Alexey Kazakov

Machine learning-based detection of cardiovascular disease using ECG signals: performance vs. complexity

Mar 10, 2023

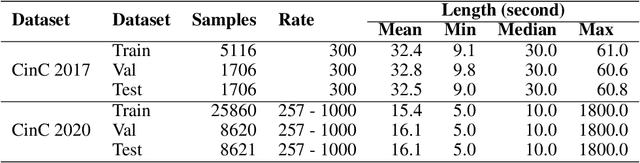

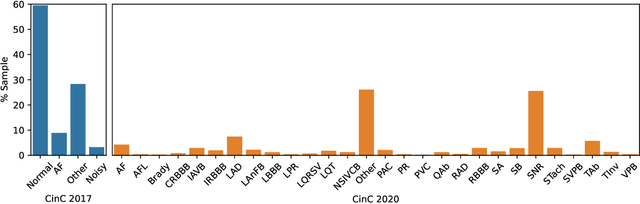

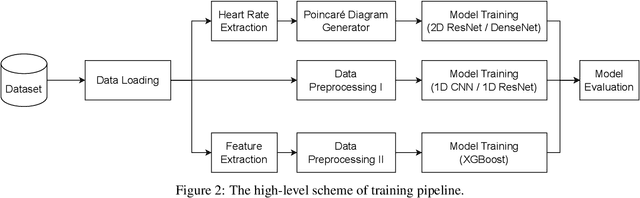

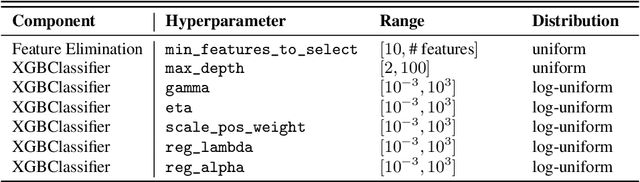

Abstract:Cardiovascular disease remains a significant problem in modern society. Among non-invasive techniques, the electrocardiogram (ECG) is one of the most reliable methods for detecting abnormalities in cardiac activities. However, ECG interpretation requires expert knowledge and it is time-consuming. Developing a novel method to detect the disease early could prevent death and complication. The paper presents novel various approaches for classifying cardiac diseases from ECG recordings. The first approach suggests the Poincare representation of ECG signal and deep-learning-based image classifiers (ResNet50 and DenseNet121 were learned over Poincare diagrams), which showed decent performance in predicting AF (atrial fibrillation) but not other types of arrhythmia. XGBoost, a gradient-boosting model, showed an acceptable performance in long-term data but had a long inference time due to highly-consuming calculation within the pre-processing phase. Finally, the 1D convolutional model, specifically the 1D ResNet, showed the best results in both studied CinC 2017 and CinC 2020 datasets, reaching the F1 score of 85% and 71%, respectively, and that was superior to the first-ranking solution of each challenge. The paper also investigated efficiency metrics such as power consumption and equivalent CO2 emissions, with one-dimensional models like 1D CNN and 1D ResNet being the most energy efficient. Model interpretation analysis showed that the DenseNet detected AF using heart rate variability while the 1DResNet assessed AF pattern in raw ECG signals.

New drugs and stock market: how to predict pharma market reaction to clinical trial announcements

Aug 16, 2022

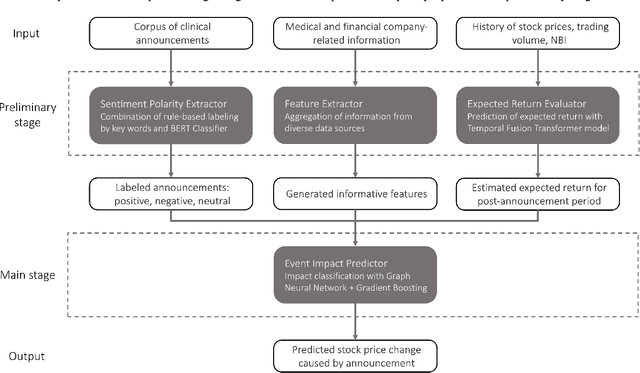

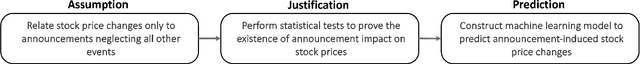

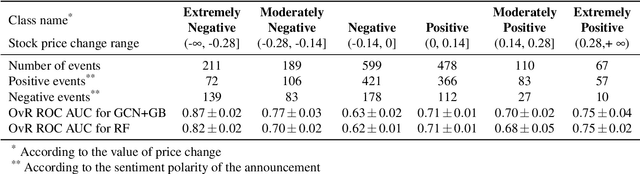

Abstract:Pharmaceutical companies operate in a strictly regulated and highly risky environment in which a single slip can lead to serious financial implications. Accordingly, the announcements of clinical trial results tend to determine the future course of events, hence being closely monitored by the public. In this work, we provide statistical evidence for the result promulgation influence on the public pharma market value. Whereas most works focus on retrospective impact analysis, the present research aims to predict the numerical values of announcement-induced changes in stock prices. For this purpose, we develop a pipeline that includes a BERT-based model for extracting sentiment polarity of announcements, a Temporal Fusion Transformer for forecasting the expected return, a graph convolution network for capturing event relationships, and gradient boosting for predicting the price change. The challenge of the problem lies in inherently different patterns of responses to positive and negative announcements, reflected in a stronger and more pronounced reaction to the negative news. Moreover, such phenomenon as the drop in stocks after the positive announcements affirms the counterintuitiveness of the price behavior. Importantly, we discover two crucial factors that should be considered while working within a predictive framework. The first factor is the drug portfolio size of the company, indicating the greater susceptibility to an announcement in the case of small drug diversification. The second one is the network effect of the events related to the same company or nosology. All findings and insights are gained on the basis of one of the biggest FDA (the Food and Drug Administration) announcement datasets, consisting of 5436 clinical trial announcements from 681 companies over the last five years.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge