Forecasting Cryptocurrency Prices Using Deep Learning: Integrating Financial, Blockchain, and Text Data

Paper and Code

Nov 23, 2023

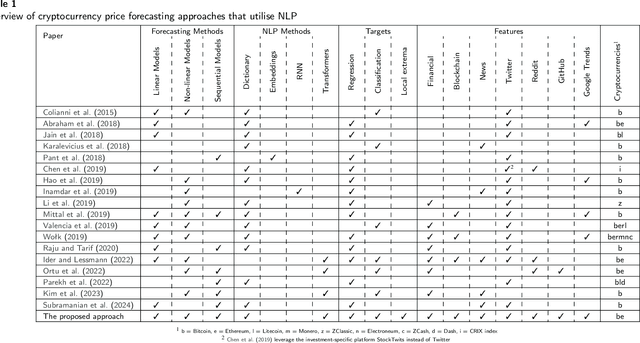

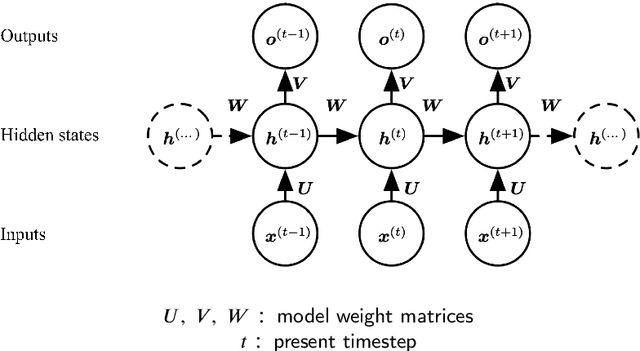

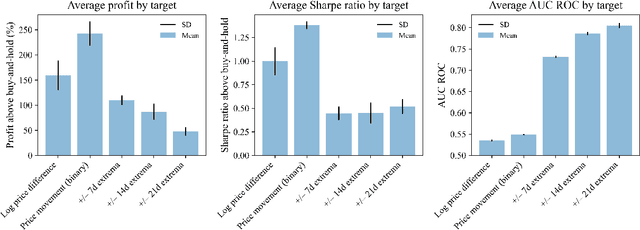

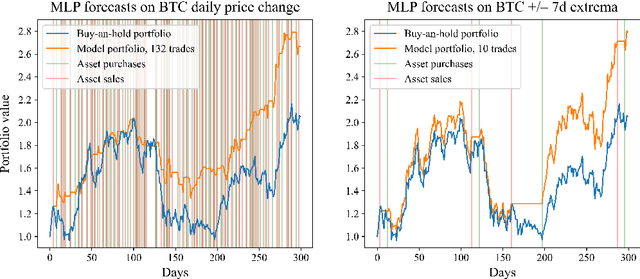

This paper explores the application of Machine Learning (ML) and Natural Language Processing (NLP) techniques in cryptocurrency price forecasting, specifically Bitcoin (BTC) and Ethereum (ETH). Focusing on news and social media data, primarily from Twitter and Reddit, we analyse the influence of public sentiment on cryptocurrency valuations using advanced deep learning NLP methods. Alongside conventional price regression, we treat cryptocurrency price forecasting as a classification problem. This includes both the prediction of price movements (up or down) and the identification of local extrema. We compare the performance of various ML models, both with and without NLP data integration. Our findings reveal that incorporating NLP data significantly enhances the forecasting performance of our models. We discover that pre-trained models, such as Twitter-RoBERTa and BART MNLI, are highly effective in capturing market sentiment, and that fine-tuning Large Language Models (LLMs) also yields substantial forecasting improvements. Notably, the BART MNLI zero-shot classification model shows considerable proficiency in extracting bullish and bearish signals from textual data. All of our models consistently generate profit across different validation scenarios, with no observed decline in profits or reduction in the impact of NLP data over time. The study highlights the potential of text analysis in improving financial forecasts and demonstrates the effectiveness of various NLP techniques in capturing nuanced market sentiment.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge