Dynamic Boltzmann Machines for Second Order Moments and Generalized Gaussian Distributions

Paper and Code

Dec 17, 2017

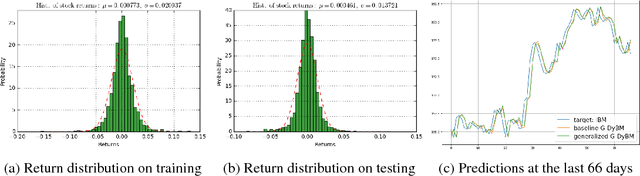

Dynamic Boltzmann Machine (DyBM) has been shown highly efficient to predict time-series data. Gaussian DyBM is a DyBM that assumes the predicted data is generated by a Gaussian distribution whose first-order moment (mean) dynamically changes over time but its second-order moment (variance) is fixed. However, in many financial applications, the assumption is quite limiting in two aspects. First, even when the data follows a Gaussian distribution, its variance may change over time. Such variance is also related to important temporal economic indicators such as the market volatility. Second, financial time-series data often requires learning datasets generated by the generalized Gaussian distribution with an additional shape parameter that is important to approximate heavy-tailed distributions. Addressing those aspects, we show how to extend DyBM that results in significant performance improvement in predicting financial time-series data.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge