Data Market Design through Deep Learning

Paper and Code

Oct 31, 2023

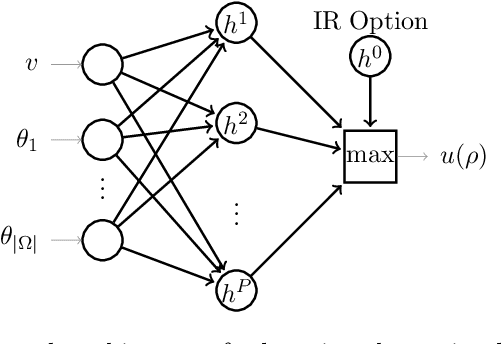

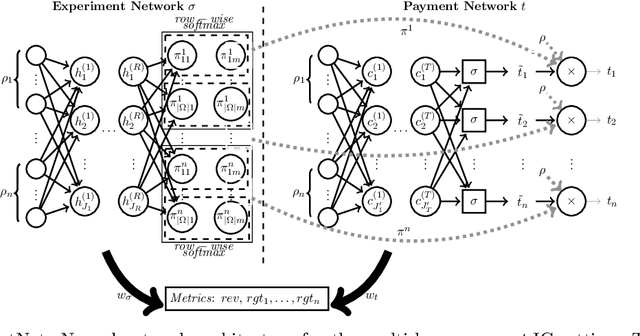

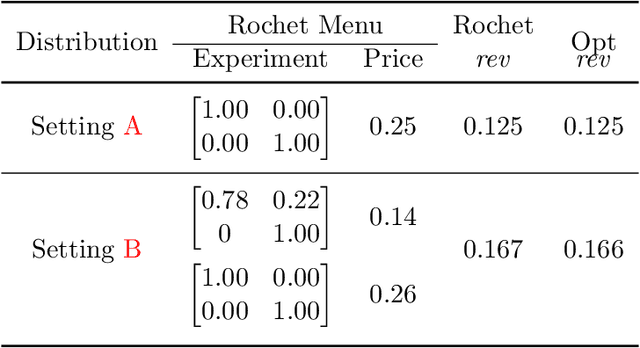

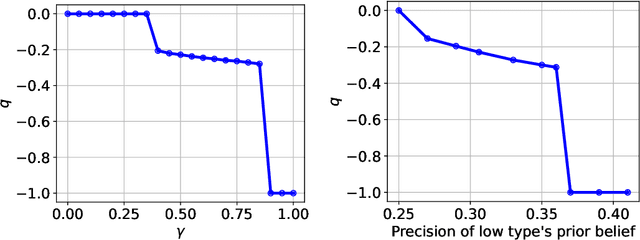

The $\textit{data market design}$ problem is a problem in economic theory to find a set of signaling schemes (statistical experiments) to maximize expected revenue to the information seller, where each experiment reveals some of the information known to a seller and has a corresponding price [Bergemann et al., 2018]. Each buyer has their own decision to make in a world environment, and their subjective expected value for the information associated with a particular experiment comes from the improvement in this decision and depends on their prior and value for different outcomes. In a setting with multiple buyers, a buyer's expected value for an experiment may also depend on the information sold to others [Bonatti et al., 2022]. We introduce the application of deep learning for the design of revenue-optimal data markets, looking to expand the frontiers of what can be understood and achieved. Relative to earlier work on deep learning for auction design [D\"utting et al., 2023], we must learn signaling schemes rather than allocation rules and handle $\textit{obedience constraints}$ $-$ these arising from modeling the downstream actions of buyers $-$ in addition to incentive constraints on bids. Our experiments demonstrate that this new deep learning framework can almost precisely replicate all known solutions from theory, expand to more complex settings, and be used to establish the optimality of new designs for data markets and make conjectures in regard to the structure of optimal designs.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge