Statistical stability indices for LIME: obtaining reliable explanations for Machine Learning models

Paper and Code

Jan 31, 2020

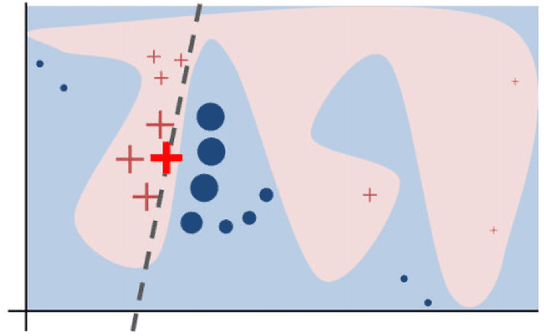

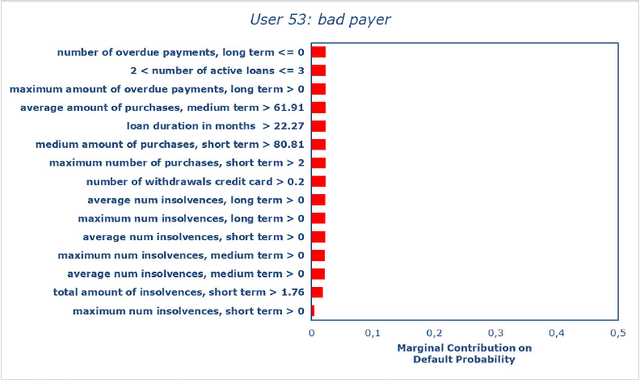

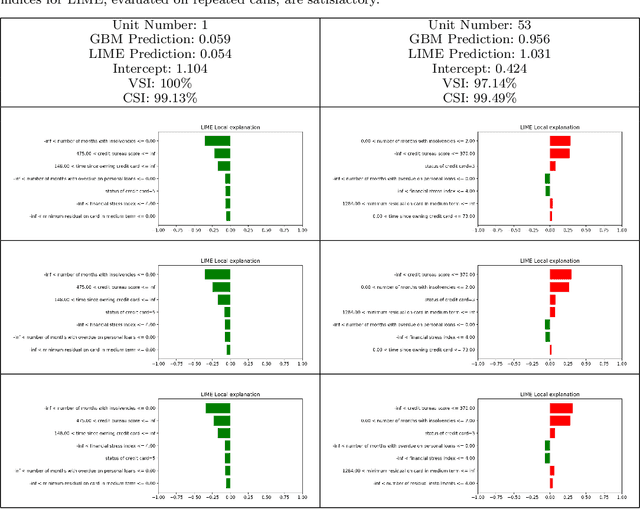

Nowadays we are witnessing a transformation of the business processes towards a more computation driven approach. The ever increasing usage of Machine Learning techniques is the clearest example of such trend. This sort of revolution is often providing advantages, such as an increase in prediction accuracy and a reduced time to obtain the results. However, these methods present a major drawback: it is very difficult to understand on what grounds the algorithm took the decision. To address this issue we consider the LIME method. We give a general background on LIME then, we focus on the stability issue: employing the method repeated times, under the same conditions, may yield to different explanations. Two complementary indices are proposed, to measure LIME stability. It is important for the practitioner to be aware of the issue, as well as to have a tool for spotting it. Stability guarantees LIME explanations to be reliable, therefore a stability assessment, made through the proposed indices, is crucial. As a case study, we apply both Machine Learning and classical statistical techniques to Credit Risk data. We test LIME on the Machine Learning algorithm and check its stability. Eventually, we examine the goodness of the explanations returned.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge