Dynamic Fraud Detection: Integrating Reinforcement Learning into Graph Neural Networks

Paper and Code

Sep 15, 2024

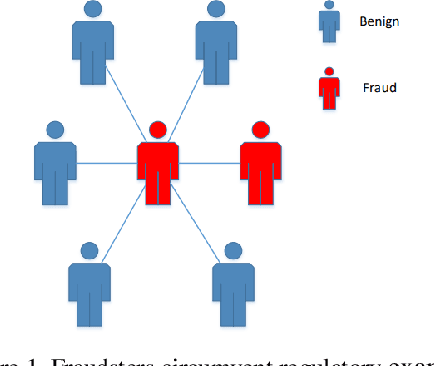

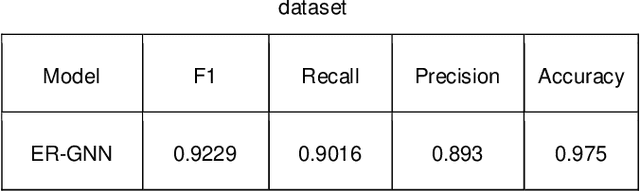

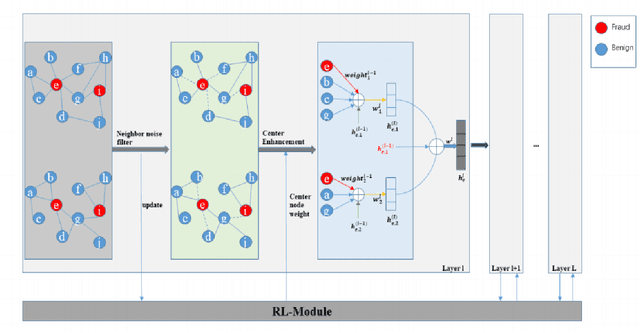

Financial fraud refers to the act of obtaining financial benefits through dishonest means. Such behavior not only disrupts the order of the financial market but also harms economic and social development and breeds other illegal and criminal activities. With the popularization of the internet and online payment methods, many fraudulent activities and money laundering behaviors in life have shifted from offline to online, posing a great challenge to regulatory authorities. How to efficiently detect these financial fraud activities has become an urgent issue that needs to be resolved. Graph neural networks are a type of deep learning model that can utilize the interactive relationships within graph structures, and they have been widely applied in the field of fraud detection. However, there are still some issues. First, fraudulent activities only account for a very small part of transaction transfers, leading to an inevitable problem of label imbalance in fraud detection. At the same time, fraudsters often disguise their behavior, which can have a negative impact on the final prediction results. In addition, existing research has overlooked the importance of balancing neighbor information and central node information. For example, when the central node has too many neighbors, the features of the central node itself are often neglected. Finally, fraud activities and patterns are constantly changing over time, so considering the dynamic evolution of graph edge relationships is also very important.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge