Detecting DeFi Securities Violations from Token Smart Contract Code with Random Forest Classification

Paper and Code

Dec 06, 2021

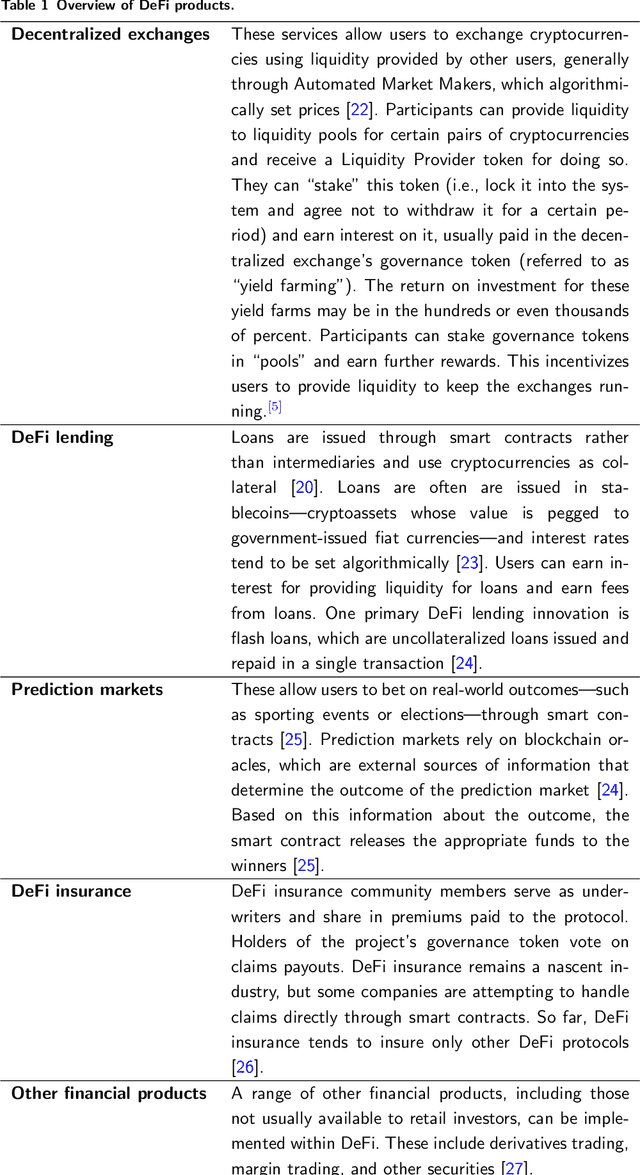

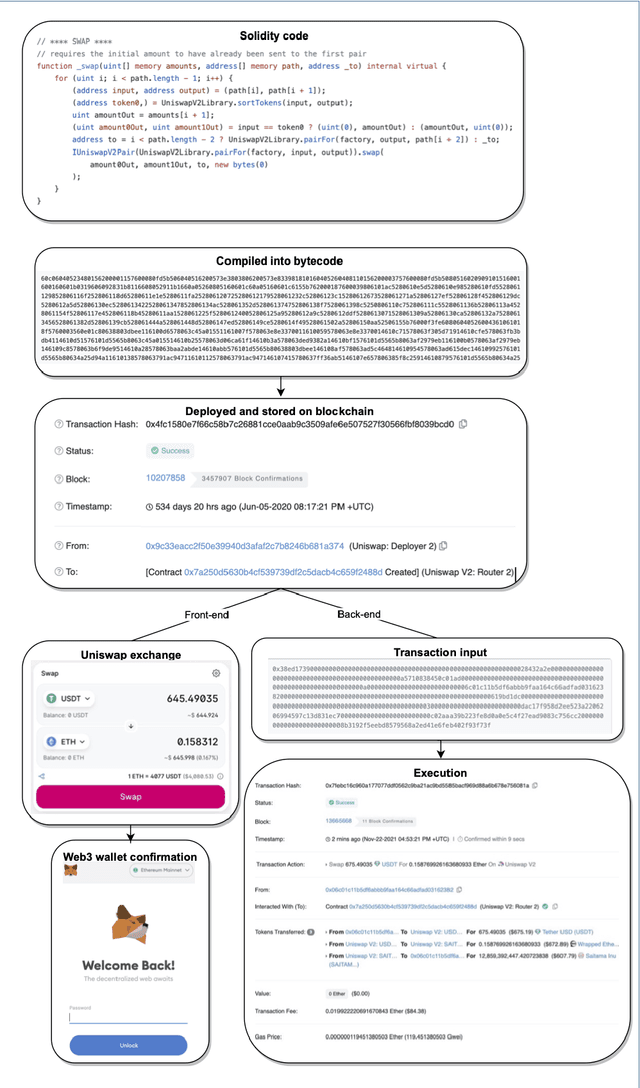

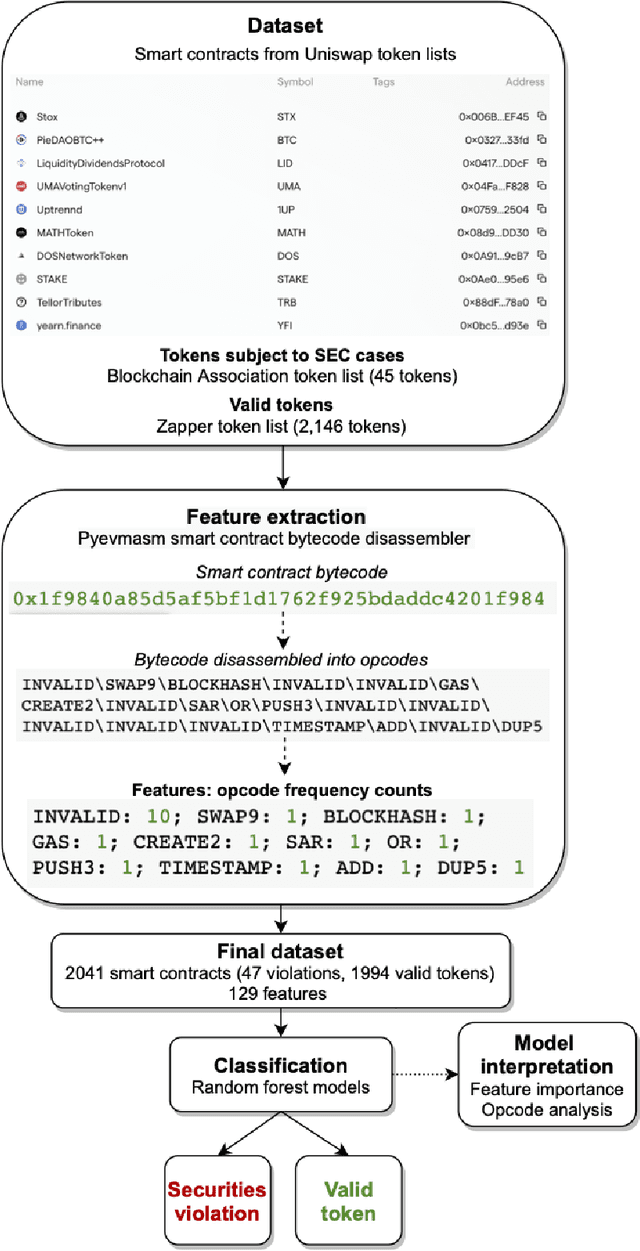

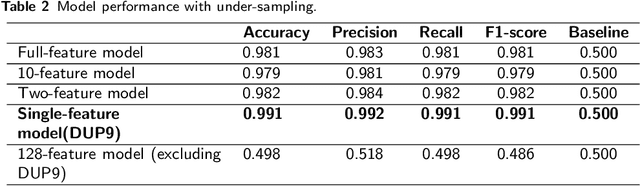

Decentralized Finance (DeFi) is a system of financial products and services built and delivered through smart contracts on various blockchains. In the past year, DeFi has gained popularity and market capitalization. However, it has also become an epicenter of cryptocurrency-related crime, in particular, various types of securities violations. The lack of Know Your Customer requirements in DeFi has left governments unsure of how to handle the magnitude of offending in this space. This study aims to address this problem with a machine learning approach to identify DeFi projects potentially engaging in securities violations based on their tokens' smart contract code. We adapt prior work on detecting specific types of securities violations across Ethereum more broadly, building a random forest classifier based on features extracted from DeFi projects' tokens' smart contract code. The final classifier achieves a 99.1% F1-score. Such high performance is surprising for any classification problem, however, from further feature-level, we find a single feature makes this a highly detectable problem. Another contribution of our study is a new dataset, comprised of (a) a verified ground truth dataset for tokens involved in securities violations and (b) a set of valid tokens from a DeFi aggregator which conducts due diligence on the projects it lists. This paper further discusses the use of our model by prosecutors in enforcement efforts and connects its potential use to the wider legal context.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge