Streaming Active Learning Strategies for Real-Life Credit Card Fraud Detection: Assessment and Visualization

Paper and Code

Apr 20, 2018

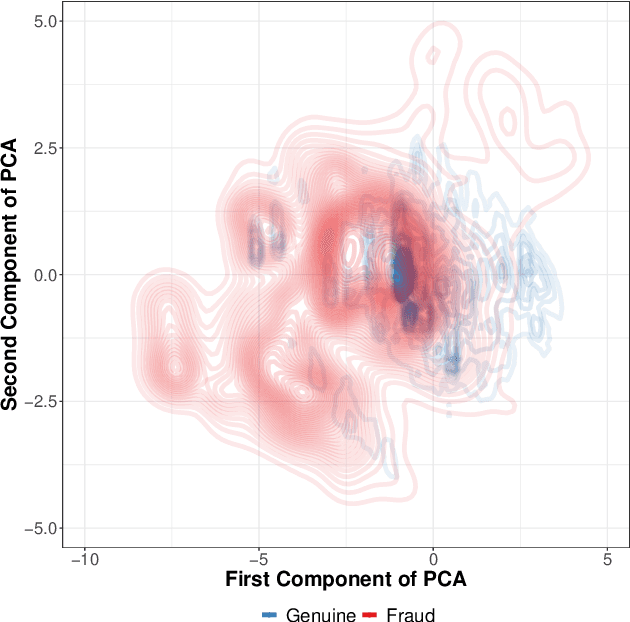

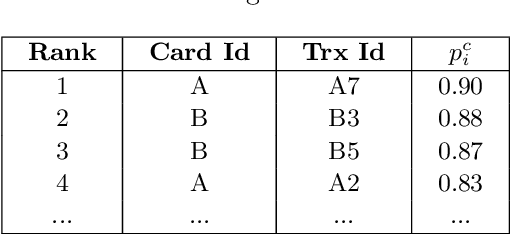

Credit card fraud detection is a very challenging problem because of the specific nature of transaction data and the labeling process. The transaction data is peculiar because they are obtained in a streaming fashion, they are strongly imbalanced and prone to non-stationarity. The labeling is the outcome of an active learning process, as every day human investigators contact only a small number of cardholders (associated to the riskiest transactions) and obtain the class (fraud or genuine) of the related transactions. An adequate selection of the set of cardholders is therefore crucial for an efficient fraud detection process. In this paper, we present a number of active learning strategies and we investigate their fraud detection accuracies. We compare different criteria (supervised, semi-supervised and unsupervised) to query unlabeled transactions. Finally, we highlight the existence of an exploitation/exploration trade-off for active learning in the context of fraud detection, which has so far been overlooked in the literature.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge