Alwin Tan

A Data-Driven Framework for Identifying Investment Opportunities in Private Equity

Apr 04, 2022

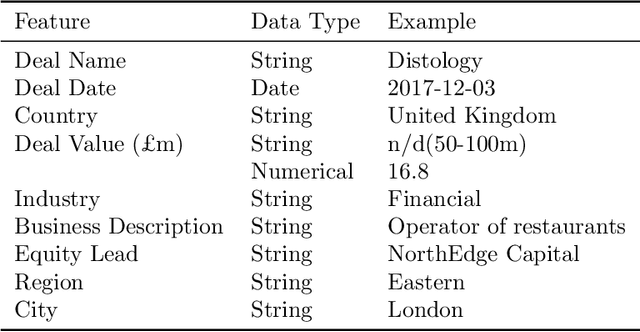

Abstract:The core activity of a Private Equity (PE) firm is to invest into companies in order to provide the investors with profit, usually within 4-7 years. To invest into a company or not is typically done manually by looking at various performance indicators of the company and then making a decision often based on instinct. This process is rather unmanageable given the large number of companies to potentially invest. Moreover, as more data about company performance indicators becomes available and the number of different indicators one may want to consider increases, manual crawling and assessment of investment opportunities becomes inefficient and ultimately impossible. To address these issues, this paper proposes a framework for automated data-driven screening of investment opportunities and thus the recommendation of businesses to invest in. The framework draws on data from several sources to assess the financial and managerial position of a company, and then uses an explainable artificial intelligence (XAI) engine to suggest investment recommendations. The robustness of the model is validated using different AI algorithms, class imbalance-handling methods, and features extracted from the available data sources.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge