Company-as-Tribe: Company Financial Risk Assessment on Tribe-Style Graph with Hierarchical Graph Neural Networks

Paper and Code

Jan 31, 2023

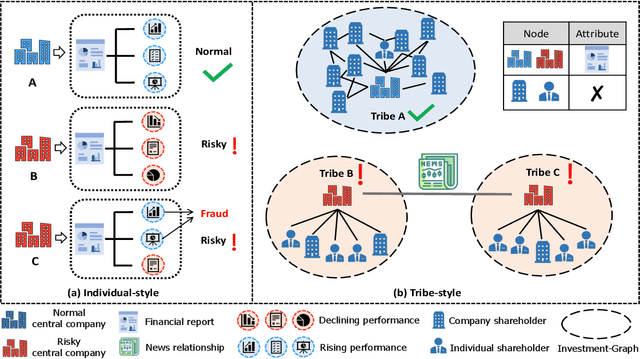

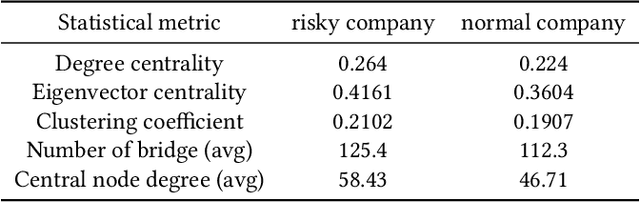

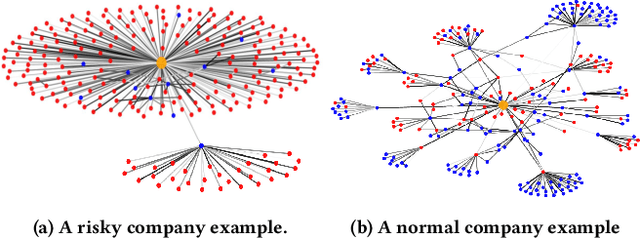

Company financial risk is ubiquitous and early risk assessment for listed companies can avoid considerable losses. Traditional methods mainly focus on the financial statements of companies and lack the complex relationships among them. However, the financial statements are often biased and lagged, making it difficult to identify risks accurately and timely. To address the challenges, we redefine the problem as \textbf{company financial risk assessment on tribe-style graph} by taking each listed company and its shareholders as a tribe and leveraging financial news to build inter-tribe connections. Such tribe-style graphs present different patterns to distinguish risky companies from normal ones. However, most nodes in the tribe-style graph lack attributes, making it difficult to directly adopt existing graph learning methods (e.g., Graph Neural Networks(GNNs)). In this paper, we propose a novel Hierarchical Graph Neural Network (TH-GNN) for Tribe-style graphs via two levels, with the first level to encode the structure pattern of the tribes with contrastive learning, and the second level to diffuse information based on the inter-tribe relations, achieving effective and efficient risk assessment. Extensive experiments on the real-world company dataset show that our method achieves significant improvements on financial risk assessment over previous competing methods. Also, the extensive ablation studies and visualization comprehensively show the effectiveness of our method.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge