Efficient Estimation in NPIV Models: A Comparison of Various Neural Networks-Based Estimators

Paper and Code

Oct 14, 2021

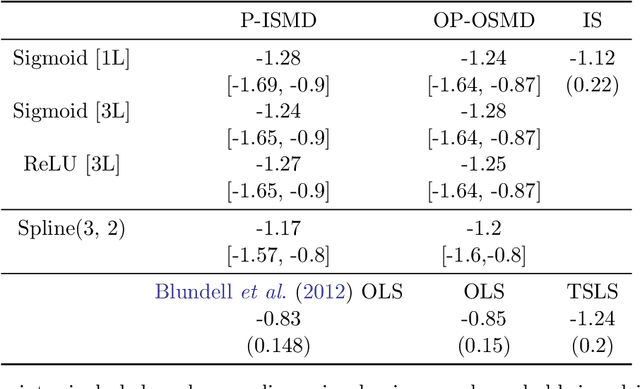

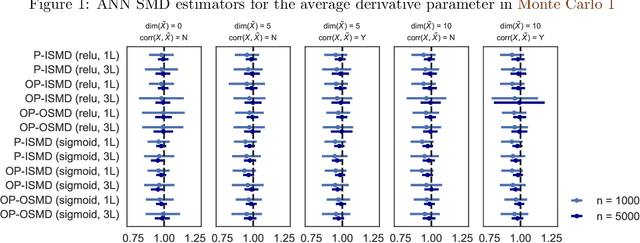

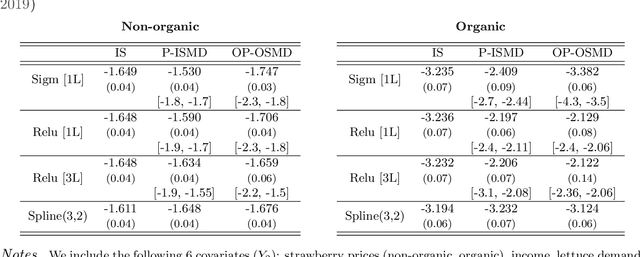

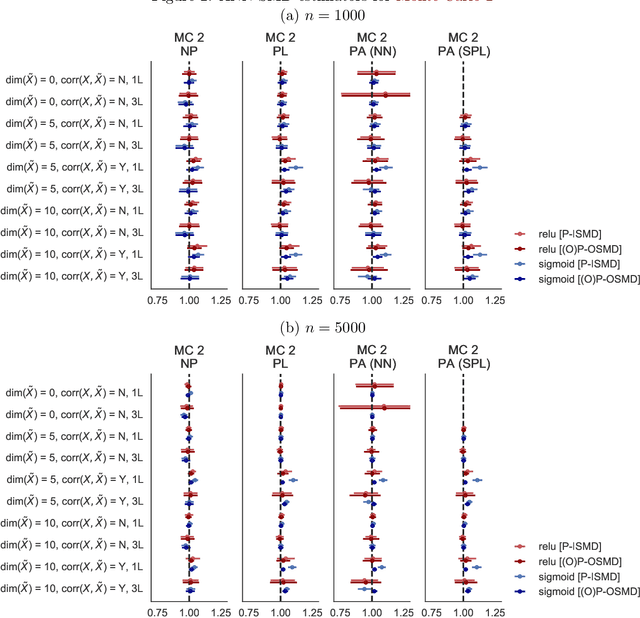

We investigate the computational performance of Artificial Neural Networks (ANNs) in semi-nonparametric instrumental variables (NPIV) models of high dimensional covariates that are relevant to empirical work in economics. We focus on efficient estimation of and inference on expectation functionals (such as weighted average derivatives) and use optimal criterion-based procedures (sieve minimum distance or SMD) and novel efficient score-based procedures (ES). Both these procedures use ANN to approximate the unknown function. Then, we provide a detailed practitioner's recipe for implementing these two classes of estimators. This involves the choice of tuning parameters both for the unknown functions (that include conditional expectations) but also for the choice of estimation of the optimal weights in SMD and the Riesz representers used with the ES estimators. Finally, we conduct a large set of Monte Carlo experiments that compares the finite-sample performance in complicated designs that involve a large set of regressors (up to 13 continuous), and various underlying nonlinearities and covariate correlations. Some of the takeaways from our results include: 1) tuning and optimization are delicate especially as the problem is nonconvex; 2) various architectures of the ANNs do not seem to matter for the designs we consider and given proper tuning, ANN methods perform well; 3) stable inferences are more difficult to achieve with ANN estimators; 4) optimal SMD based estimators perform adequately; 5) there seems to be a gap between implementation and approximation theory. Finally, we apply ANN NPIV to estimate average price elasticity and average derivatives in two demand examples.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge