Reinforcement Learning Policy Recommendation for Interbank Network Stability

Paper and Code

Apr 14, 2022

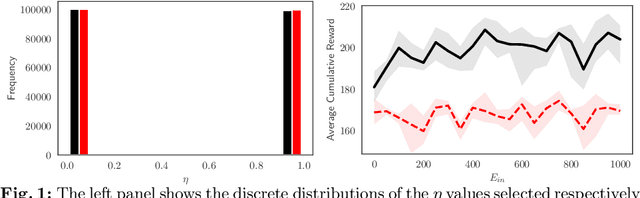

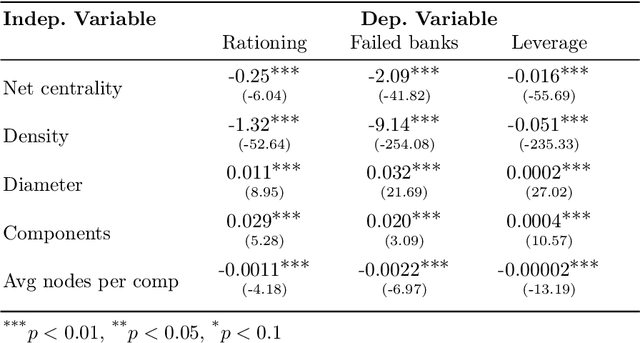

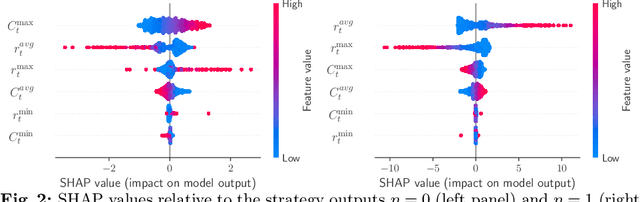

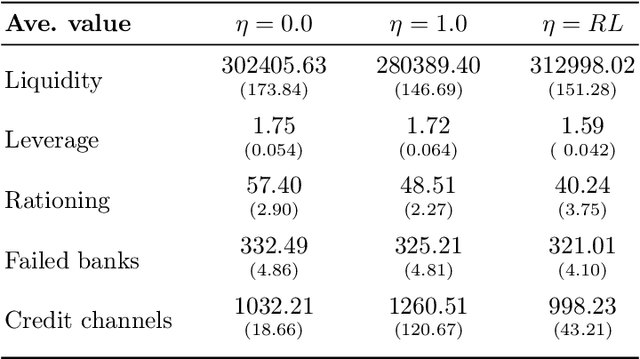

In this paper we analyze the effect of a policy recommendation on the performances of an artificial interbank market. Financial institutions stipulate lending agreements following a public recommendation and their individual information. The former, modeled by a reinforcement learning optimal policy trying to maximize the long term fitness of the system, gathers information on the economic environment and directs economic actors to create credit relationships based on the optimal choice between a low interest rate or high liquidity supply. The latter, based on the agents' balance sheet, allows to determine the liquidity supply and interest rate that the banks optimally offer on the market. Based on the combination between the public and the private signal, financial institutions create or cut their credit connections over time via a preferential attachment evolving procedure able to generate a dynamic network. Our results show that the emergence of a core-periphery interbank network, combined with a certain level of homogeneity on the size of lenders and borrowers, are essential features to ensure the resilience of the system. Moreover, the reinforcement learning optimal policy recommendation plays a crucial role in mitigating systemic risk with respect to alternative policy instruments.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge