Learning who is in the market from time series: market participant discovery through adversarial calibration of multi-agent simulators

Paper and Code

Aug 02, 2021

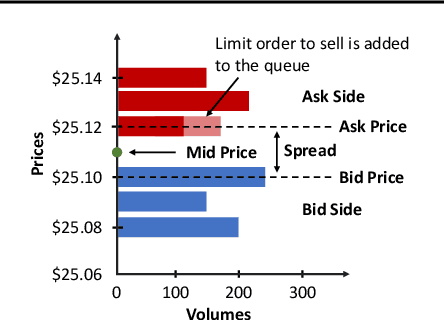

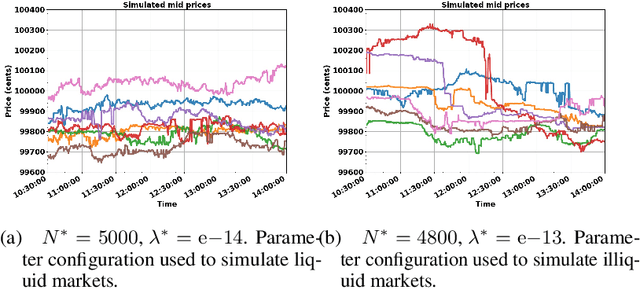

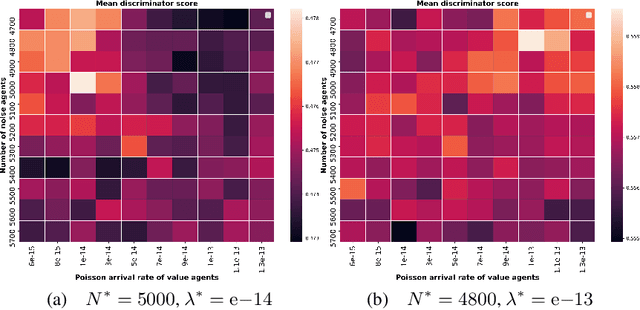

In electronic trading markets often only the price or volume time series, that result from interaction of multiple market participants, are directly observable. In order to test trading strategies before deploying them to real-time trading, multi-agent market environments calibrated so that the time series that result from interaction of simulated agents resemble historical are often used. To ensure adequate testing, one must test trading strategies in a variety of market scenarios -- which includes both scenarios that represent ordinary market days as well as stressed markets (most recently observed due to the beginning of COVID pandemic). In this paper, we address the problem of multi-agent simulator parameter calibration to allow simulator capture characteristics of different market regimes. We propose a novel two-step method to train a discriminator that is able to distinguish between "real" and "fake" price and volume time series as a part of GAN with self-attention, and then utilize it within an optimization framework to tune parameters of a simulator model with known agent archetypes to represent a market scenario. We conclude with experimental results that demonstrate effectiveness of our method.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge