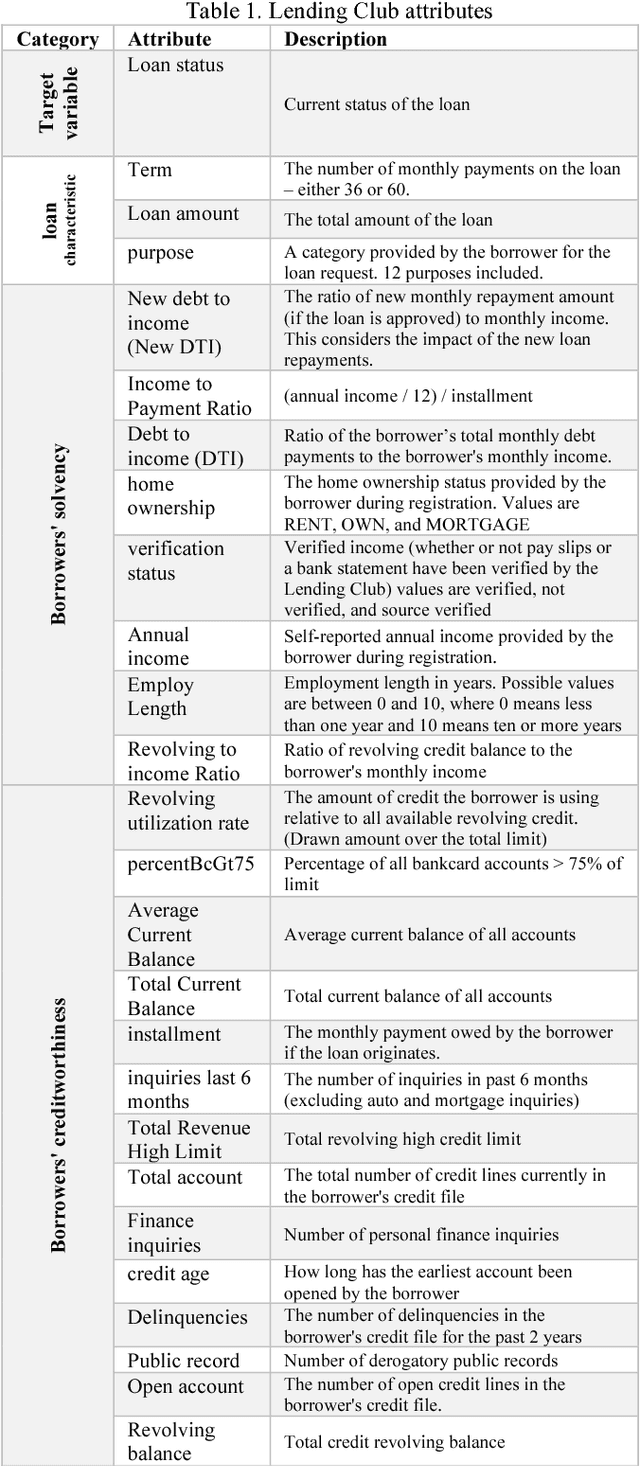

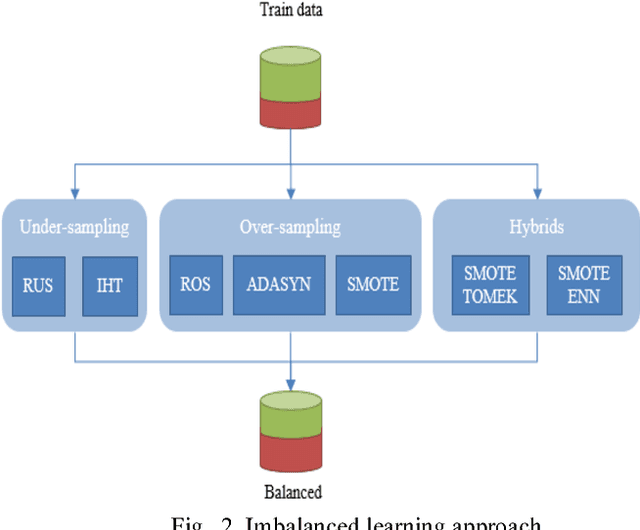

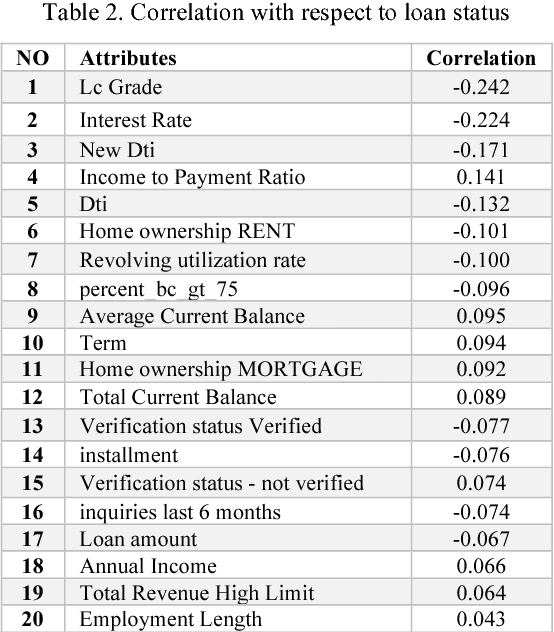

Abstract:Credit risk prediction is an effective way of evaluating whether a potential borrower will repay a loan, particularly in peer-to-peer lending where class imbalance problems are prevalent. However, few credit risk prediction models for social lending consider imbalanced data and, further, the best resampling technique to use with imbalanced data is still controversial. In an attempt to address these problems, this paper presents an empirical comparison of various combinations of classifiers and resampling techniques within a novel risk assessment methodology that incorporates imbalanced data. The credit predictions from each combination are evaluated with a G-mean measure to avoid bias towards the majority class, which has not been considered in similar studies. The results reveal that combining random forest and random under-sampling may be an effective strategy for calculating the credit risk associated with loan applicants in social lending markets.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge