Improved Forecasting of Cryptocurrency Price using Social Signals

Paper and Code

Jul 01, 2019

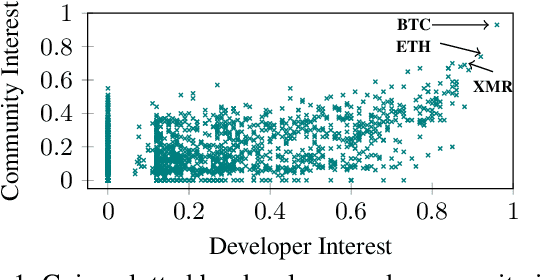

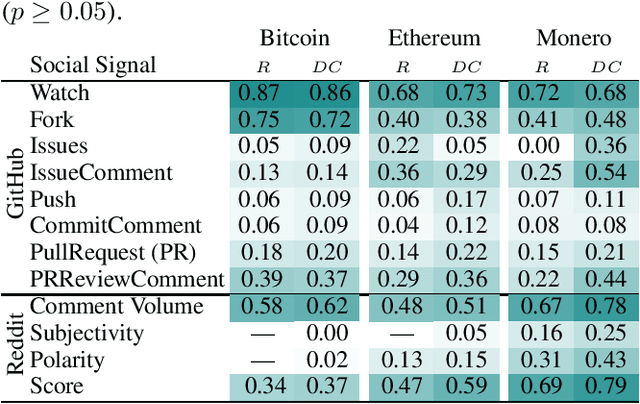

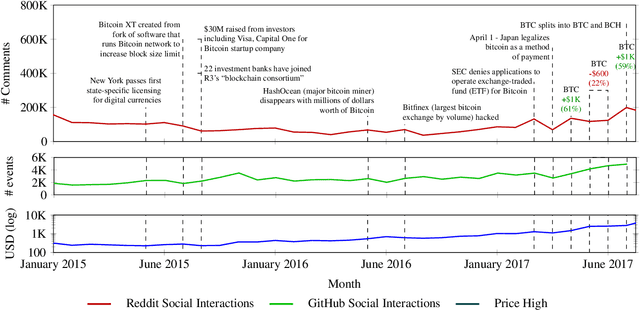

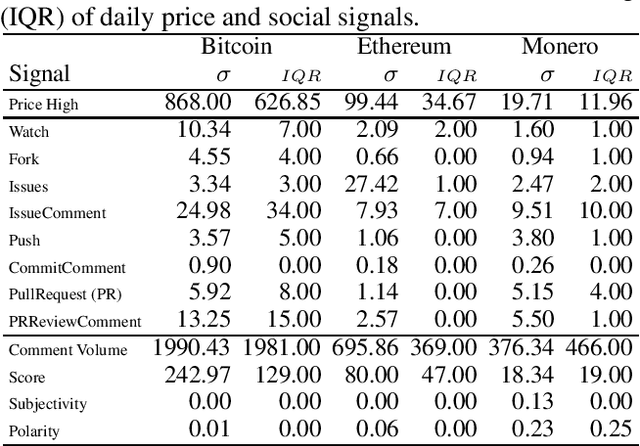

Social media signals have been successfully used to develop large-scale predictive and anticipatory analytics. For example, forecasting stock market prices and influenza outbreaks. Recently, social data has been explored to forecast price fluctuations of cryptocurrencies, which are a novel disruptive technology with significant political and economic implications. In this paper we leverage and contrast the predictive power of social signals, specifically user behavior and communication patterns, from multiple social platforms GitHub and Reddit to forecast prices for three cyptocurrencies with high developer and community interest - Bitcoin, Ethereum, and Monero. We evaluate the performance of neural network models that rely on long short-term memory units (LSTMs) trained on historical price data and social data against price only LSTMs and baseline autoregressive integrated moving average (ARIMA) models, commonly used to predict stock prices. Our results not only demonstrate that social signals reduce error when forecasting daily coin price, but also show that the language used in comments within the official communities on Reddit (r/Bitcoin, r/Ethereum, and r/Monero) are the best predictors overall. We observe that models are more accurate in forecasting price one day ahead for Bitcoin (4% root mean squared percent error) compared to Ethereum (7%) and Monero (8%).

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge