Alessio Brini

Improving DeFi Accessibility through Efficient Liquidity Provisioning with Deep Reinforcement Learning

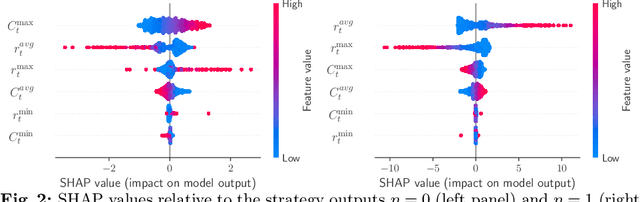

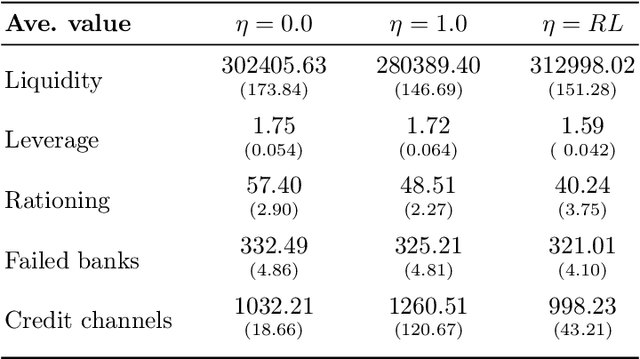

Jan 13, 2025Abstract:This paper applies deep reinforcement learning (DRL) to optimize liquidity provisioning in Uniswap v3, a decentralized finance (DeFi) protocol implementing an automated market maker (AMM) model with concentrated liquidity. We model the liquidity provision task as a Markov Decision Process (MDP) and train an active liquidity provider (LP) agent using the Proximal Policy Optimization (PPO) algorithm. The agent dynamically adjusts liquidity positions by using information about price dynamics to balance fee maximization and impermanent loss mitigation. We use a rolling window approach for training and testing, reflecting realistic market conditions and regime shifts. This study compares the data-driven performance of the DRL-based strategy against common heuristics adopted by small retail LP actors that do not systematically modify their liquidity positions. By promoting more efficient liquidity management, this work aims to make DeFi markets more accessible and inclusive for a broader range of participants. Through a data-driven approach to liquidity management, this work seeks to contribute to the ongoing development of more efficient and user-friendly DeFi markets.

A Machine Learning Approach to Forecasting Honey Production with Tree-Based Methods

Mar 30, 2023Abstract:The beekeeping sector has undergone considerable production variations over the past years due to adverse weather conditions, occurring more frequently as climate change progresses. These phenomena can be high-impact and cause the environment to be unfavorable to the bees' activity. We disentangle the honey production drivers with tree-based methods and predict honey production variations for hives in Italy, one of the largest honey producers in Europe. The database covers hundreds of beehive data from 2019-2022 gathered with advanced precision beekeeping techniques. We train and interpret the machine learning models making them prescriptive other than just predictive. Superior predictive performances of tree-based methods compared to standard linear techniques allow for better protection of bees' activity and assess potential losses for beekeepers for risk management.

Reinforcement Learning Policy Recommendation for Interbank Network Stability

Apr 14, 2022

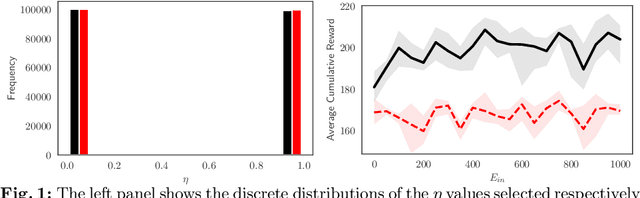

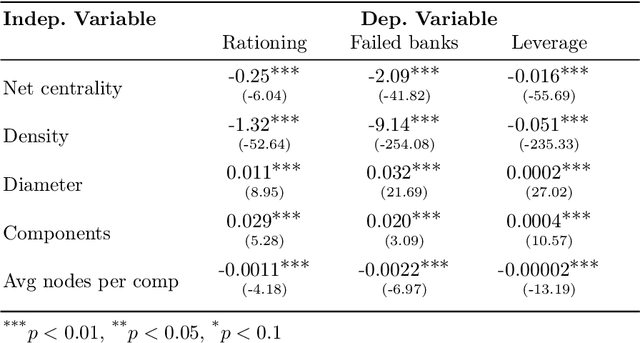

Abstract:In this paper we analyze the effect of a policy recommendation on the performances of an artificial interbank market. Financial institutions stipulate lending agreements following a public recommendation and their individual information. The former, modeled by a reinforcement learning optimal policy trying to maximize the long term fitness of the system, gathers information on the economic environment and directs economic actors to create credit relationships based on the optimal choice between a low interest rate or high liquidity supply. The latter, based on the agents' balance sheet, allows to determine the liquidity supply and interest rate that the banks optimally offer on the market. Based on the combination between the public and the private signal, financial institutions create or cut their credit connections over time via a preferential attachment evolving procedure able to generate a dynamic network. Our results show that the emergence of a core-periphery interbank network, combined with a certain level of homogeneity on the size of lenders and borrowers, are essential features to ensure the resilience of the system. Moreover, the reinforcement learning optimal policy recommendation plays a crucial role in mitigating systemic risk with respect to alternative policy instruments.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge